Warsh Is In The Race: Fed Chair Odds In Flux

Over the last few weeks, it seemed all but a done deal that Kevin Hassett would replace Jerome Powell as the next Fed Chair. That changed this past weekend as President Trump added Kevin Warsh alongside Hassett as his top Fed contenders. It’s likely that there are a couple of factors leading Trump to add Warsh to the race.

First, the Financial Times indicated that the Treasury Department was soliciting feedback from Wall Street banks and large asset management firms. In these private conversations, investment professionals expressed concern that Hassett would prioritize Trump’s demands for sharp rate cuts over a more appropriate data-driven policy. Furthermore, if the Fed were to pursue an unwarranted monetary policy, it would pose risks to bond markets and to Fed credibility.

Second, the bond market was sending a cautionary signal. Treasury yields have been slowly creeping higher over the last few weeks as the market comes to terms with Hassett as the next Fed Chair. Since early December, when ten-year UST yields fell below 4%, yields have steadily risen. After topping at 4.25% last Friday, they have since backed off. The betting odds shown below and bond market yields will be telling in the coming weeks and months. We suspect that higher odds for Warsh will correspond to lower yields, and vice versa.

Tomorrow’s Commentary will have more on the differences between Hassett and Warsh, and how the bond and stock markets may view the selection of each potential nominee.

What To Watch Today

Earnings

(Click on image to enlarge)

Economy

(Click on image to enlarge)

Market Trading Update

Yesterday, we discussed the technical backdrop of the market. Today, we are going to receive a significant amount of economic data that will likely move the market for better or worse. A lot of this data is already factored into the market, at least partially, but employment, retail sales, and incomes will feed investors the data they need to start predicting the Fed’s next move.

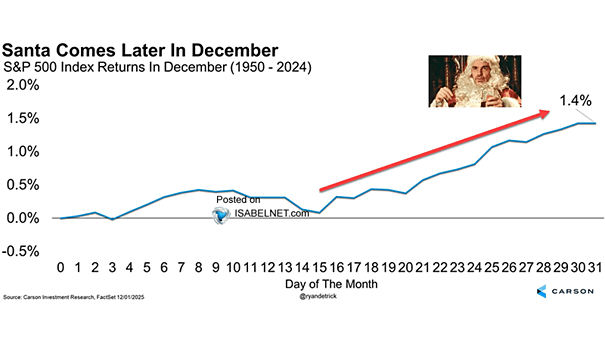

However, yesterday also marked the start of the last two weeks of December, which investors closely watch due to a well-documented seasonal pattern known as the “Santa Claus” rally. Historically, stock indices such as the S&P 500 tend to rise during the final trading days of December and the early part of January. Over the decades, this period has shown positive returns around 75–80 percent of the time, with average gains in the Santa Claus window exceeding those of typical random weeks, about 1.4% on average. The trend, as shown, is strongest in the second half of December, as professional managers begin to “window dress” for year-end reporting, and are helped by lighter trading volumes.

Of course, there are always reasons why such a rally may not occur, but that is why the 1.4% is an “average.”

What could go wrong? Several risks could upset the trend:

- Unexpected economic data or a surprise Fed policy shift due to stronger-than-expected economic data or inflationary pressures.

- Geopolitical events that trigger risk‑off trading.

- Profit‑taking at record highs as 2025 markets have already run strongly.

- Volatility from tech or macro shocks that overwhelm typical seasonal flows.

Seasonality provides context but not certainty, and while historical patterns help frame expectations, they do not guarantee outcomes. Therefore, here are five clear tactics to navigate the last two weeks of December:

- Trim Extended Positions: If you hold stocks that have run well in 2025, reduce exposure. Locking in gains into strength is better than reacting to weakness.

- Avoid New High-Beta Buys: Don’t chase stretched tech or speculative names. Liquidity dries up in late December, making sharp reversals more likely.

- Use Tax-Loss Selling to Offset Gains: Sell underperformers before year-end to harvest losses against 2025 gains. It improves your after-tax return.

- Watch for Low-Volume Traps: Be cautious when trading thin markets. Big moves on small volume are often misleading. Use limit orders and widen stops.

- Set Up for January: Begin building positions in quality names you want for Q1. Institutions reposition in January, and early inflows often favor fundamentally strong stocks.

Discipline matters more than predictions in low-volume, headline-sensitive conditions. Keep risk tight and stay tactical.

Small Caps In Vogue While Large Caps Languish

After grossly underperforming the market, small-cap stocks are finally having their day in the sun. As noted below, courtesy of SimpleVisor, MicroCap stocks, along with small caps, are among the most overbought. At the same time, MegaCap and Large Growth are the most oversold. Interestingly, the rotation toward smaller stocks and away from larger stocks is not about investors seeking more conservative, value-oriented companies. To wit, note that Low Beta stocks are very oversold while High Beta stocks are overbought. The market is generally favoring value over growth. For instance, Mid and Small Cap Value are among the most overbought, while the growth versions of those same size factors are less overbought and further down the list.

We caution readers against overanalyzing sector and factor rotations at this time of year. Distortions tend to occur at year-end, as many institutional money managers take gains and losses and window-dress their books. Often, rotations toward the last few weeks of December are fast and not lasting.

(Click on image to enlarge)

Bull Market Genius Is A Dangerous Thing

During extended upward-trending markets that reward risk-takers and punish caution, everyone is a “bull market genius.” That dynamic flips investor psychology and, over time, creates a false sense of control. As the market continues to climb, risk appears to vanish, and investors believe that nothing can go wrong, leading them to take on increasing levels of risk and leverage. After all, why wouldn’t you if there is “no risk” in investing?

“Over the past 15 years, the markets were repeatedly bailed out of more serious corrections by either fiscal or monetary policy. That neutral stimulus (the interventions) was repeatedly paired with a reward-stimulus of markets going higher. As such, investors were “conditioned” to expect rescue whenever issues arise, to buy stocks on every decline, and to believe that this cycle will indefinitely continue. This was the point we made recently regarding “moral hazard.”

“The Federal Reserve’s well-intentioned interventions have created one of modern finance’s most powerful behavioral distortions: the conviction that there is always a safety net. After the Global Financial Crisis, zero interest rates and repeated rounds of quantitative easing conditioned investors to expect that policy support would always return during volatility. Over time, that conditioning hardened into a reflex: buy every dip, because the Fed will not allow markets to fail. What exactly is the definition of ‘moral hazard?’

Noun – ECONOMICS: The lack of incentive to guard against risk where one is protected from its consequences, e.g., by insurance.

In other words, just as Pavlov’s dogs would start salivating at the “ringing of the bell,” investors are “chasing speculative assets” simply on the assumption that the “food” will arrive. But, as noted, while the Federal Reserve has trained investors to “buy the dip” over the last 15 years, the market has detached from underlying fundamentals. READ MORE…

Tweet of the Day

More By This Author:

Bull Market Genius Is A Dangerous ThingSpaceX: A Financial And Strategic Windfall For Google

The “Double Bubble”

Disclaimer: Click here to read the full disclaimer.