Microsoft Corp (MSFT) DCF Valuation: Is The Stock Undervalued?

Image Source: Unsplash

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently on our screens, Microsoft Corp (MSFT).

Profile

Microsoft develops and licenses consumer and enterprise software. It is known for its Windows operating systems and Office productivity suite. The company is organized into three equally sized broad segments: productivity and business processes (legacy Microsoft Office, cloud-based Office 365, Exchange, SharePoint, Skype, LinkedIn, Dynamics), intelligence cloud (infrastructure- and platform-as-a-service offerings Azure, Windows Server OS, SQL Server), and more personal computing (Windows Client, Xbox, Bing search, display advertising, and Surface laptops, tablets, and desktops).

Recent Performance

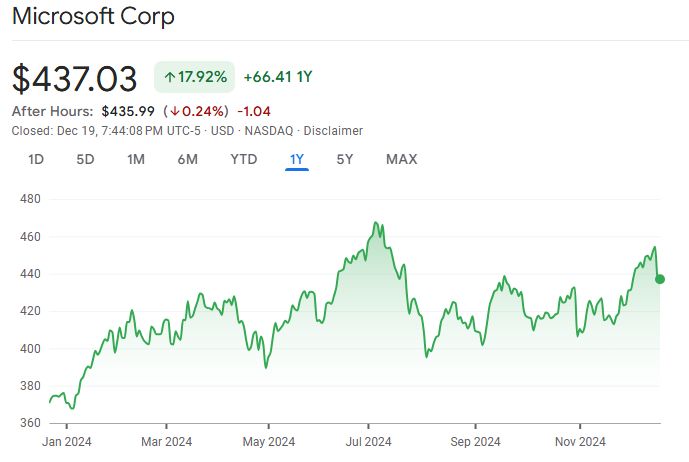

Over the past twelve months, the share price is down 17.92%.

Source: Google Finance

Inputs

- Discount Rate: 8%

- Terminal Growth Rate: 2%

- WACC: 8%

Forecasted Free Cash Flows (FCFs)

| Year | FCF (billions) | PV(billions) |

| 2024 | 74.07 | 68.58 |

| 2025 | 87.66 | 75.15 |

| 2026 | 100.38 | 79.68 |

| 2027 | 114.95 | 84.49 |

| 2028 | 131.63 | 89.59 |

Terminal Value

Terminal Value = FCF * (1 + g) / (r – g) = 3422.38 billion

Present Value of Terminal Value

PV of Terminal Value = Terminal Value / (1 + WACC)^5 = 2329.21 billion

Present Value of Free Cash Flows

Present Value of FCFs = ∑ (FCF / (1 + r)^n) = 397.50 billion

Enterprise Value

Enterprise Value = Present Value of FCFs + Present Value of Terminal Value = 2726.71 billion

Net Debt

Net Debt = Total Debt – Total Cash = 66.22 billion

Equity Value

Equity Value = Enterprise Value – Net Debt = 2660.49 billion

Per-Share DCF Value

Per-Share DCF Value = Enterprise Value / Number of Shares Outstanding = $356.20

Conclusion

| DCF Value | Current Price | Margin of Safety |

|---|---|---|

| $356.20 | $437.03 | -22.69% |

Based on the DCF valuation, the stock is overvalued. The DCF value of $356.20 per share is lower than the current market price of $437.03. The Margin of Safety is -22.69%.

More By This Author:

10 Worst Performing Large-Caps Last 12 MonthsCHTR: The One Stock That Superinvestors Are Dumping: Is It Time To Sell?

The Risks Of Shorting MSTR And Long Bitcoin