Unlocking Long-term Value: 3 S&P 500 Stocks To Buy Now On The Dip

Audio Length: 00:19:39

Today’s episode of Full Court Finance at Zacks explores the stock market as the bulls and bears fight for control in the early weeks of September. Despite the possibility of more near-term uncertainty, volatility, and selling, the overall upbeat backdrop that drove much of the 2023 rally remains in place.

Therefore, investors with long-term horizons might want to consider buying proven S&P 500 stocks that are trading at levels that could look like steals years or even months from now. The three stocks we explore today are Starbucks (SBUX) , Paycom Software (PAYC) , and Public Storage (PSA).

The recent downturn in the early days of a traditionally poor month for stocks has seen the S&P 500 and the Nasdaq slide back below their 50-day moving averages. The bulls might have to hold their ground in the lead-up to the August CPI release on September 13. Yet, the nearby chart showcases how the Nasdaq is interacting with its 21-week moving average (red line) and why it might indicate more bullishness going forward.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Now might be a time for investors to take a giant step back and remember to block out the constant noise and look to the two biggest drivers of stock prices: earnings and interest rates.

Zacks estimates call for S&P 500 earnings to soar 11.7% in 2024 and another 10.9% in 2025 vs. a projected decline of -3.2% in 2023. And Jay Powell and Co. remain near the end of their tightening cycle.

Rates might have to stay higher for longer as the U.S. economy remains resilient. In fact, the higher rates signal ongoing strength and growth, which further supports the soft landing that more Wall Street giants are calling for.

All told, it might be time for investors to take one of Warren Buffett’s most used mantras to heart and “be greedy when others are fearful” and start looking at large-cap S&P 500 stocks that have fallen out of favor and are trading at levels that might look likes steals years from now.

Starbucks is the coffee shop powerhouse that boasts over 37,000 stores globally. The company has grown at an impressive clip for over 20 years to become one of the most valuable brands in the world. SBUX’s e-commerce, delivery, and other digital initiatives have helped it thrive in the changing retail environment, with its app one of the most downloaded food and drink apps in the world last year, behind only McDonald’s, Uber Eats, and DoorDash.

Starbucks topped our Q3 FY23 earnings estimates in early August, as it showcased impressive resilience amid slowing consumer spending, with global comparable sales up 10%. SBUX is improving how its stores and supply chains operate and working on expanding in smaller cities and towns.

Some are worried about consumers in its two largest markets—the U.S. and China—but Zacks estimates call for it to post 11% YoY revenue growth both this year and next to help boot its adjusted earnings by around 17% each year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Starbucks, which currently lands a Zacks Rank #3 (Hold), has soared 1,200% over the last 20 years vs. the S&P 500’s 350% and McDonald’s 1,100%. Yet, SBUX trades 25% below its peaks and 21% under its average Zacks price target.

Some investors might want to wait for it to cross above some key moving averages. But coffee isn’t going out of style and neither is Starbucks. SBUX is also trading at a 36% discount its highs and 10% below its 10-year median at 23.8X forward earnings.

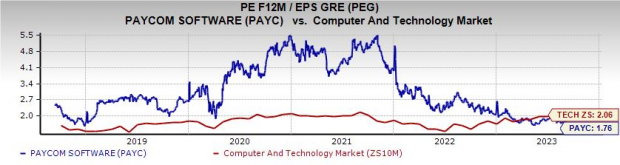

Paycom Software was a pioneer in digital HR and payroll technology over 20 years ago. Paycom’s cloud software today helps with onboarding, benefits enrollment, talent management, and beyond. PAYC and other similar software are now deeply embedded and essential at companies big and small. And Paycom’s decade of impressive double-digit revenue growth backs up its value and vital nature.

Paycom topped our Q2 earnings and sales estimates in early August and upped its guidance as it expands its total addressable market to “include larger North American organizations with both domestic and foreign employees.” Zacks estimates call for it to post 25% revenue and earnings growth this year and 21% higher sales and EPS in 2024.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Paycom stock has skyrocketed since its 2014 IPO, but it is currently trading 50% below its record highs. The downturn, coupled with its earnings outlook helps its valuation look far more reasonable. Plus, PAYC earlier this year began to pay a dividend for the first time to highlight its overall financial strength.

Public Storage is one of the largest self-storage companies in the country, with roughly 3,000 facilities in the U.S. and almost two million customers. PSA is a REIT that’s been gaining momentum for years as Americans continue to buy tons of stuff, big and small. The company’s revenue has soared over the last 20-plus years, including 22% growth in 2022.

Zacks estimates call for PSA to post 8% revenue growth in FY23 and 6% higher sales in FY24, which would mark stronger expansion compared to the several-year stretch prior to its Covid boom. Public Storage’s adjusted FFO (which are essentially earnings for REITs) are projected to climb by roughly 5% during both years.

(Click on image to enlarge)

Image Source: Zacks Investment Research

PSA shares have climbed 600% over the last 20 years to crush the benchmark. Public Storage is still up nearly 30% in the past three years even though it is down 35% from its peaks.

PSA is currently trading at its lowest forward earnings multiple since the initial Covid crash (15.5X), which puts it at decade-long lows even though the stock has climbed 75% in the past 10 year. Plus, Public Storage lifted its dividend by 50% earlier this year, with it yielding 4.5% at the moment.

More By This Author:

3 Top Under-The-Radar Stocks To Buy In September

Bear of the Day - Foot Locker, Inc.

Finding The Best Cheap Stocks Under $10 To Buy

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more