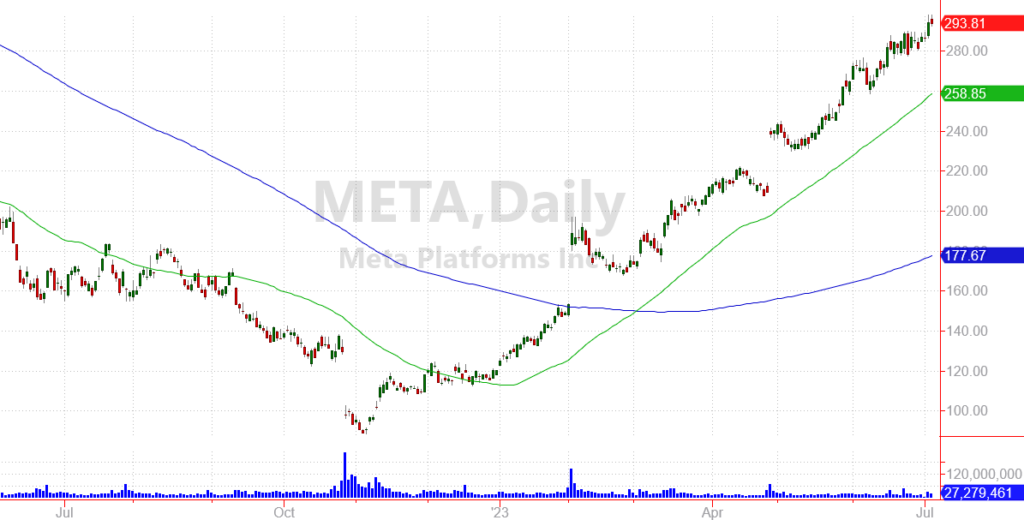

Will “Threads” Keep META Trading Higher?

Shares of Meta Platforms Inc. (META) are on a tear.

In fact, the stock is one of the best-performing positions in my Speculative Trading Program. (The program includes real-time alerts for the most aggressive trades I put in my own account.)

So far this year, META’s story has centered around cost-cutting.

Investors have been encouraged to see the company focusing more on managing expenses and boosting profits — instead of throwing resources at the “Metaverse” (which may or may not be a long-term growth driver).

Thanks to these austerity measures, Wall Street analysts have been boosting their profit targets for META. The company is now expected to earn $11.56 per share this year and grow profits to $14.34 in 2024.

Shares currently trade nearly 20 times next year’s expected profits — a reasonable price for a company with several widely-accepted social media platforms and strong potential growth for years to come.

Now that the company has expenses under control, META is launching a new app — Threads — designed to compete directly with Twitter.

What’s the likelihood this new project will succeed?

Meta’s Potential Blockbuster App

While there are no guarantees that a new app will catch on, META has a solid track record for building an engaged audience. More importantly, META is now able to monetize that audience through a growing network of advertising partners.

The company’s existing properties — Facebook, Instagram and WhatsApp — all generate reliable revenue. And if META can convince its existing user base to begin using Threads, that pattern should continue.

It certainly helps that Twitter’s current user base has become increasingly frustrated with the platform.

Following a takeover by Elon Musk, Twitter’s platform has been undergoing a series of changes. And many of these changes have been quite unpopular.

This past weekend, Twitter introduced a limit on how many posts individual users can see. Free accounts can now only see 500 posts per day, while paid (or “verified”) members can see up to 6,000 posts per day. The numbers continue to be adjusted, but many of Twitter’s most loyal members have been upset by this new limit.

Also, Twitter’s popular “Tweet Deck” platform got a recent makeover.

The platform allows users to set up categories of tweets to view, schedule future tweets, and better organize the Twitter experience. Since the makeover users can no longer see groups of tweets or categories that were previously set up — leading to more user frustration.

So META’s launch of Threads may be coming at the perfect time to lure disenchanted Twitter users over to META’s new platform.

Reliable Profits With a New App Kicker

Even without the new Threads platform, META has become a great standalone investment.

The company is expected to grow profits by 24% over the next year, and by another 16% in 2025. With the stock trading for just 20 times expected profits, shares of META are attractively priced and could still trade higher without entering “bubble” territory.

Meanwhile, a successful Threads launch could drive earnings expectations much higher, paving the way for an even higher stock price.

Using in-the-money option contracts is the best way that I’ve found to play this move.

Buying in-the-money call contracts allows you to control more shares of META for every dollar invested. So you can essentially build a larger position while investing less capital.

Meanwhile, if shares of META pull back (which happens even to the very best of stocks), only the money you spent on the call contracts is at risk. So you can invest while taking less risk compared to investors who bought shares outright.

This is the aggressive style of investing I use for trades in my Speculative Trading Program. And one of the great features of this strategy is that you can also place trades on stocks expected to go lower.

So there are chances to make money in both bull markets and bear markets.

In fact, this trading model was able to generate profits of 190% in 2022 — one of the toughest bear markets in recent history.

More By This Author:

This New Bull Market Has Room To Run

Maximize Your Investment Income With This Simple Step

Oil Refiners Have The Best Of Both Worlds