Under The Spotlight: Walgreens Boots Alliance

Walgreens Boots Alliance (WBA) is a global leader in retail and wholesale pharmacy, touching millions of lives every day through dispensing and distributing medicines, its convenient retail locations, digital platforms and health and beauty products. The company has more than 100 years of trusted health care heritage and innovation in community pharmacy and pharmaceutical wholesaling. Including equity method investments, WBA has a presence in more than 25 countries, employs more than 440,000 people and has more than 18,750 stores.

MARKET LEADER

In 1849, John Boot opened the first Boots store in Nottingham, UK selling herbal remedies. Eleven years later John Boot died and his 10-year-old son, Jesse Boot, helped his mother run the family's herbal medicine shop with the company opening its 1,000th UK store in 1933. On the other side of the Atlantic, in 1901, Charles R. Walgreen, Sr. purchased the Chicago drugstore where he had worked as a pharmacist for $6,000. In 1984, Walgreens opened its 1,000th store in the U.S. In December 2014, Walgreens and Alliance Boots combined, bringing together two leading firms with iconic brands, complementary geographic footprints, shared values and a heritage of trusted healthcare services dating back more than a century. The combined company boasts more than 18,000 stores in 25 countries. To gain distribution efficiency and manufacturer pricing leverage in a competitive market, Walgreens Boots Alliance in 2013 took an equity stake in AmerisourceBergen — a major U.S. pharmaceutical distributor — and agreed to buy stores from rival drugstore chain Rite Aid in 2017.

ROBUST CASH FLOWS

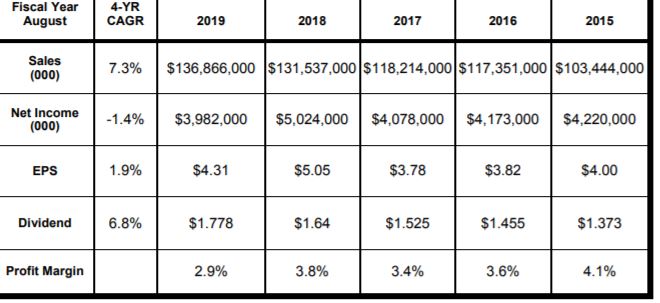

Walgreens Boots Alliance generates robust cash flows. Over the past five years, the company has produced more than $27 billion in free cash flow. The company has returned most of the cash to shareholders over the same period through $8 billion in dividends and nearly $17 billion in share repurchases. Fiscal year-to-date, free cash flow increased an additional 24% to $2.4 billion. During the first nine months of this fiscal year, Walgreens paid $1.3 billion in dividends and repurchased $1.4 billion of its common stock. Walgreens has suspended its share buyback program for the time being.

At the same time, the company increased its dividend 2.2% to an annual rate of $1.87 per share, which marks the 45th consecutive year of dividend increases and the 87th year a dividend has been paid. The dividend currently yields a healthy 4.8%.

THIRD QUARTER RESULTS

Walgreens reported fiscal third quarter sales were relatively flat at $34.6 billion with the company reporting a loss of $1.7 billion. These results were significantly impacted by the COVID-19 pandemic stay-at-home orders, especially in the United Kingdom. The Boots UK stores had a dramatic 85% reduction in foot traffic which resulted in a $700 million to $750 million shortfall in sales during the quarter. Gross margin was adversely impacted by a shift from higher to lower margin categories and supply chain costs. Walgreens re-evaluated goodwill of the Boots UK business and took a non-cash impairment charge of $2 billion reflecting the operating loss and continued uncertainty related to COVID-19. Globally, pharmacy volume was impacted by a drop in doctor visits and hospital patient admissions. The company is accelerating investments in key strategic priorities such as restructuring retail offerings, creating neighborhood health destinations and driving cost transformations and digitalization. Walgreens’ digital sales increased 23% during the quarter with Boots.com digital sales up 78%. Walgreens increased its annual cost savings target to in excess of $2 billion by fiscal 2022 from its transformational cost management program.

For fiscal 2020, Walgreens expects adjusted EPS in the range of $4.65- $4.75 including an estimated adverse COVID-19 impact of $1.03-$1.14. In the fourth quarter, UK retail sales are expected to remain depressed despite gradual easing of restrictions. More robust sales growth is expected in the United States, although retail margins are expected to remain compressed. Despite significant current challenges, Walgreens is expected to come out of the crisis in a strong position with a path set for long-term sustainable growth.

Long-term investors seeking a profitable prescription should consider Walgreens Boots Alliance, a high quality market leader with robust cash flows, an attractive valuation and a healthy dividend which should continue to grow. Buy.

This is an interesting and very educational article, indeed. And evidently the Walgreens management is doing more things "right" than many others.

But I see one thing that is a real puzzle: Claiming a reduction in profits is a loss. Making less profit than somebody had guessed would be made, but still making a quite respectable profit, and claiming that is a loss, is rather strange, and it puts far more validity on somebodies guess that that guess deserves. A reduced net income is not a loss, it is a reduced gain.

Yes, that is odd.