Verizon Communications Inc DCF Valuation: Is The Stock Undervalued?

Image Source: Pixabay

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is currently on our screens, Verizon Communications Inc (VZ).

Profile

Wireless services account for about 70% of Verizon Communications’ total service revenue and nearly all of its operating income. The firm serves about 93 million postpaid and 20 million prepaid phone customers via its nationwide network, making it the largest US wireless carrier. Fixed-line telecom operations include local networks in the Northeast, which reach about 30 million homes and businesses and serve about 8 million broadband customers. Verizon also provides telecom services nationwide to enterprise customers, often using a mixture of its own and other carriers’ networks. Verizon agreed to acquire Frontier Communications in September 2024.

Recent Performance

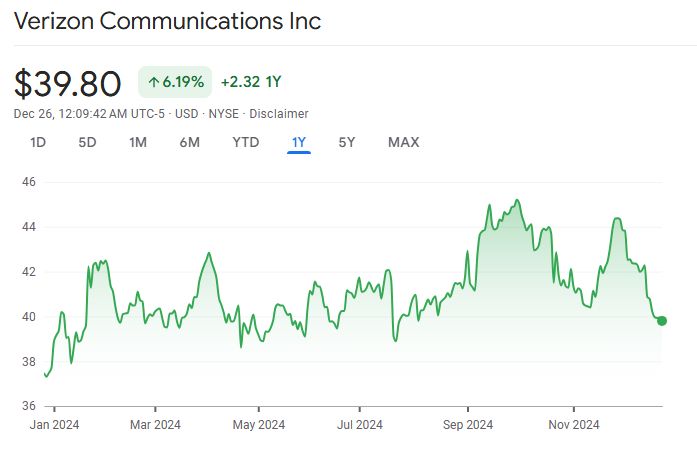

Over the past twelve months, the share price is up 6.19%.

Source: Google Finance

Inputs

- Discount Rate: 5%

- Terminal Growth Rate: 1%

- WACC: 5%

Forecasted Free Cash Flows (FCFs)

| Year | FCF (billions) | PV(billions) |

| 2024 | 17.63 | 16.79 |

| 2025 | 17.71 | 16.06 |

| 2026 | 17.79 | 15.37 |

| 2027 | 17.87 | 14.70 |

| 2028 | 17.94 | 14.06 |

Terminal Value

Terminal Value = FCF * (1 + g) / (r – g) = 452.99 billion

Present Value of Terminal Value

PV of Terminal Value = Terminal Value / (1 + WACC)^5 = 354.93 billion

Present Value of Free Cash Flows

Present Value of FCFs = ∑ (FCF / (1 + r)^n) = 76.98 billion

Enterprise Value

Enterprise Value = Present Value of FCFs + Present Value of Terminal Value = 431.91 billion

Net Debt

Net Debt = Total Debt – Total Cash = 169.22 billion

Equity Value

Equity Value = Enterprise Value – Net Debt = 262.69 billion

Per-Share DCF Value

Per-Share DCF Value = Enterprise Value / Number of Shares Outstanding = $62.17

Conclusion

| DCF Value | Current Price | Margin of Safety |

|---|---|---|

| $62.17 | $39.82 | 35.95% |

Based on the DCF valuation, the stock is undervalued. The DCF value of $62.17 per share is higher than the current market price of $39.82. The Margin of Safety is 35.95%.

More By This Author:

10 Worst Performing Large-Caps Last 12 MonthsOne Stock Superinvestors Are Dumping: Is It Time To Sell ORCL?

WCC: The Undervalued Stock That Superinvestors Are Loading Up On