The Fed’s “Battle Of Midway”

Today’s Fed decision has similarities to the WWII Battle of Midway — a major decision point for the course of the war.

Only today’s “Midway decision” will set the direction for the economy, employment, and key areas of the U.S. stock market.

At 2:00 PM EST, the Federal Open Market Committee will release its decision on interest rates. Most expect the Fed will hike its target rate by another 25 basis points (or 0.25%).

Shortly after, Jerome Powell will host a press conference. And that’s when this economic “Battle of Midway” will be in full force.

It’s important to understand exactly what’s at stake — and how your trading will be impacted by today’s Fed meeting.

What’s At Stake From Today’s “Midway” Meeting

While the Fed’s interest rate decision is fairly certain, Jerome Powell’s commentary has the potential to drive a huge move in the stock market.

Up to this point, Powell has been telling investors that the Fed will keep interest rates “higher for longer.”

He has made it very clear that the Fed is determined to put the brakes on inflation. Even if it means causing pain for the overall economy.

Traders think Powell is bluffing.

In the bond market, traders are betting that the Fed will start CUTTING interest rates before the end of the year. And in the stock market, speculative stocks have been rebounding — exactly what you would expect to see if the Fed was about to cut interest rates.

So which is it?

Will Jerome Powell finally change his tone… admit that inflation levels are starting to pull back… and signal that the Fed is done hiking rates?

Or will Powell continue to “stay the course”… signal that interest rates will continue to rise… and catch traders leaning the wrong way?

Here’s What Could Happen…

Today’s Fed meeting will lead to one of two outcomes.

Powell could hint that the Fed is done hiking rates for now — backing off his “higher for longer” rhetoric.

Under this scenario, the bulls will have an immediate advantage.

Expect to see market interest rates drop sharply, and speculative growth stocks surge higher. Many of the large-cap tech stocks like Meta Platforms (META) and Alphabet Inc. (GOOG) could also ramp sharply higher.

That’s because the prospect for lower interest rates makes the future profits from growth stocks more attractive. And with lower rates, its easier for growth companies to get capital needed to fund new opportunities.

On the other hand, Powell could continue to warn of higher interest rates — catching traders off-guard.

Under this scenario, the bears will win today’s “Battle of Midway”.

Market interest rates will be forced to adjust to the Fed’s hawkish guidance. And as market rates move higher, growth plays and economically sensitive stocks will naturally trade lower.

Possibly a LOT lower!

How I’m Positioned for Powell’s “Battle of Midway”

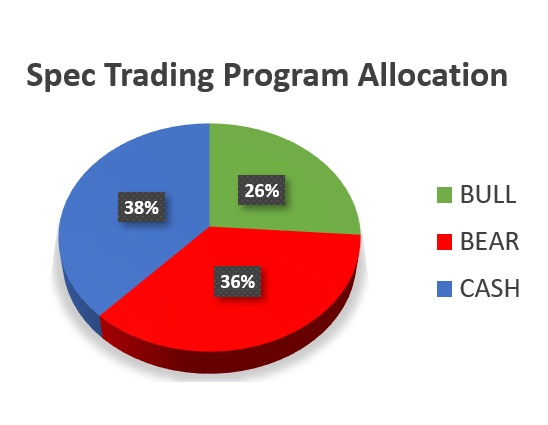

My Speculative Trading Program currently has a balanced mix of bullish and bearish trades heading into the Fed meeting.

A couple of my favorite bullish plays include a position in the SPDR Gold Trust (GLD) and another bullish play for O’Reilly Automotive (ORLY).

The GLD position is tied to the current price of gold. So if Powell hints that the Fed may be done hiking rates, gold has the potential to surge — driving big profits for our GLD play.

ORLY sells car parts and accessories and has been profiting from the shortage of new cars available (leading to demand for maintenance items).

I also have a bearish position for Roku Inc. (ROKU) and Snowflake Inc. (SNOW) — among others.

Both are high-valuation growth stocks that could be hurt by higher interest rates. So if Powell comes across as more hawkish than expected, these are two of the names that could lose a lot of value in a very short amount of time.

Once today’s “Battle of Midway” is decided, I’ll likely be making some adjustments — and you can follow along with your own trades!

More By This Author:

Speculative Tech Stocks Face A Double-Dose Of Risk

The Good Side Of Today’s Banking Crisis (More Income)

My Hedge Against The Silicon Valley Bank Crisis

Excellent article.