Three Travel Stocks For Summer Profits

As I write this note, I can feel the anticipation building outside my home office.

- The kids are finally out of school for the summer…

- The sun is shining and temperatures are rising…

- And in a few short days the family will head to the beach!

Around the country, families like yours and mine are packing suitcases, booking airline tickets and hotel rooms, and heading out for some summer fun.

Recent TSA data showed record numbers of passengers traveling through U.S. airports. And a recent research report from AAA indicated a 72% increase in international travel compared to pre-pandemic levels.

Families are heading out for casual day trips, luxurious international vacations and just about every kind of trip in between. And this sets up some great opportunities for you to profit from some of the market’s best travel stocks.

Let’s take a look at three of the top travel names on my list right now.

High End Resorts are Full!

Despite challenges in the overall economy, affluent travelers still have pent-up savings. This means luxury destinations will continue to attract high-end customers leading to lucrative profits.

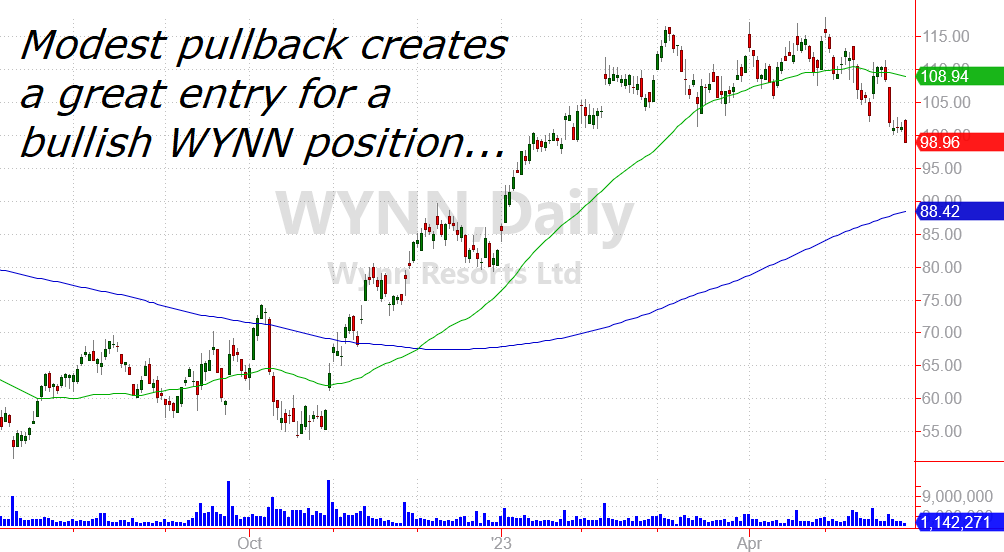

One of my favorite high-end travel stocks is Wynn Resorts (WYNN).

The company operates luxury resorts around the world. Each resort typically includes hotel rooms, high-end restaurants, luxury retail shops and a casino floor.

Wynn’s locations in Macau (known as the “Las Vegas of Asia”) should do very well this summer now that China has relaxed its “zero covid” policy and begun reopening its economy.

Shares of WYNN had a great run from October through March. A short-term pullback sets up a great buying opportunity. And I expect this stock to continue higher as summer travel picks up.

(Click on image to enlarge)

The Cruise Line Rebound is Underway

Cruse ship operators had an especially difficult time during the pandemic. Most cruise ships were totally offline for several quarters. But the companies still had to cover interest payments and general maintenance costs for their vessels.

This led to some challenging financial situations for many of the most popular cruse lines.

But this summer these companies are now fully operational and benefiting from strong demand. Profits are on the rise and expected to grow for years to come.

One of my favorite stocks in this area is Royal Caribbean Group (RCL).

Shares have been trending higher this year and could have much farther to go!

(Click on image to enlarge)

The company currently operates 64 ships and has another 10 vessels set to come online in the next three years. As these new ships are put into operation, RCL should be able to steadily grow its profits.

Wall Street analysts expect RCL to earn $4.78 per share this year and grow profits to $6.84 in 2024 — and $8.92 in 2025. That profit growth should drive shares of RCL higher long-term. And any positive earnings news from this summer’s travel season could drive a short-term pop for the stock.

Profits from Travel Package Deals

A third way to invest in the travel market is to own shares of booking agencies that help families plan an entire trip.

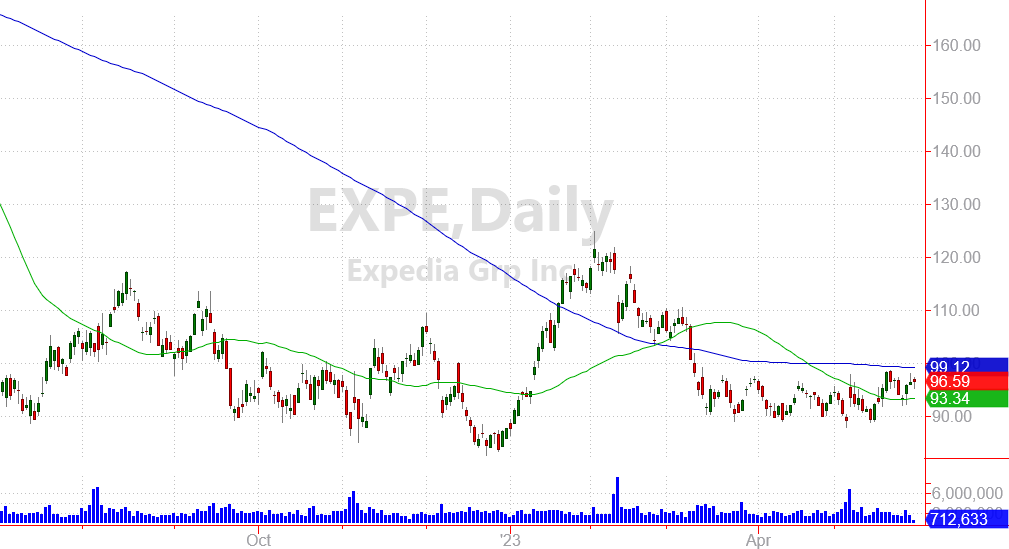

Expedia Group (EXPE) is the world’s second-largest online travel agency. The company helps customers book hotel rooms, flights, rental cars, cruises and tickets to local attractions.

Expedia also profits from ad revenue on the company’s popular travel booking websites. The company owns many different popular travel brands including Expedia, Hotels.com, Travelocity, Orbitz and Vrbo.

Shares have been rangebound for the past several months, and now looked poised for a powerful breakout.

(Click on image to enlarge)

The company is expected to earn $9.38 per share this year and grow profits to $11.69 in 2024. Meanwhile, shares trade for just over 10 times this year’s expected profit.

This is a very attractive price for a company with EXPE’s current profits and expected growth. I recommend buying shares now before a major breakout makes the stock more expensive.

Keep Your Watch List Updated…

Today’s market is full of both opportunity and risk.

Dynamics continue to shift as political, economic and social forces drive different areas of the market.

In a turbulent period like this, it’s especially important to keep a current watch list of stocks to trade. That way when new information shifts the market’s direction, you already know which stocks are set to benefit. (You can also pinpoint which names have the most risk in different situations).

My Free Watch List gives you a constantly updated list of the top 60 stocks on my personal radar.

The free list includes detailed notes on:

- 20 stocks I expect to trade higher…

- 20 stocks I expect to trade lower…

- 20 stocks for investment income…

- All with no strings attached!

I’d love to send you a recent copy of my watch list to help you lock in profits from travel stocks, from energy plays, from tech companies, and the many other hot areas of today’s market.

In the meantime, hopefully, these travel stocks can give you some great profits to use for your family’s next trip!

More By This Author:

The Fed’s “Battle Of Midway”

Speculative Tech Stocks Face A Double-Dose Of Risk

The Good Side Of Today’s Banking Crisis (More Income)