U.S. Stocks Adobe Inc.

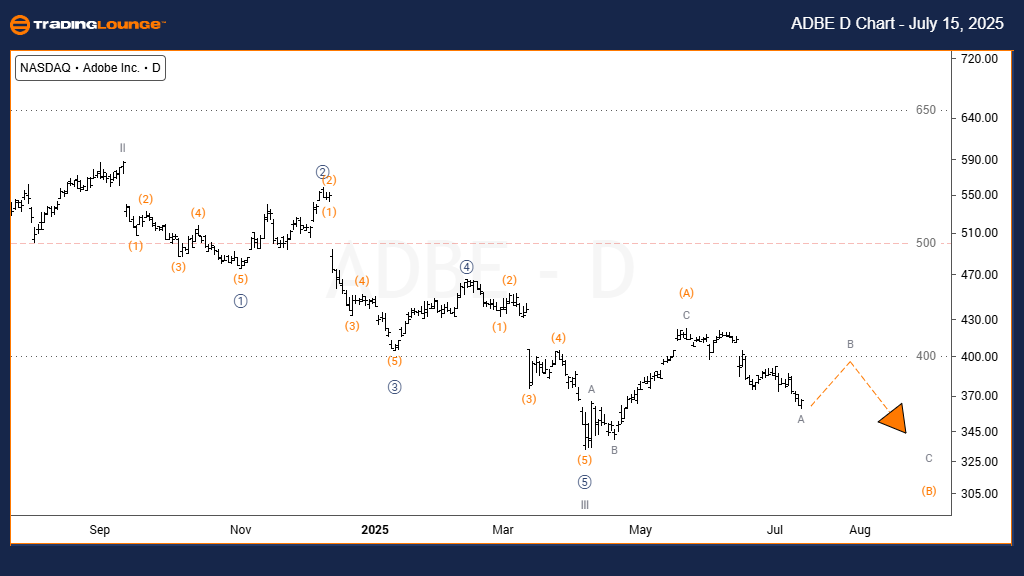

Adobe Inc. (ADBE) – Elliott Wave Analysis – Daily Chart

Technical Analysis – Trading Lounge

Function: Counter trend

Mode: Corrective

Structure: Flat Correction

Position: Wave (Y) of {B}

Direction: Downtrend

Details: Expecting wave (B) to complete near the Wave III top around the 325–330 zone before moving into wave (C).

On the daily chart, Adobe Inc. (ADBE) is undergoing a flat correction as part of wave (Y) of {B}, following the completion of wave III. Since wave II formed a zigzag, the guideline of alternation suggests wave {B} will unfold as a flat or triangle.

Wave (A) of the flat appears complete, and the market is now advancing through wave (B), with expectations that it may terminate close to the previous high of wave III near the 325–330 level. This corrective structure aligns well with Elliott Wave rules, maintaining proportionality and supporting the flat pattern outlook.

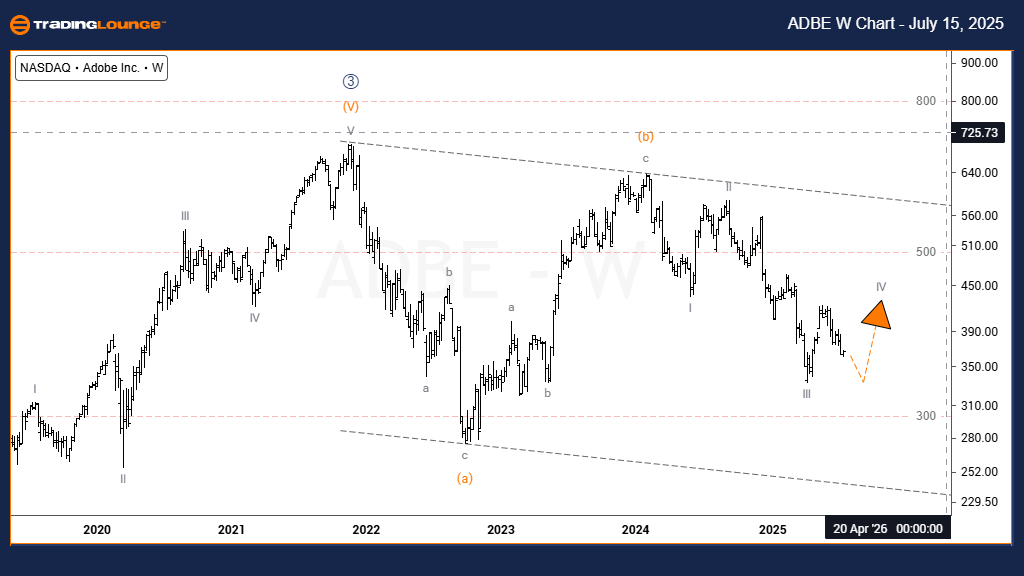

Adobe Inc. (ADBE) – Elliott Wave Analysis – Weekly Chart

Technical Analysis – Trading Lounge

Function: Trend

Mode: Motive

Structure: Impulsive

Position: Wave IV of (c)

Direction: Uptrend

Details: The price is in wave IV of (c), forming a zigzag correction within a parallel channel before potentially continuing higher in wave V.

On the weekly chart, Adobe Inc. is correcting after a major upward impulsive wave. This correction is progressing in the form of a zigzag (a)-(b)-(c) and is consistent with classic Elliott Wave behavior. Waves (a) and (b) are completed, and the current price action represents wave (c), which is still unfolding.

Inside wave (c), the structure has reached wave IV, which is expected to develop further within a parallel channel. The broader trend remains bullish, and this temporary correction is part of a continuation setup for a longer-term uptrend.

Technical Analyst: Dhiren Pahuja

More By This Author:

Unlocking ASX Trading Success: Unibail-Rodamco-Westfield - Tuesday, July 15

U.S. Stocks: Apple Inc.

Elliott Wave Technical Analysis: British Pound/Australian Dollar - Tuesday, July 15

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more