Vale SA: Is This Deeply Undervalued Stock A Hidden Gem?

Image Source: Pixabay

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s possibly a deeply undervalued gem.

The Stock this week is:

Vale SA (VALE)

Vale is a large global miner and the world’s largest producer of iron ore and pellets. In recent years the company has sold noncore assets such as its fertilizer, coal, and steel operations to concentrate on iron ore, nickel, and copper. Earnings are dominated by the bulk materials division, primarily iron ore and iron ore pellets. The base metals division is much smaller, consisting of nickel mines and smelters along with copper mines producing copper in concentrate. In 2024, Vale sold a minority 10% stake in energy transition metals, its base metals business, likely the first step in separating base metals and iron ore.

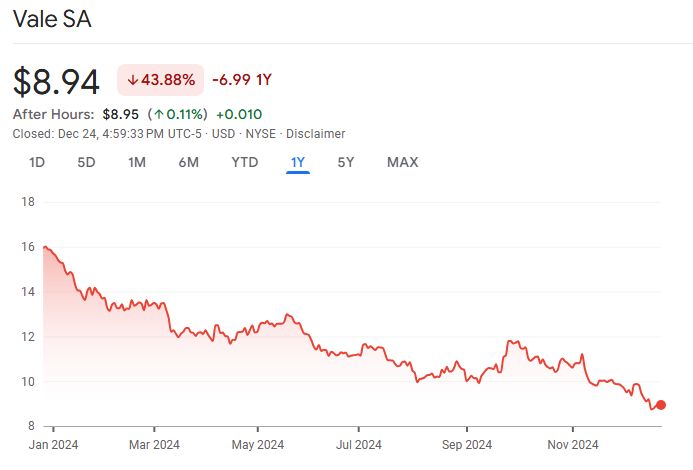

A quick look at the share price history (below) over the past twelve months shows that the price is down 43.88%.

Source: Google Finance

One of the metrics we use in our screens is IV/P (Intrinsic Value to Price). Let us simplify what it means:

IV/P (Intrinsic Value to Price) tells you if a stock is a good deal or not based on how much value you’re getting for the price you pay. Here’s how it works:

- The Calculation: It adds up the stock’s ability to make money (Earning Power), grow (Incremental Growth), and pay back investors (Shareholder Yield). This gives you an idea of what the stock is really worth, called its Implied Value.

- The Meaning of IV/P:

- If IV/P is greater than 1, it means you’re getting more value than you’re paying for. For example, for every $1 you invest, you’re getting more than $1 of value. That’s a good deal!

- If IV/P is less than 1, it means you’re getting less value than you’re paying for. For example, for every $1 you invest, you’re getting less than $1 of value. That might not be a great deal.

- What It’s Used For:

- It’s a quick way to spot undervalued stocks (good deals).

- If IV/P is very low, like 0.6 (you’re only getting 60 cents of value for $1), it’s likely overpriced.

- Important Note: This is just an estimate. Other factors, like market trends or company issues, can affect how accurate this is.

So, IV/P helps investors find stocks that are “cheap” based on how much value they give back. Higher is usually better!

We currently have an IV/P of 2.30 for Vale SA (VALE), which means the stock’s Implied Value is calculated to be 2.30 times greater than its current price. In simpler terms:

- For every $1 you invest, you’re potentially getting $2.30 of value.

- This is an extremely high ratio, which might suggest the stock is deeply undervalued or that there’s some mispricing or unusual calculation in the data.

Possible Reasons for This Undervaluation Include:

VALE S.A. (a Brazilian multinational corporation engaged in metals and mining) might be considered undervalued for several reasons. Understanding these factors requires analyzing both macroeconomic conditions and company-specific details. Here are possible reasons:

1. Commodity Price Fluctuations

- Iron Ore Prices: As one of the largest iron ore producers, VALE’s profitability is heavily tied to iron ore prices. A decline in global demand, especially from major importers like China, could negatively impact revenue and make the stock appear undervalued.

- Other Metals: VALE also deals in nickel, copper, and other metals, whose prices might be volatile due to global economic conditions, geopolitical tensions, or supply chain issues.

2. Global Economic Concerns

- China’s Slowdown: Since China is a major importer of iron ore and other metals, any slowdown in its economy (e.g., due to real estate issues or weak manufacturing activity) reduces demand and pressures VALE’s valuation.

- Recession Fears: Global concerns about a recession may reduce investor confidence in cyclical sectors like mining, even if the company remains fundamentally strong.

3. Currency Fluctuations

- VALE generates a significant portion of its revenue in USD while incurring many costs in BRL (Brazilian real). A strengthening BRL or a weakening USD could compress margins and earnings.

4. Environmental, Social, and Governance (ESG) Issues

- Past Incidents: Events like the Brumadinho dam disaster in 2019 may continue to weigh on investor sentiment, increasing perceived risks despite mitigation efforts.

5. Geopolitical Risks

- Brazil’s Political Climate: Uncertainty in Brazil’s political or regulatory environment could deter investors, even if the company’s fundamentals are strong.

6. High Capital Intensity

- Mining operations are highly capital-intensive, requiring substantial investments in exploration, extraction, and infrastructure. Delays or overruns in these projects can lead to concerns about profitability.

7. Perceived Overdependence on Iron Ore

- Investors may see VALE as overly reliant on iron ore, even if it is diversifying into other metals or focusing on growth areas like green metals (e.g., nickel for batteries). A lack of diversification might make the stock less attractive during periods of commodity-specific weakness.

More By This Author:

Verizon Communications Inc DCF Valuation: Is The Stock Undervalued?

10 Worst Performing Large-Caps Last 12 Months

One Stock Superinvestors Are Dumping: Is It Time To Sell ORCL?