3 Top Under-The-Radar Stocks To Buy In September

The stock market ended August on an upbeat note, even if some of the buying cooled down on the last day of the month. Wall Street absorbed the much-needed pullback and then began to buy stocks as soon as the S&P 500 and the Nasdaq reached oversold levels earlier this month.

Both of those major indexes are back above their key 50-day moving averages. And the bulls appear to be back in control of the market as investors continue to forecast a soft landing, even if rates have to stay higher for longer to fight lingering inflation. Plus, the earnings growth outlook for 2024 and 2025 is very strong.

Of course, there could be more selling in the coming weeks since markets don’t just go up. But 2023 and the last three-plus years have proven how difficult it can be to time the market.

Today, we explore three under-the-radar, highly-ranked stocks that investors might want to buy now as we flip the calendar to September.

(Click on image to enlarge)

Image Source: Zacks Investment Research

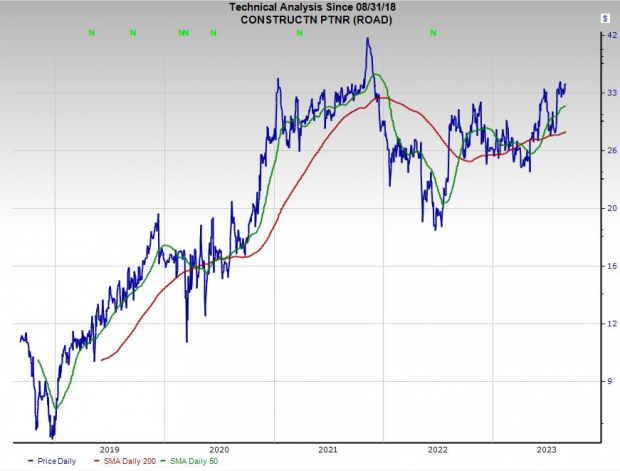

Construction Partners, Inc. (ROAD)

Construction Partners’ ticker symbol provides investors with the basic idea of its business. ROAD is a vertically integrated civil infrastructure company specializing in the construction and maintenance of roadways across various regions of the southeastern U.S. The firm’s core business is currently centered around publicly funded projects such as local and state roadways, as well as interstate highways, airport runways, and bridges.

Beyond its public segment, Construction Partners operates in the private sector, offering paving and sitework services for offices and industrial parks, shopping centers, local businesses, and residential subdivisions. Construction Partners currently operates under various brands across six states including Florida, North Carolina, South Carolina, and Georgia. ROAD is one of the fastest-growing civil contractors in a booming part of the country that’s expanding its population and its economic growth.

(Click on image to enlarge)

Image Source: Zacks Investment Research

ROAD posted 43% revenue growth in fiscal 2022 and 16% in FY21. The firm in early August topped our Q3 FY23 earnings and revenue estimates and raised its guidance, with its FY23 consensus EPS estimate up 20% and its FY24 outlook 22% higher to help it grab a Zacks Rank #2 (Buy) right now.

Construction Partners is projected to post another 20% sales growth this year and 8% higher next year to hit $1.68 billion to help boost its adjusted earnings by 105% and 39%, respectively.

ROAD shares have climbed around 190% since the company’s 2018 IPO vs. the S&P 500’s 72% and its industry’s 63%. The stock is also up 31% YTD and trading above its 50-day and 200-day moving averages, yet ROAD still trades 15% below its highs and 9% under its average Zacks price target at around $35 a share.

Construction Partners stock has chopped around a lot, and it is rather low volume (272K average). But it is part of a highly-ranked Zacks industry and boasts a sturdy balance sheet. And it trades right at its five-year median at 30.7X forward earnings.

Payoneer Global (PAYO)

Payoneer is a fintech firm focused on small and medium-sized businesses. Payoneer’s global financial platform is spread across more than 190 countries and territories, though Payoneer is aiming to cement itself as a major digital payments firm in many emerging markets. Payoneer wants to help its customers “to pay and get paid, manage their funds, and grow their business.” PAYO is operating in an underserviced fintech area that offers huge long-term potential as the likes of Block and other players chase new growth markets as well.

Payoneer posted 33% revenue growth last year and it crushed our adjusted Q2 earnings estimate by 300% on August 8 on the back of 40% YoY sales expansion. Payoneer grabs a Zacks Rank #1 (Strong Buy) at the moment, with its FY23 consensus estimate up 83% since its last report and its FY24 figure 39% improved.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Zacks estimates call for Payoneer to post 32% revenue growth in FY23 to reach $825.5 million to help it swing from an adjusted loss of -$0.03 a share to +$0.22 per share. PAYO is projected to post double-digit earnings and revenue growth next year as well to the tune of 17% EPS expansion and 13% higher sales.

Payoneer stock has ripped 40% higher in the last three months to help it trade above its 50-day and 200-day moving averages, with it possibly on the verge of completing a golden cross where the shorter-dated MA climbs above the longer-term trend.

At around $6.15 a share, PAYO stock trades 33% below its average Zacks price target and 50% under its own peaks. On top of that, seven of the nine brokerage recommendations Zacks has are “Strong Buys,” alongside two more “Buys.” And it is trading at a 50% discount to its Technology services industry at 2.5X forward sales.

Hubbell Incorporated (HUBB)

Hubbell is a leading manufacturer of utility and electrical solutions with an established track record that is set to benefit from the critically pressing need for grid modernization and the wave of electrification. Expanding and revamping electrical grids is vital as the U.S. and many countries around the globe roll out alternative energy sources in the coming decades.

Hubbell is a stable, proven stock to help benefit from the booming growth of solar, wind, nuclear, EVs, and beyond. Hubbell has been in business for 135 years and it boasts a very solid history of earnings and revenue growth. HUBB is also exposed to the ongoing expansion of broadband networks.

HUBB topped our Q2 estimates in late July and upped its guidance once again, with its consensus EPS estimates up double digits for Q3, Q4, FY23, and FY24 to help it grab a Zacks Rank #2 (Buy). Zacks estimates call for Hubbell to post 44% adjusted earnings expansion in 2023 and 9% higher sales, with more solid top and bottom line growth expected next year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Hubbell has easily outpaced the S&P 500 over the last 10 years and the last three, up 125% in the past 36 months. HUBB is rebounding after some post-release profit taking, with it back above its 50-day moving average again as it attempts to return to all-time highs.

Hubbell is trading right around its 10-year median at 20.5X forward 12-month earnings, which also marks a 15% discount to its own highs. On top of that, the company raised its dividend (by 7%) for the 15th year running, with it yielding 1.4% at the moment.

(Disclosure: Ben Rains owns HUBB in the Zacks Alternative Energy Innovators service)

More By This Author:

Bear of the Day - Foot Locker, Inc.

Finding The Best Cheap Stocks Under $10 To Buy

3 Stocks to Buy Amid the August Market Pullback and Hold

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more