VIX Doing The Limbo Dance – How Low Can We Go?

I’ve been trying to think of the proper mental image for a VIX that seems to steadily ratchet down to ever-lower handles. For the second time this month, the best I could come up with is a line dance – this time it’s the limbo. Can we get below 17?No problem.How about 16, 15, 14?So far, so good. How low can we go?

This is hardly a new topic for us. Faithful readers know that volatility is a frequent theme in our daily pieces, and the fact that we have been plumbing multi-year lows in VIX on a relatively consistent basis has hardly escaped our attention. We wrote at length about it from mid-April through early May, just before a brief spike from 15.50 to 21.50 in the four days that included the last FOMC meeting. On April 28th, we noted:

The rally of the past two days has caused VIX to sink to its lowest levels since November 2021. We even saw a 15 handle briefly today. For perspective, November 2021 was the peak in NDX, about 27% above current levels. (SPX peaked in early January 2022).

Can this relative complacency continue? If the past is prologue, then sure. We’ve been in a tight range and it’s normal for people to have a recency bias. That means that recent events weigh more heavily in people’s decision-making. We’ve been quiet, so it’s normal for traders to extrapolate that calm into their pricing.

Might the coming week’s FOMC meeting and/or Apple (AAPL) earnings upset that calm? Sure…

It turned out that there was some degree of truth in both assertions. On balance, we have indeed seen the relative complacency continue. And as it turned out, the FOMC meeting (though not AAPL), did turn out to be the catalyst for the aforementioned spike. But complacency remains in the fore.

In our mid-April piece, we asserted that VIX often functions better as a contrarian than a predictive indicator. In theory, it is meant to tell us the market’s best expectation for volatility over the coming 30 days. As the Cboe describes it:

The VIX Index is a calculation designed to produce a measure of the constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPX℠) call and put options.

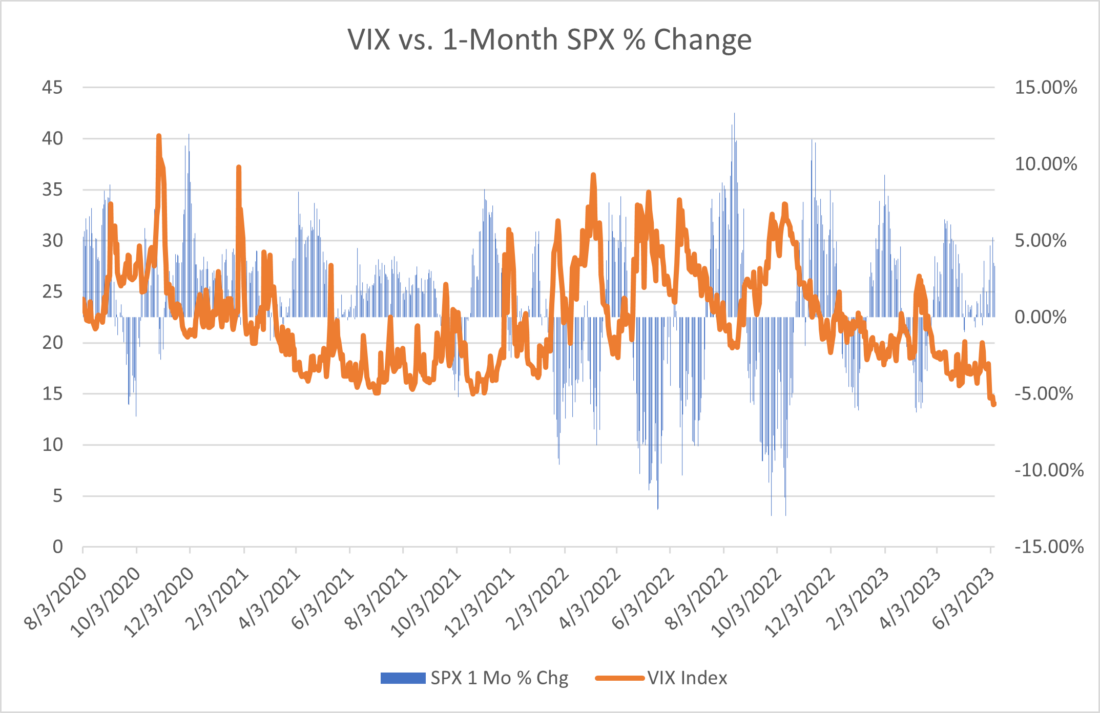

Yet in practice, it tends to follow changes in SPX rather closely. The chart below updates one that we first used in mid-April, showing the level of VIX versus the rolling 1-month percentage changes in SPX.Quite frankly, it is as reactive as it is predictive, if not more.

Source: Interactive Brokers

Recency bias is a well-known concept in behavioral finance. Originating in psychology, it is the phenomenon that people tend to favor recent events over those that occurred some time ago. It would not at all be surprising that traders, who often use the past as prologue, favor more recent events over those that occurred some time ago. If we’re headed down, then traders assume that might persist; and vice versa.

But that only covers part of the decision process. I believe that demand for VIX and volatility protection, in general, is a reaction to fear and greed – particularly by institutional investors. Although individuals and aggressive institutions have favored zero-dated options for their speculative and hedging strategies, larger institutions continue to favor the highly evolved and liquid VIX complex. It is a more efficient way to hedge significant portfolios, which is the basis of our assertion that 0DTE options have not “broken” VIX.

When institutions get nervous, they seek protection in VIX. When they feel sanguine, they don’t. Large institutions obviously either feel sanguine or that they have already de-risked their portfolios sufficiently by raising cash, investing defensively, or similar. If the former is the case, then VIX can spike in a hurry. We saw it in early May, and at several other times in the chart above. The spikes occur when portfolio managers and/or large traders clamor for protection simultaneously and in a hurry. And the more sanguine they are, the more susceptible they are to a change in sentiment.

Bear in mind the timing of the piece we wrote in early May. An FOMC meeting was occurring within a few days, and the market was caught by surprise. We have another meeting one week from today. As we noted, a “skip” is widely expected. The current probability is 33% for a 25-basis point hike. There is varying views about whether that “skip” will lead to a pause in rate hikes, and maybe a pivot to lower rates eventually.

We seem awfully sanguine about a benign outcome to a meeting with a wide range of potential outcomes, don’t we?

More By This Author:

Keeping An Eye On The Russell 2000

The FOMC Cha-Cha: Skip, Hike, Pause, Pivot

Today In Gloomy Charts

Disclosure: OPTIONS TRADING

Options involve risk and are not suitable for all investors. For more information read the “ more