This New Bull Market Has Room To Run

Image Source: Pixabay

No, you didn’t miss the new bull market.

Sure, the S&P 500 is already up 5.7% this month, and the Nasdaq 100 index is up 39% since the start of the year. But that doesn’t mean you can’t still invest in this brand new bull market.

In fact, the best could be yet to come!

Let me tell you a story…

My Hedge Fund Friend Missed a Career Opportunity

Back in 2009, investors were still reeling from the Great Financial Crisis.

Jack was a good friend of mine managed a small hedge fund. And as the market started to rebound, Jack was very worried.

And for good reason! After all, there were plenty of risks still in play — chief of which was the $25 trillion that central banks around the world printed to help the world get through the crisis.

Jack told everyone who would listen that the new bull market was bogus. And he kept the capital in his hedge fund uninvested, anticipating a major decline.

Of course in hindsight, we know that 2009 was the beginning of the longest bull market in history. And as the market climbed higher, Jack’s fund fell behind.

His investors eventually bailed out and Jack had to close the fund. All because he misjudged the power of a new bull market.

Don’t let that happen to YOUR investment account!

Why This New Bull Market Could Continue

Today — much like 2009 — there are plenty of risks on the horizon.

- Stubborn inflation.

- High interest rates.

- Geopolitical risks.

- Extended tech valuations.

- Recession risk.

- Bank balance sheets.

- And the list goes on…

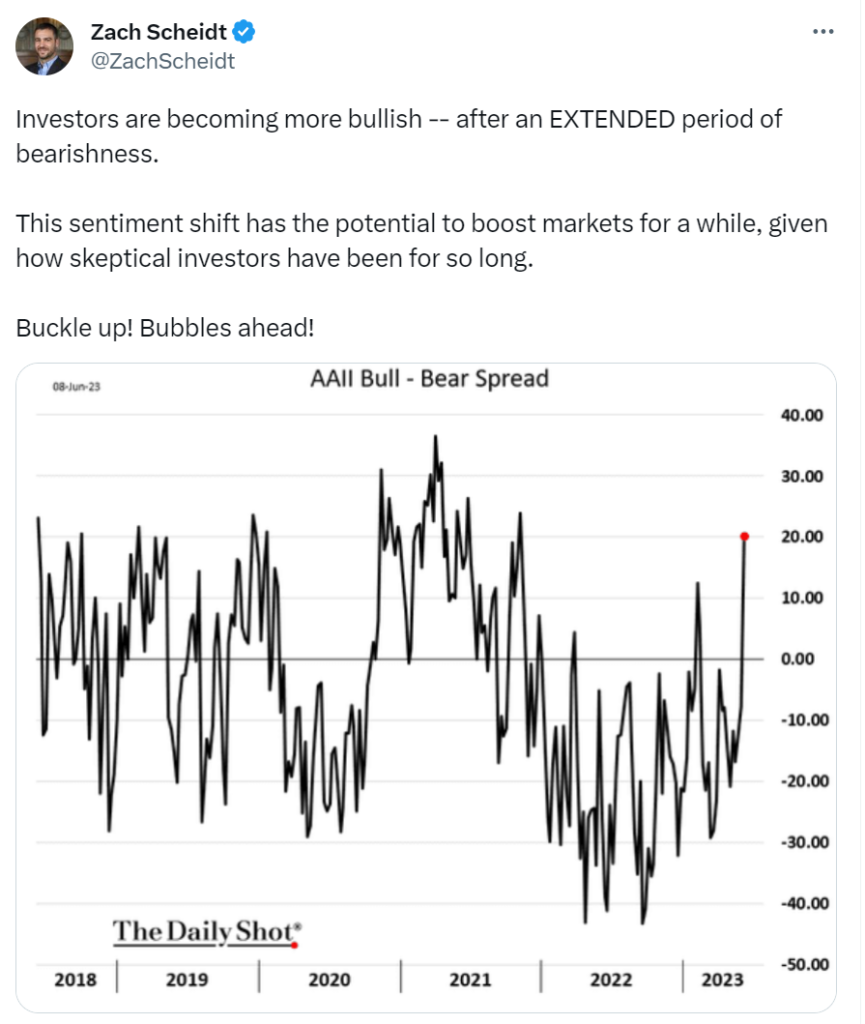

Even still, the market is pushing higher. And since investors have been bearish for an extended period of time, there’s still plenty of money on the sidelines.

According to Bespoke Investment Group the average bull market lasts an average of 1,011 days. If this new bull market lasts that long, stock prices will continue to rise through July of 2025!

Bull markets also post average gains of 114% — which would drive the S&P 500 to roughly 7,650.

So given the historical stats, we should have plenty of room for stocks to continue higher.

Tapping In to the New Bull Market

As our new bull market picks up momentum, I’m putting more of my own cash to work.

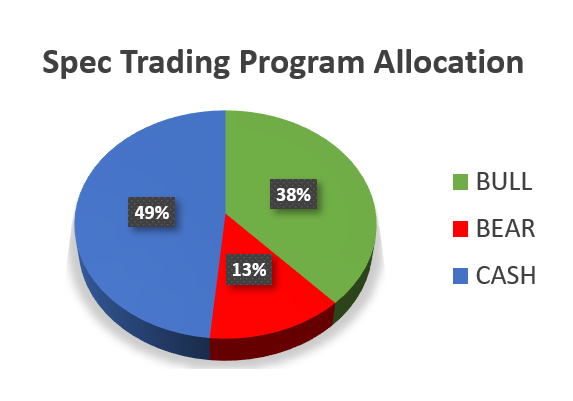

The pie chart below shows my Speculative Trading Program allocation — and you can see my bullish exposure is nearly three times what I have allocated to bearish plays.

As profits accumulate, I anticipate investing more of my cash into bullish speculative plays — compounding returns as we move through the year.

Of course, it still makes sense to have some bearish exposure on the books. That way if the market does pull back, my bearish plays can help offset potential losses from my bullish positions.

But for now, the clear trend of the market is positive. Investors still have plenty of cash to put to work. And institutional investors risk career risk (like my friend Jack), if they don’t quickly invest in this new bull market.

More By This Author:

Maximize Your Investment Income With This Simple Step

Oil Refiners Have The Best Of Both Worlds

Three Travel Stocks For Summer Profits