Oil Refiners Have The Best Of Both Worlds

Photo by American Public Power Association on Unsplash

The summer driving season is here, and oil refiners are looking forward to windfall profits.

As a consumer, this is bad news. Because you’ll likely be paying more for gasoline (or diesel or for that airline ticket).

But as an investor, this driving season gives you an opportunity to grab your share of profits from a very unique situation.

Oil Refiners Enjoy Low Input Costs

Like any other business, oil refiners profit from the difference between revenue and expenses. If costs are low, it’s much easier to generate a lucrative profit.

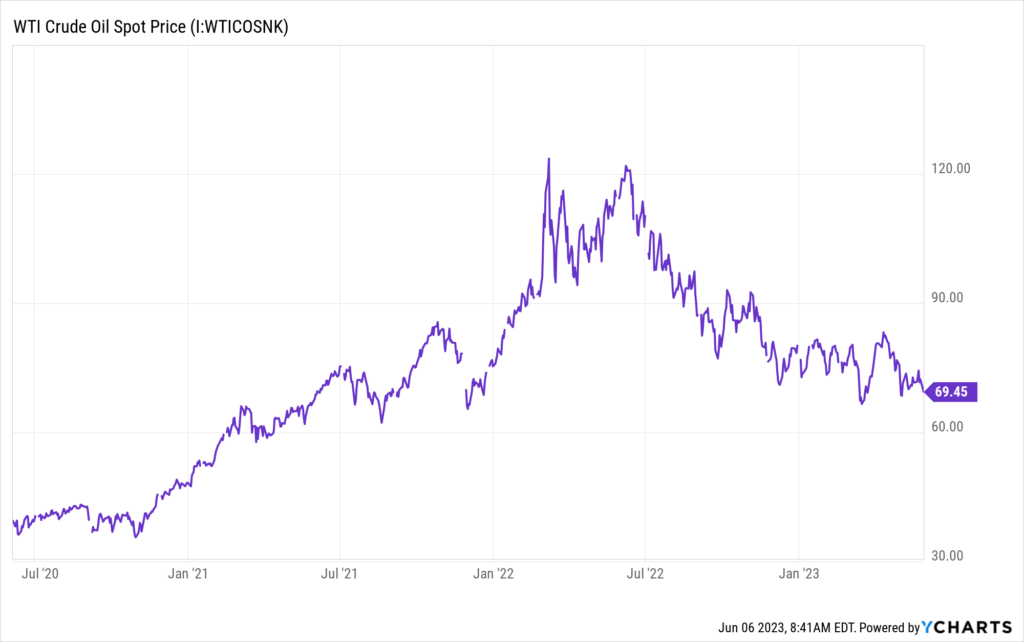

Crude oil represents the largest expense for most refiners. So with crude prices falling, oil refiners are able to buy barrels at very attractive prices.

U.S. crude currently trades near the important $70 per barrel mark.

Production cuts from Saudi Arabia and a potential refilling of the U.S. Strategic Petroleum Reserve will likely keep oil from dropping much farther.

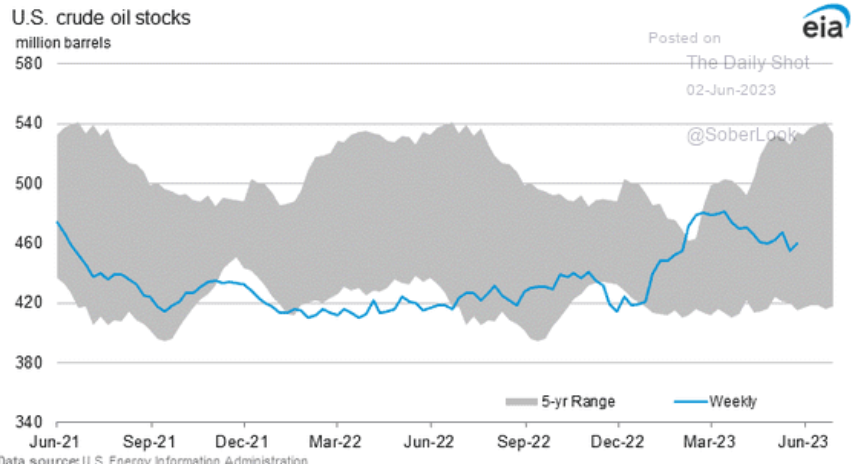

But for the time being, crude inventories in the U.S. are still high, giving oil refiners plenty of supply to work with.

So while there may be a floor just below $70 for crude oil prices, the current supply / demand dynamics is very favorable for oil refiners this summer.

Gasoline Prices Should Remain High

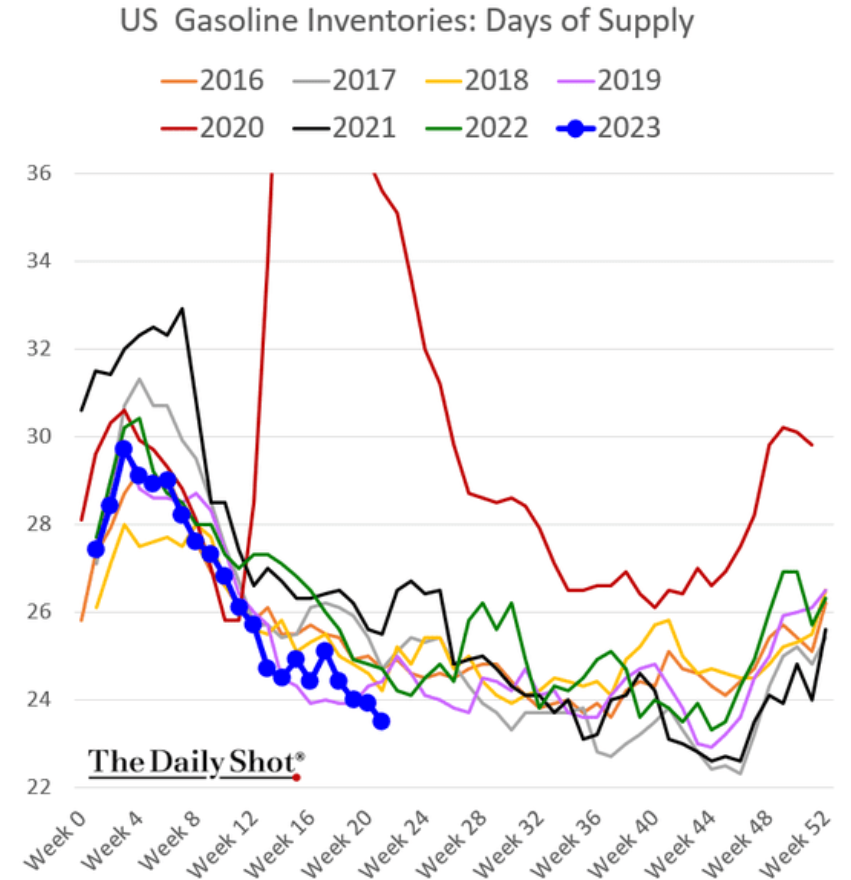

While there’s plenty of crude oil in storage right now, gasoline inventories are near multi-year lows. And this at a time when demand for gasoline, diesel, jet fuel and other refined products is surging.

Economics 101 tells us that when supply of a commodity like gasoline is low, prices will naturally rise.

That’s great news for oil refiners. Because as gasoline prices rise, these companies will be able to sell their refined products at higher prices.

Combining low input costs with high selling prices is a perfect situation for oil refiners.

Profit margins will be exceptionally high this year, helping to fund lucrative dividend payments and a surge higher for stock prices.

Some of the names I’m watching closely include:

- Valero Inc. (VLO) – one of the largest oil refiners with 15 refineries and capacity of 3.2 million barrels per day. VLO currently pays a 3.8% dividend yield.

- Phillips 66 (PSX) – an independent refiner with 12 refineries and capacity of 1.9 million barrels per day. PSX pays a 4.4% dividend yield.

- CVR Energy (CVI) – A diversified refiner with additional profits coming from oil gathering, storage, and pipeline operations. CVI pays an 8.0% dividend yield.

More By This Author:

Three Travel Stocks For Summer Profits

The Fed’s “Battle Of Midway”

Speculative Tech Stocks Face A Double-Dose Of Risk