One Stock Superinvestors Are Dumping: Is It Time To Sell ORCL?

Image Source: Unsplash

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and Howard Marks.

While doing this research we’ve also uncovered a number of stocks that superinvestors have sold, or reduced in their portfolios, according to their latest 13f’s. So we’re now providing a new weekly feature article called ‘One Stock Superinvestors Are Selling‘. This week we’ll take a look at:

Oracle Corp (ORCL)

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has more than 400,000 customers in 175 countries.

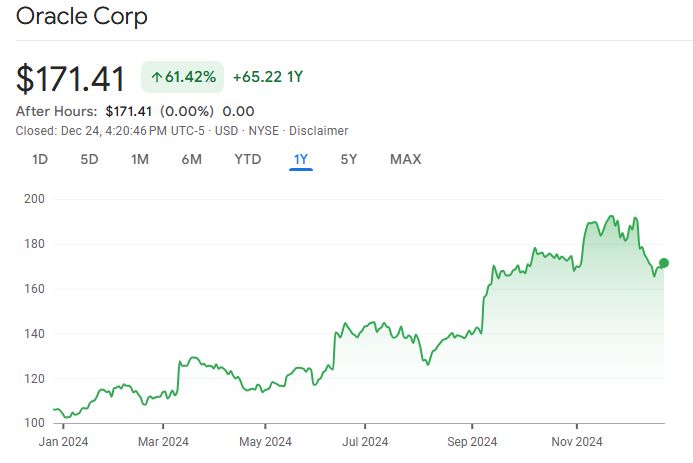

A quick look at the price chart below for the company shows us that the stock is up 61.42% in the past twelve months.

Source: Google Finance

Superinvestors who reduced, or sold out of the company’s stock, according to their latest 13Fs, include:

(Remaining shares)

Jean-Marie Eveillard – 14,083,656

David Tepper – 1,573,394

Donald Yacktman – 646,955

Israel Englander – 573,000

John Rogers – 55,244

Ray Dalio – SOLD OUT

Steve Cohen – SOLD OUT

Lee Ainslie – SOLD OUT

More By This Author:

WCC: The Undervalued Stock That Superinvestors Are Loading Up On

Stellantis NV: Is This Deeply Undervalued Stock A Hidden Gem?

Microsoft Corp (MSFT) DCF Valuation: Is The Stock Undervalued?