Credit Card Debt Sets A Grim Outlook For The Holidays

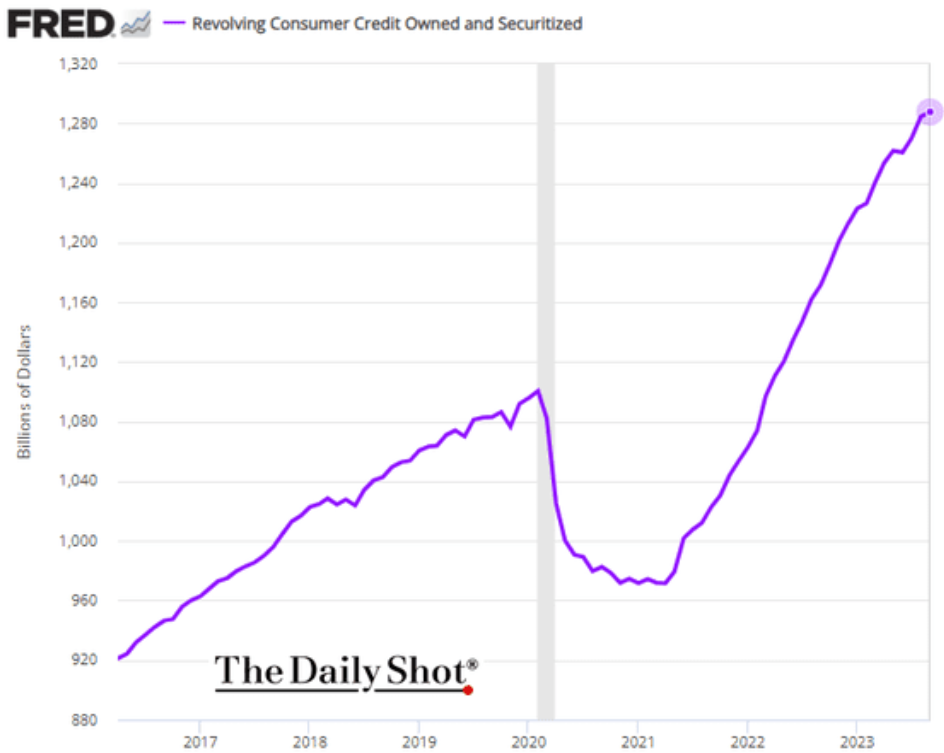

American consumers are struggling under mounting credit card debt. In less than three years, Americans have added more than $300 billion in credit card debt, bringing the total near $1.3 trillion!

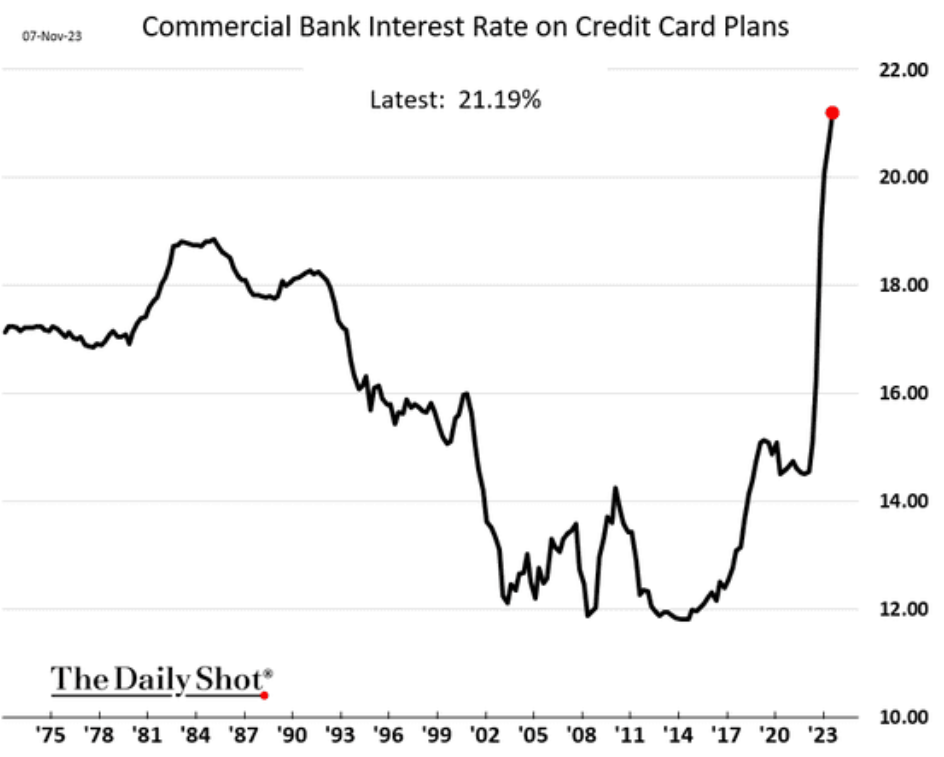

As if the debt wasn’t enough, rising interest rates are making it more difficult for families to cover the credit card bills.

Today, the average rate of credit card debt is well north of 20%. So, as debt levels rise, the required monthly payments are growing exponentially, which makes it imperative for families to find the best debt relief company. Debt-relief companies can help families reduce their debt burden by negotiating with creditors to reduce the interest rates and monthly payments.

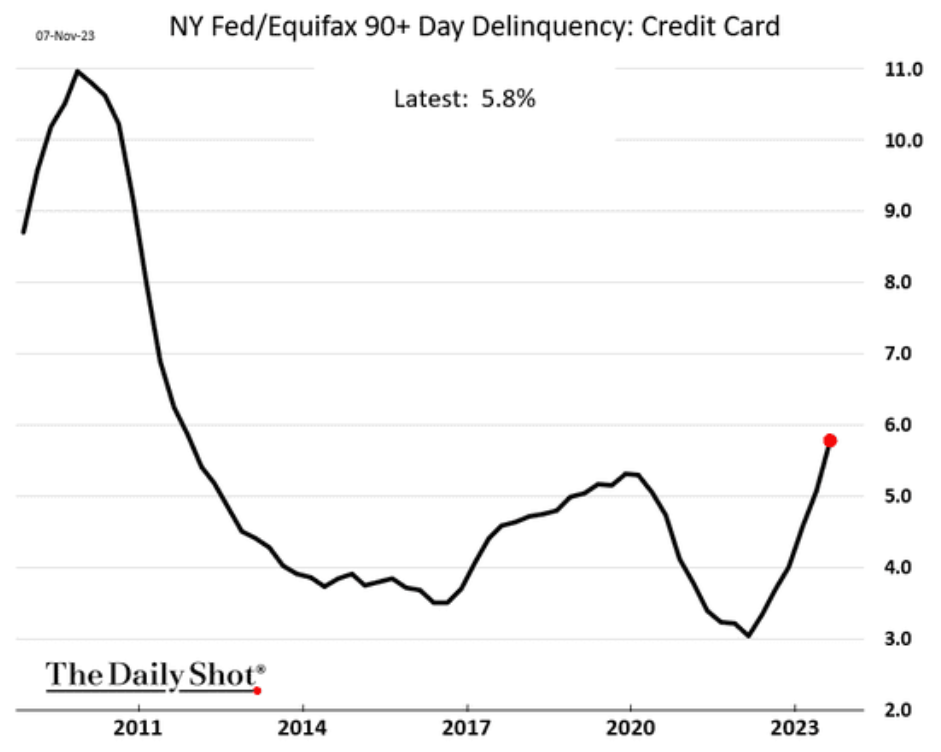

With higher debt balances and surging interest rates, its no surprise that families are falling behind on payments. The chart below shows a concerning rise in the number of delinquent credit card accounts.

This trend of delinquencies could quickly accelerate as many families work through the last of pent up savings following the pandemic. Once that cash is gone, more consumers will be unable to pay their bills, diving delinquency rates even higher.

A Sobering Season for Retail Stocks

This credit card debt crisis couldn’t come at a worse time for retailers.

The holiday shopping stretch from Thanksgiving to Christmas accounts for up to 30% of annual sales for many retailers.

But with credit cards maxed out in many cases, and the cost of everyday essentials still elevated, consumers will have less discretionary cash available for holiday gifts and celebrations this year.

Already, major retailers have issued gloomy outlooks ahead of the shopping season. Retail management teams warn that consumers are delaying purchases and shifting toward lower-priced private label and discount store options. Walmart, Target and Best Buy have all announced profit warnings in recent months, citing changing consumer behavior.

The numbers paint a concerning picture for retail stocks. Especially retail stores that cater to middle-class and lower-income customers.

Weak holiday spending could also spill over to related areas of the market including delivery stocks like FedEx Corp. (FDX) and United Parcel Service (UPS).

And I’m concerned about credit card companies like Capital One Financial (COF) and Discover Financial (DFS). While both of these companies can generate higher profits from rising interest rates, the risk is that both companies will have to write off loans due to higher default rates.

Mounting credit card debt and rising delinquencies among American consumers spell trouble for retailers this holiday season.

Shoppers burdened with high interest payments and inflation have less ability and willingness to splurge on gifts and other discretionary purchases. Retailers relying on a strong holiday shopping boost will likely be disappointed, putting additional pressure on struggling stocks.

The stretched consumer also adds risk for the overall economy — and the broad stock market — heading into 2024.

More By This Author:

Bonds Are No Longer Boring

Three Reasons For A Tradeable Market Rally

The $250,000,000,000 Bank Debt Bomb

Disclosure: I have a personal bearish position on COF and may be taking trades in other stocks mentioned. If you would like to see the trades I’m placing in my personal account, be sure to ...

more

Household debt service burdens are well below where they were in 2006. A headline number like a record amount of credit card debt doesn't provide context. Is credit card debt higher? Yes. Is the economy larger? Also yes. I think the arguements laid out are not compelling enough to change my bullish outlook.