Will Alibaba Ever Decide To Pay A Dividend?

Alibaba (BABA) has strongly rewarded its shareholders since its IPO, in 2014. Since then, the stock of the Chinese e-commerce giant has rallied 91% whereas the S&P 500 Index has advanced only 49%.

Like many other technology stocks, Alibaba does not currently pay a dividend to shareholders. But a company’s capital allocation program can change over time. Alibaba has some unique characteristics that could allow it to pay a dividend at some point in the future.

In contrast to other high-growth tech stocks that do not pay dividends and might never, such as Netflix (NFLX), Uber (UBER), and Lyft (LYFT), Alibaba is highly profitable and enjoys positive free cash flows.

Nevertheless, as Alibaba does not pay a dividend yet, the big question for income investors is whether the company will ever pay a dividend.

Business Overview

Alibaba is a gigantic e-commerce company, which provides online and mobile commerce businesses in China and in many other international markets.

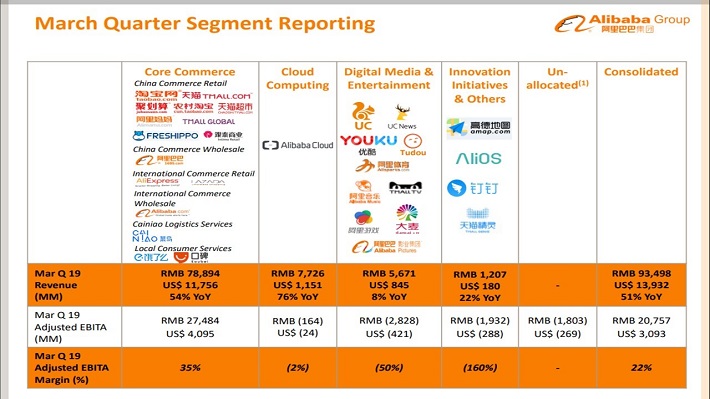

It operates in four segments: Core commerce, cloud computing, digital media, and innovation initiatives. While the company expects meaningful growth from all its segments, its core commerce business is by far it's most important, as it generates essentially all the earnings of the company.

Alibaba benefits from the strong growth of the Chinese economy. China has grown its gross domestic product by more than 6% per year every single year in the last decade.

Source: Trading Economics

The middle class of China has exceeded 300 million people and thus it has become almost equal to the entire U.S. population. Even better, China’s middle class is expected to double in size within the next 10 years, with most of the growth driven by the less developed cities.

Consumption from this category of Chinese cities is expected to approximately triple in a decade, from $2.3 trillion this year to about $7.0 trillion in 2029. This secular trend will provide a strong tailwind to the business of Alibaba, which relies to a great extent to the consumption of China.

Alibaba stock has incurred a 13% correction off its recent peak, primarily due to the ongoing trade conflict between the U.S. and China. While the eventual effect of the trade tensions on the Chinese economy is unknown, it is reasonable to assume that Chinese exports will be negatively affected. Consequently, the growth of the Chinese economy may incur a headwind from the outcome of the trade conflicts in the upcoming years.

However, it is important to note that the Chinese economy will continue growing at a high rate despite its shift from an export economy to a consumption economy. In the last five years, China lost 14 million manufacturing jobs but gained 70 million jobs in services. Overall, Alibaba has exciting growth prospects ahead thanks to the sustained economic growth of China.

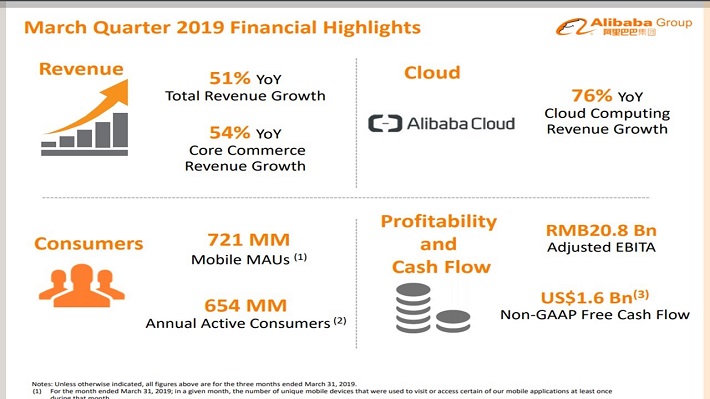

The growth potential of Alibaba was evident in its latest earnings report. In its fiscal fourth quarter, the online retailer grew its revenue 51% over last year’s quarter, mostly thanks to 54% revenue growth in its core commerce business. Its cloud business posted 76% revenue growth but this segment is still too small to have a meaningful effect in the results of the company.

Source: Investor Presentation

In the year, Alibaba grew its revenue by 51% and its adjusted revenue by 39%. The company saw the number of its annual active consumers rise by 102 million, from 552 million to 654 million. It also saw its mobile customers grow by 104 million, to 721 million customers.

Source: Investor Presentation

More than 70% of the increase in active consumers came from less developed cities in China. While this trend may fuel some concerns that the company is approaching its limits in its growth trajectory, the high growth rate confirms that the company has ample room to keep growing for several years.

Thanks to its strong business performance, Alibaba grew its earnings per share 27%, from $3.91 to $4.97 for the full fiscal year. Since its IPO in 2014, the company has more than tripled its earnings per share, from $1.61 in 2014 to $4.97 in fiscal 2019.

Free Cash Flows

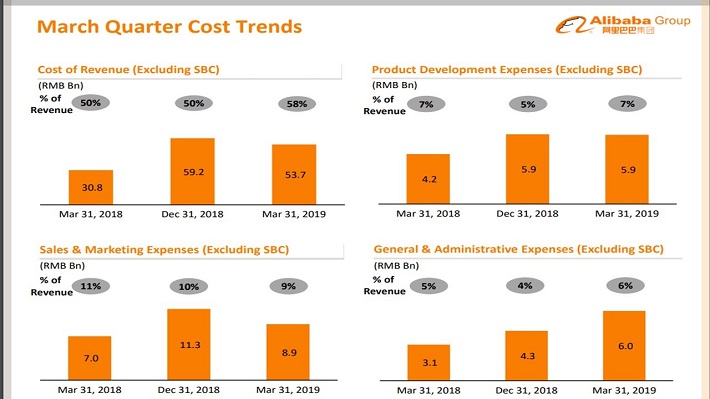

As Alibaba is trying to grow its customer base at a relentless pace, it is investing heavily in its business. More precisely, it spends significant amounts on product developments, marketing and general & administrative expenses.

Source: Investor Presentation

In fiscal 2019, the company invested heavily in its cloud computing business and hence its technology-related expenses accounted for more than half of the increase in capital expenses.

All these expenses consume a significant portion of the operating cash flows of Alibaba and thus they somewhat limit its free cash flows. However, the online retailer has enjoyed positive free cash flows in each of the last seven years. Even better, Alibaba has enhanced its free cash flows at an impressive pace, from $2.0 billion in 2013 to $14.7 billion in the last 12 months.

This performance greatly differentiates Alibaba from other high-growth stocks, such as Netflix, Uber and Lyft. These companies have been growing their revenues at tremendous rates but are still far from achieving positive free cash flows.

Will Alibaba Ever Pay A Dividend?

Thanks to its positive free cash flows, Alibaba has the financial capacity to initiate a dividend. In addition, the company has a remarkably strong balance sheet. Its net debt is only $18.5 billion, which is less than twice the annual earnings of the company. Moreover, interest expense consumes only ~8% of the operating income. Therefore, it would not be unreasonable for Alibaba to initiate a dividend in the future.

It is also remarkable that the company repurchased 10.9 million shares in fiscal 2019 and its management confirmed its commitment to continue repurchasing shares to enhance shareholder value. However, it is important to note that the share count slightly increased in fiscal 2019.

This means that the company repurchased shares only to offset the dilutive effect of the shares awarded to management. Even if this were not the case, the number of shares repurchased is only 0.4% of the total share count. Therefore, investors should not expect meaningful share repurchases for Alibaba.

Plus, while Alibaba seems to have the financial strength to initiate a dividend, it is not likely to do so for the foreseeable future. The company has initiated the process for a secondary listing, in Hong Kong. Alibaba is expected to raise as much as $20 billion in this secondary listing and use the proceeds to fund its growth initiatives, such as cloud computing and Hema supermarkets.

It is thus evident that the company is trying to raise new funds in order to invest in its business instead of returning cash to its shareholders. This should not be considered a negative move, as Alibaba has strong growth potential. When a company grows at a fast pace, it is much more profitable to invest in the business than to return cash to the shareholders.

Alibaba’s strategy conveys a positive signal, as it implies that there is great potential for future growth. In fact, whenever Alibaba initiates a dividend, its stock might actually decline, as investors could conclude that the high-growth years of the company are coming to an end.

Final Thoughts

Alibaba greatly benefits from China’s high economic growth. The e-commerce giant has been growing its revenues and its earnings at an impressive rate for many years.

Moreover, in contrast to other popular high-growth stocks, Alibaba is already strongly profitable with positive free cash flow. In addition, it has a strong balance sheet, which collectively means the company could initiate a dividend without facing any financial stress.

However, Alibaba is still in its high-growth phase, with the potential to continue growing at a high rate for several more years. As a result, it makes much more sense to invest in its business than to return cash to its shareholders right now.

This is clearly reflected in Alibaba’s strategy, which is to implement a secondary listing in Hong Kong in an effort to raise as much as $20 billion and use the proceeds to fund its growth initiatives. For all these reasons, investors should not expect a dividend from the company for the next several years at least.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more