Wall Street HATES These Three Stocks

Image Source: Pexels

Professional investors on Wall Street are betting against a handful of consumer stocks.

Many of these stocks have significant challenges, which is why these speculative traders are betting on the stocks trading lower.

But in the world of investing, taking a contrarian approach can often be very profitable. Especially when Wall Street traders are leaning too heavily on one side of the market.

You see when a large number of traders are betting on a stock trading in one direction… (Lower in the case of our stocks today)… It can create a situation where stocks move in the opposite direction quite quickly!

Over the weekend, I took a look at the top stocks Wall Street is betting against. Traders who bet against these stocks make money when the stocks trade lower. And by the same token, they lose money when the stocks trade HIGHER.

So any strength in these names can cause losses on Wall Street, and create an incentive for traders to buy shares simply to cut their losses. So as these unpopular stocks rebound, it’s very likely that momentum will pick up, giving us a great chance to profit.

Here are three stocks that Wall Street hates — with a chance to trade sharply higher:

Hated Stock #1: CVS Health Corp.

Shares of CVS Health Corp. (CVS) had a terrible year in 2023. In addition to challenges with the company’s pharmaceutical business, CVS also dealt with material amounts of theft.

In many cities, theft has not been prosecuted. CVS and other retailers either had to accept the losses from “shrinkage”, or lock up merchandise making it more difficult for legitimate customers to purchase items.

Naturally, shares traded lower as profits decreased. But today, that problem has been fully documented and the stock is already trading lower because of this challenge. Meanwhile, the company is now slated to grow profits over the next few years.

At a current stock price near $73, investors are paying roughly 8.5 times this year’s expected profits. That’s a reasonable price and one that could move sharply higher on any good news from CVS.

Shares surged in December as the broad market hit new highs. The stock’s chart also featured a “golden cross” which happens when the stock’s 50-day moving average crosses above its 200-day moving average. You can see this in the chart below. Notice how the green line crossed above the blue line at the beginning of this year.

(Click on image to enlarge)

With shares finding support at the end of last year… And with Wall Street still leaning too far on the bearish side, shares of CVS could rally sharply in the early stages of 2024.

Hated Stock #2: Kohl’s Corp.

Similar to CVS, Wall Street investors have been betting against Kohl’s Corp. (KSS).

The company caters to working class consumers and investors are concerned about discretionary spending trends. Many consumers have now spent down excess savings from the pandemic, and we’re seeing credit card delinquencies start to pick up.

KSS also had some missteps in 2022 when inventory levels surged faster than the company could sell merchandise.

Now that these inventory issues are improving, KSS profits should grow. Wall Street expects the company to earn $2.63 per share in the coming fiscal year, and then grow profits to $2.92 per share the following year.

These estimates could be revised higher as the U.S. economy proves to be more resilient than many expected.

Shares of KSS traded sharply lower in 2022. But they’ve found support and now appear ready to break higher in early 2024.

(Click on image to enlarge)

Any positive action for KSS could trigger a short-covering rally. This happens when bearish traders are forced to close out their short positions because of the losses they are suffering.

Short covering rallies can happen very quickly and drive stocks sharply higher. I’m watching to see if KSS can break above $30. Once that level is breached, KSS could build momentum and potentially double in price.

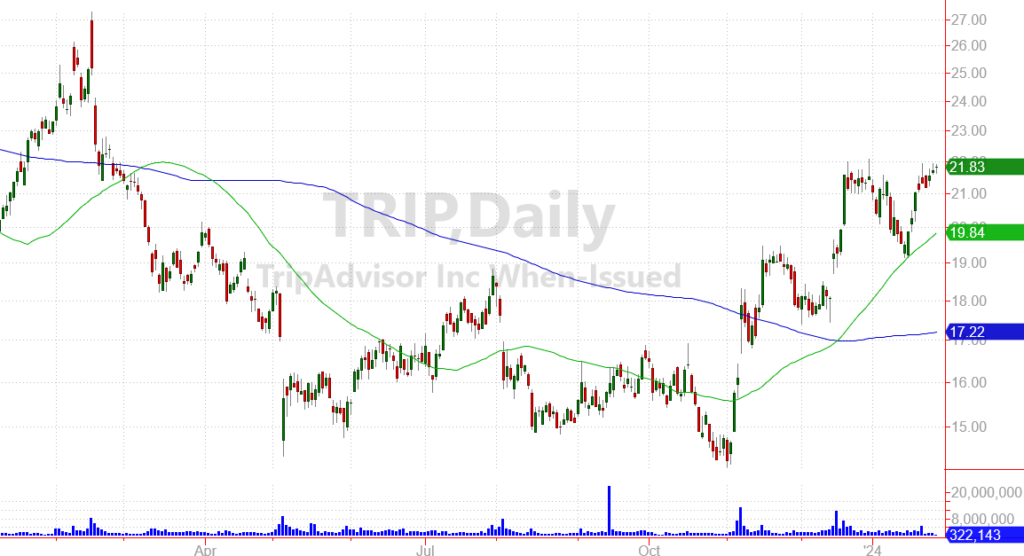

Hated Stock #3: TripAdvisor Inc. (TRIP)

I’ve been keeping a close eye on travel stocks this year. Spending on both personal and business travel is likely to expand this year. And travel stocks have plenty of potential for investors.

Wall Street earnings estimates for TRIP have been declining for several quarters. Investors have had plenty to worry about including geopolitical tensions and economic uncertainty.

But in today’s market, affluent consumers still have plenty of cash to spend. And this group has consistently opted to spend money on experiences rather than expensive “things”.

Meanwhile, business travel is picking up after being challenged during the pandemic. Flights are full, hotel occupancy levels are high, and bookings for the rest of the year look very healthy.

Shares of TRIP have been moving higher over the last three months. And a breakout above $22 could ignite a powerful short-covering rally for TRIP.

(Click on image to enlarge)

I’m close to pulling the trigger on a new bullish position for TRIP — possibly early this week!

More By This Author:

Profit From Fed Rate Cuts In 2024

Credit Card Debt Sets A Grim Outlook For The Holidays

Bonds Are No Longer Boring