Finding The Best Cheap Stocks Under $10 To Buy

The bulls showed they were ready to fight on Monday, with buyers finally stepping up to the table in a big way after an extended August downturn. The Nasdaq’s strong showing was driven by big gains from Nvidia, Tesla, and other growth-focused stocks.

The S&P 500 had dropped nearly 5% in August, with the Nasdaq down roughly 7%. The declines took both major indexes below their 50-day moving averages and to near oversold RSI levels. The S&P 500 is currently sitting at its lowest RSI levels since early March when it began to rebound after a selloff in February.

Stocks cannot go up forever and the August selling was not only healthy it was very much necessary to prevent the possibility of a much larger selloff down the road. Despite near-term unknowns and the possibility of more selling and volatility, the foundation that supported the big rally through July remains intact.

Earnings growth is projected to be stellar in both 2024 and 2025 and the Fed appears to be near the end of its tightening cycle even though the U.S. economy remains strong.

Investors with long-term horizons should remember that some of the best times to buy stocks are during pullbacks. Today we dive into a pocket of the stock market that many investors like to own as part of diversified portfolios: cheap stocks trading for $10 a share or less.

Along with the cheap price tag, the stocks we explore today boast high Zacks Ranks given their improving earnings outlooks.

Penny Stocks

One dollar or less used to be the common threshold for what we call “penny stocks.” Today, the SEC has expanded penny stocks to securities that trade for less than $5 a share. Many investors avoid these stocks because they are speculative in nature.

Meanwhile, penny stocks often trade infrequently and hold wide bid/ask spreads. These stocks also carry many other traits that, in many cases, cause excessive volatility. With that said, some penny stocks perform incredibly well, which helps them remain attractive.

Stocks Under $10

Moving on, let’s briefly discuss the next class of cheap stocks. Stocks that trade in the $5 to $10 range are generally less risky than their penny stock counterparts. Investors might be more likely to have heard of these companies or seen the tickers. They are, however, still inherently more speculative than many other higher-priced stocks.

Investors can obviously find winning stocks for under $10 if they are extremely selective. So today, we narrowed the list of thousands of these more speculative stocks down to a more manageable group of $10 and under stocks that might help boost your portfolio.

Payoneer Global (PAYO)

Payoneer is a fintech firm focused on small and medium-sized businesses. Payoneer’s global financial platform is spread across more than 190 countries and territories, though Payoneer attempts do a ton of business in emerging markets. Payoneer wants to help its customers “to pay and get paid, manage their funds, and grow their business.” Payoneer posted 33% revenue growth last year and it crushed our adjusted Q2 earnings estimate by 300% on August 8 on the back of 40% YoY sales expansion.

Zacks estimates call for Payoneer to post another 32% revenue growth in FY23 to help it swing from an adjusted loss of -$0.03 a share to +$0.22 per share. The financial technology firm focused on emerging markets is projected to post double-digit earnings and revenue growth next year as well. And Payoneer’s upbeat earnings outlook helps it land a Zacks Rank #1 (Strong Buy) right now.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Payoneer shares have climbed 30% in the last three months to help it trade above its 50-day and 200-day moving averages. At around $5.88 a share, PAYO stock trades 40% below its average Zacks price target. Plus, seven of the nine brokerage recommendations Zacks has are “Strong Buys,” alongside two more “Buys.” And it is trading at a 40% discount to the Zacks Tech sector at 2.3X forward sales.

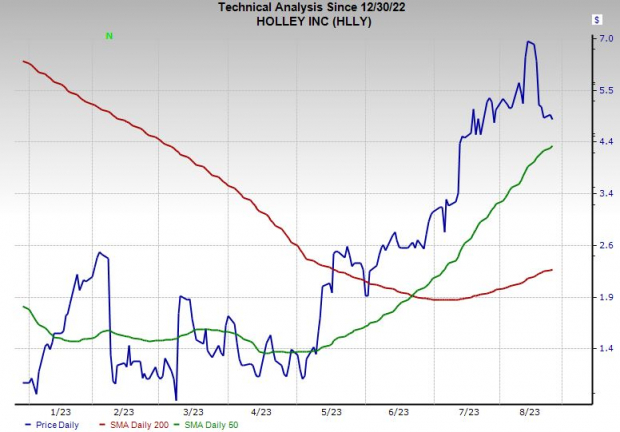

Holley Inc. (HLLY)

Holley is a leading designer, marketer, and manufacturer of high-performance automotive aftermarket products for car and truck enthusiasts. Holley’s portfolio includes iconic brands and it caters to customers that are “passionate about the performance and the personalization of their classic and modern cars.” HLLY topped our Q2 earnings and revenue estimates on August 10 and upped its full-year sales and adjusted EBITDA guidance.

The company’s newly upbeat bottom-line outlook helps it land a Zacks Rank #1 (Strong Buy) at the moment. Zacks estimates call for HLLY’s adjusted earnings to soar roughly 230% this year from $0.07 a share to $0.23 per share and then climb another 50% next year. And Holley has blown away our EPS estimates in the last two quarters.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Holley is part of the Automotive - Original Equipment space that currently ranks in the top 39% of over 250 Zacks industries. HLLY shares have climbed over 170% in 2023, yet they still trade 45% below their average Zacks price target. And seven of the 10 brokerage recommendations Zacks has are “Strong Buys.”

Both stocks offer solid growth potential. Yet, it isn’t wise to pack your portfolio full of cheap, $10 or less stocks. Still, these stocks are certainly worth further investigation because grabbing a few of the top names from this list might bolster your returns. And let’s not forget that picking a few cheap stocks can also be quite fun.

Get the rest of the stocks on this list and start screening for the best stocks under $10 for yourself. And don't forget to backtest your strategy so you'll know how successful it's been before you put any of your money at risk.

More By This Author:

3 Stocks to Buy Amid the August Market Pullback and HoldBull of the Day: Uber Technologies, Inc.

Bear of the Day: Zebra Technologies

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more