My Hedge Against The Silicon Valley Bank Crisis

Are you looking for a way to protect your wealth as the Silicon Valley Bank crisis unfolds?

To be perfectly frank, this has been an incredibly difficult period for investors and traders alike. And if you’re feeling discouraged, I don’t blame you!

I mean, just take a look at some of the price action for different stocks in today’s market…

Some of the most speculative stocks are trading sharply higher. For example:

- Bill.com (BILL) is up 8.2% as I write this note…

- Unprofitable Moderna (MRNA) is up 7.1% today…

- And speculative Snowflake Inc. (SNOW) is up 4.7%…

That’s not what you would expect to see when investors are worried about balance sheet risks, liquidity, and the overall banking industry.

Meanwhile, profitable companies like Caterpillar (CAT), Estee Lauder (EL), and Expedia (EXPE) are red on the day.

It’s as if traders are throwing out the good stocks to make room for the riskiest plays the market has to offer!

While I don’t expect this trend to continue much longer, it does create some challenges for our trading positions.

But there’s one area of the market that is trading exactly according to plan. And if you have a meaningful position in this area, you’re probably doing just fine — even on a topsy-turvy day like today.

Using Gold to Hedge Your Silicon Valley Bank Risk

While some of my trades have been difficult to manage this year, gold is turning out to be one of the most profitable positions in my account right now.

Take a look at the chart for the SPDR Gold Trust (GLD) which tracks the underlying price of gold.

Gold has surged higher over the last few days as a direct result of new risks in the market.

On one hand, gold offers a safe storage of value — which is important at a time when bank deposits are being called into question. Whether YOU hold physical gold or not, the mere fact that other investors are using gold as a storage of wealth has helped to drive the price of gold higher.

Another important factor is tied to the Fed’s interest rate decisions.

Now that regional banks are under pressure, the Fed is much less likely to continue tightening interest rates. At the very least, the Fed will be less aggressive — and more likely the Fed will pause it’s current tightening campaign.

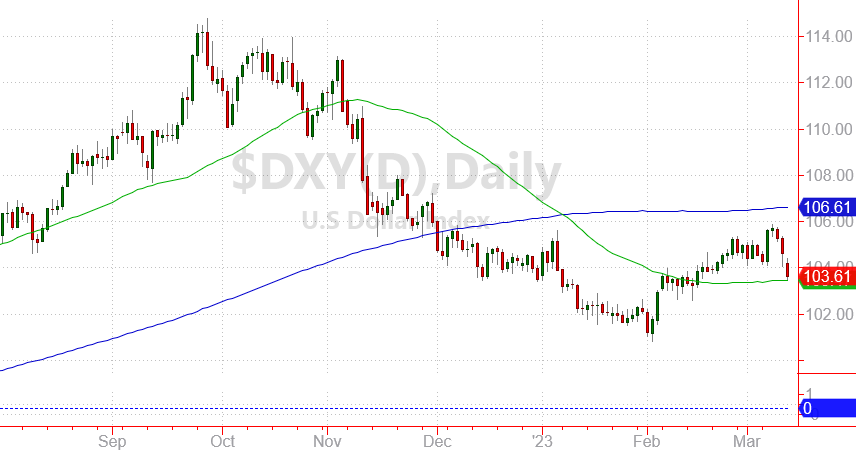

Without the prospect of higher interest rates, the U.S. dollar is drifting lower.

Now that the dollar is weakening, it takes more weak dollars to buy an ounce of gold.

In other words, the Fed’s response to today’s banking crisis has turned out to be another catalyst driving gold prices higher.

More By This Author:

Forget ODTE! The Only Options I Buy For MyselfI Hate Shopping, But These Consumers Don’t

How I’m Positioned For Today’s Fed Announcement