Volatility Selling Is Back

First things first, the bull market and the predominantly retail-driven frenzy in cryptocurrencies, SPACs, NFTs, and BANG stocks—BlackBerry (BB), AMC (AMC), Nokia (NOK), and GameStop (GME)—are to me all derivatives of the fact that the policy mandarins of the world are showering the real economy and financial markets with unprecedented levels of liquidity.

To be clear, I do not mean to disparage traders who are able to extract value from these markets; all the more power to them. What I am saying is that if global monetary policymakers were not doing QE by the trillions, on an annualized basis, the bull market in many of these things would evaporate like mist on a hot summer morning.

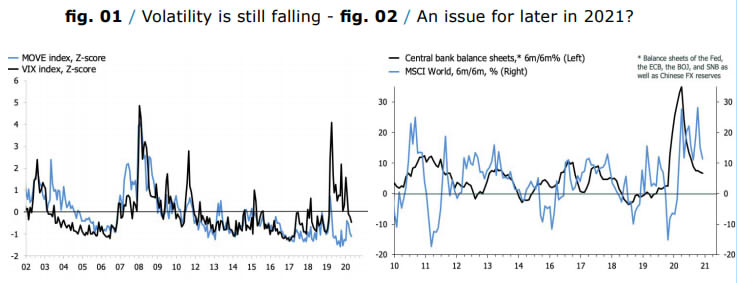

Meanwhile, in old-school assets—themselves beneficiaries of QE—the overarching theme at the moment seems that the vol-sellers are back in charge. The VIX has hurtled lower, to just over 15, and at this rate it will soon be in the low teens. The same is the case for the MOVE index for fixed income volatility, which is also now clearly driving lower, hitting a 13-month low of 53.4 in May.

For comparison, the most previous low in the VIX was just over 12 in November 2019, coinciding with a period of very low volatility through Q4 in that year, and for the MOVE, the recent low traces back to July last year, at around 41.

From an empirical perspective, volatility is famously auto-correlated—low volatility begets low volatility, high volatility tends to lead to higher volatility and so on—until, of course, something happens. Black Swans notwithstanding, the two most obvious catalysts possible for a regime change in volatility is a shift in central bank policy— tapering of QE—and the grim realization that a new virus variant has managed to beat our vaccines.

The second chart shows that the six-month trailing return on the MSCI World remains robust, at 10-to-15%, compared to a clear slowdown in the rate of change in global central bank QE. This is probably not an issue in the very near-term. After all, the pace of QE is still punchy. By my calculations, the Fed, the ECB, and the BOJ bought $300- to-400 billion's worth of assets per month between April and June, and none of them are feeding markets with information that this is ending anytime in the very near future.

That said, “taper” is now starting to feature more prominently in debates and commentary, and it is difficult to believe that its prevalence won’t grow if the major economies perform anywhere near what the consensus expects them to over the next six months.

One of the most predictable mini-cycles in the current environment is the scenario where policy makers attempt to withdraw stimulus, only to be met with the wrath of financial markets, and thus forced to retreat. The timing of the onset of these cycles, as well as their length, vary and are difficult to predict, but the playbook is simple in the end. I think investors will have to go through a similar cycle in the next six-to-12 months.

Monetary policymakers will try to taper their QE programs—the Fed might even contemplate a rate hike or two by the end of 2022 depending on the response to a reduction QE—and markets won’t like it. As per usual, the ensuing tightening of financial conditions will be interpreted as prima facie evidence of a policy mistake, and central banks will have to reverse course.

I concede that how far and how quickly policymakers manage to withdraw policy stimulus before markets rebel is important, but it doesn’t change the story. As I have explained before, this tit-for-tat game between markets and policymakers—in which the former ultimately dictate the latter—rests on a very specific political equilibrium.

Politicians and policymakers fully understand that their approach comes with the caveat of increasing wealth and income inequality, via rampant asset price inflation, but they have contended that this is reasonable price to pay to avoid the gut-wrenching economic damage wrought by a normalization in financial market and real asset prices. This seems paradoxical, even naive, in light of the creed of the current policymaking consensus of helping those at the bottom.

After all, even if the tide lifts all the boats, some might rise faster than others, and this, in itself, could become a political problem. We see clear evidence that the new U.S. administration is grappling with these issues—which aren’t easy to reconcile, mind—but for now, the policy put for asset markets remain in place.

If and when the political wind changes, investors will need to run for the hills. As far as the possibility of a new vaccine-busting COVID-19 variant is concerned, it’s important to distinguish between two scenarios; one in which a new variant is vaccine-resistant, and another in which markets are led to believe that such a variant is spreading.

The key point here is that we won’t know for sure a new variant is resistant to our existing vaccines until after markets have decided that it might very well be. This is to say, there is an, at this point unknown, threshold for the degree of certainty that markets need, to determine that a vaccine-resistant COVID-19 variant is upon us.

The initial response to such a shift would be brutal; imagine the entire post-November rally—when Pfizer (PFE) announced that its vaccine is 95% efficient against the virus—in a few weeks, if not days.

That said, I would still be inclined to buy the dip in such an environment. The discovery, either actual or perceived, of a vaccine-resistant COVID-19 variant would be a bit like the moment in the movie Independence Day when they unsuccessfully get rid of the aliens. It is the point of no return where everything is lost, except that in the real world, just as in Hollywood, humanity will find a way.

In addition, if markets collapsed on the assumption that COVID-19 will elude even our best scientific and medical response, policymakers would be forced to respond with overwhelming stimulus, or at least, I assume that this would be their knee-jerk reaction. In the meantime, I suspect vol selling will remain lucrative over the summer, but a spike is looming, and my guess is that it will happen before the year is over.

Disclosure: None