Profit From Fed Rate Cuts In 2024

Image Source: Unsplash

The week between Christmas and New Year is typically quiet in the market. But this lull can be a great time to prepare for the year ahead.

Next year will certainly be an interesting one for many different reasons.

Here in the U.S., 2024 is an election year with important implications for the economy. And while I typically try to steer clear of political arguments, I’ll be sure to keep you up to speed on how political developments are affecting your investments.

2024 will also be “the year of Fed interest rate cuts”.

After one of the most aggressive series of interest rate hikes in history, the Federal Reserve has largely tamed our inflation problem. And in 2024, the Fed will be more focused on trying to avoid an economic recession — especially during an election period.

Here are three ways I expect these rate cuts to affect our investments.

1: A Breakout for Gold

Gold has historically been a good hedge for inflation. But during the post-pandemic inflationary period, gold did little to help offset consumers’ erosion in spending power.

A big part of gold’s underperformance was tied to the U.S. dollar. High interest rates made the dollar mor attractive to international investors. And these rates helped prop up the value of the dollar.

It takes fewer “strong dollars” to buy an ounce of gold. So the dollar price of gold was a bit stagnant despite the highest inflation we’ve seen in decades.

But now that market interest rates are pulling back… And now that the Fed is posturing for interest rate cuts in 2024, the U.S. dollar is rolling lower.

That’s good news for gold and should continue to be good news throughout much of 2024.

Take a look at the long-term chart below. As you can see, gold has etched out a long-term cup-with-handle pattern. This is a classic pattern that typically resolves in a major break higher.

(Click on image to enlarge)

Thanks to the high inflationary period we’ve already endured… And thanks to the Fed’s upcoming interest rate cuts (which are already being priced into the market)… Gold should have a stellar year in 2024!

2: An Active Housing Market

The U.S. housing market should also benefit from a pullback in interest rates.

Following the Great Financial Crisis — and especially during the pandemic, mortgage interest rates were very low. Many homeowners are currently sitting on mortgage rates below three percent. The vast majority of homeowners have a mortgage rate below four percent.

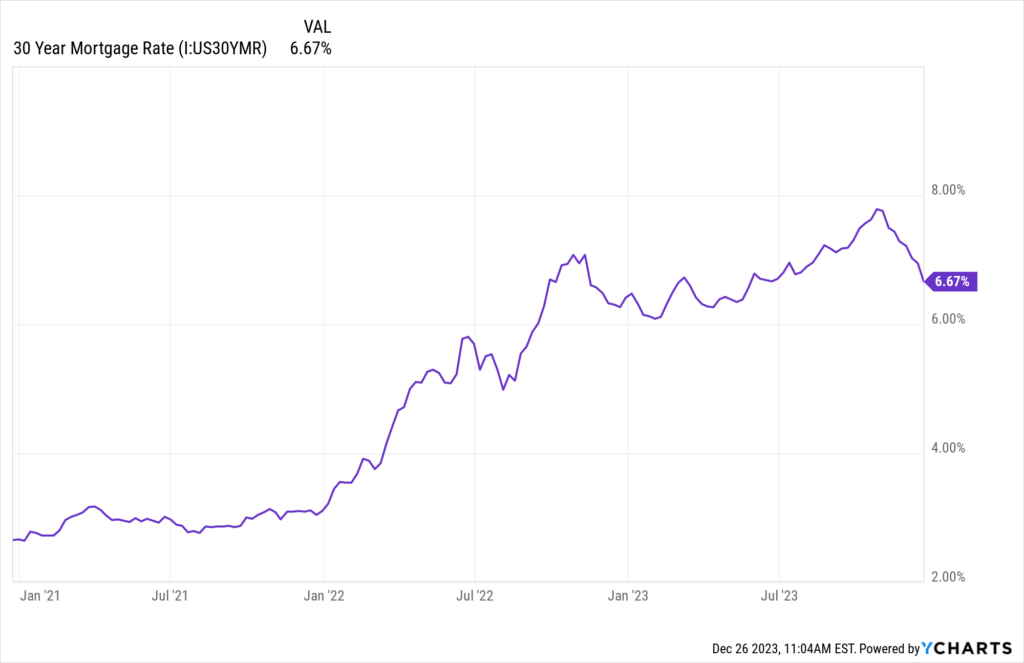

But the Fed’s fight against inflation changed this for new home buyers. The average rate on a 30-year mortgage approached 8% earlier this year before beginning to pull back.

When rates were at their peak, existing homeowners didn’t want to sell their homes. This is because giving up a current 3% mortgage and moving to a new home with an 8% mortgage just didn’t make sense!

Many had the option of buying a new home with the same value as their old home — and DOUBLING their mortgage payment!

For this reason, many would-be sellers refused to put their homes on the market. And so there was a relative shortages of available homes for sale.

As we head into 2024, mortgage rates are now trending lower. This is because the market is anticipating up to six Fed interest rate CUTS in 2024. Take a look at the mortgage rate chart below.

(Click on image to enlarge)

Now that rates are pulling back, more homeowners will be willing to put their houses on the market. This may not lead to higher prices for homes. But it will certainly lead to more activity in the residential real estate market.

With more homes being bought and sold, I expect to see stocks tied to the real estate market trade higher. Some names that come to mind include:

Of course, timing will be key. And there are other fundamental factors to watch carefully in 2024. But an active housing market will certainly be a benefit to these stocks and similar investment plays.

3: A Rebound for Small Cap Stocks

For the past several years, large cap stocks have captured investors attention. Meanwhile, smaller companies have been overlooked and left out of the market’s overall rally.

But as we head into 2024, smaller stocks have begun a powerful rally… One I expect to continue in 2024!

(Click on image to enlarge)

Many small companies were hurt by higher interest rates. These companies often need to borrow cash for working capital. So higher interest rates have been a challenging headwind.

But now that rates are pulling back, those borrowing costs are easing a bit. And there is potential for interest charges to improve even more as the Fed actually implements lower interest rates.

Many small cap stocks are trading at very attractive valuations.

Since investors have been focusing on the market’s largest companies, small cap stocks have been overlooked. This leaves many stock prices very low compared to the profits these companies are expected to generate.

This creates a great opportunity for investors. Especially now that interest rates are pulling back and small companies can save on financing expenses.

Buying shares of the iShares Russell 2000 ETF (IWM) is a good way to gain exposure to this entire group. And I’m spending some time this week researching individual small stocks that may be good trading opportunities for 2024.

More By This Author:

Credit Card Debt Sets A Grim Outlook For The Holidays

Bonds Are No Longer Boring

Three Reasons For A Tradeable Market Rally