Tuesday Talk: Musking Twitter - Done!

Sold for $44 billion dollars to the only and highest bidder, Elon Musk, whose offer to buy Twitter for $54.20 per share was approved by the company's board of directors, yesterday.

The deal is expected to close by the end of the year, and despite a few cries to the contrary it is expected that government regulators will allow the sale to proceed.

While the announcement of the deal propelled the market to an end of day green close on Monday, the Russian war in the Ukraine and fears of a lockdown in Beijing due to COVID-19 is keeping volatility high, even if further Fed rate hike anxiety had been digested by the end of last week.

Yesterday the S&P 500 closed at 4,296, up 24 points, the Dow Jones Industrial Average closed at 34,049, up 238 points and the Nasdaq Composite closed at 13,005, up 166 points. In morning action S&P 500 market futures are trading down 12 points, Dow market futures are trading down 95 points and Nasdaq 100 market futures are trading down 35 points.

TalkMarkets contributor Sue Strachan writing in Twitter + Elon = Twitterverse Eruption has a first look at social media and industry reaction to the Twitter (TWTR) deal.

"What does the Twitterverse think of the latest in Musk-lore?

Twitter co-founder and former Jack Dorsey hasn’t tweeted anything about the announcement (yet). Maybe he paused to luxuriate in the $974 million he is supposed to earn with the buyout — a number shared by CNBC’s Robert Frank on Twitter.

Fellow CNBC pundit Jim Cramer issued two interesting tweets this afternoon.

Another user questioned the deal too: "Twitter does $3.5 billion a year in revenue, a business roughly the size of the Olive Garden. You have to admit today is hilarious," tweeted Josh Brown, the CEO of Ritholtz Wealth Management.

Others are concerned about what Musk will do to Twitter operations.

Skooks, well-known in the #NOLATwitter universe, tweeted, “People keep freaking out that Elon is going to bring all the Nazis back onto the site but that’s not really what’s going to happen. He’s just going to do a lot of aggravating functionality changes that make the site less useful for everybody.”

And then there are those who are less worried about functionality issues, and where they are going to get their celebrity news or just plain swap industry gossip.

There are a few that may blame @RedLetterDave for the takeover — at least putting the idea in Musk's head — even if it was 2017.

The conclusion? Be careful what you tweet to Musk, he just might act on it."

The Staff at LMAX Group ask How Long Until The Next Big Drop? in one of their short early morning headline videos in which they review current action.

"The bleeding finally came to an end late Monday, at least for now, though it would be hard to classify the recovery as anything more than some short-term profit taking after an extreme move to the downside."

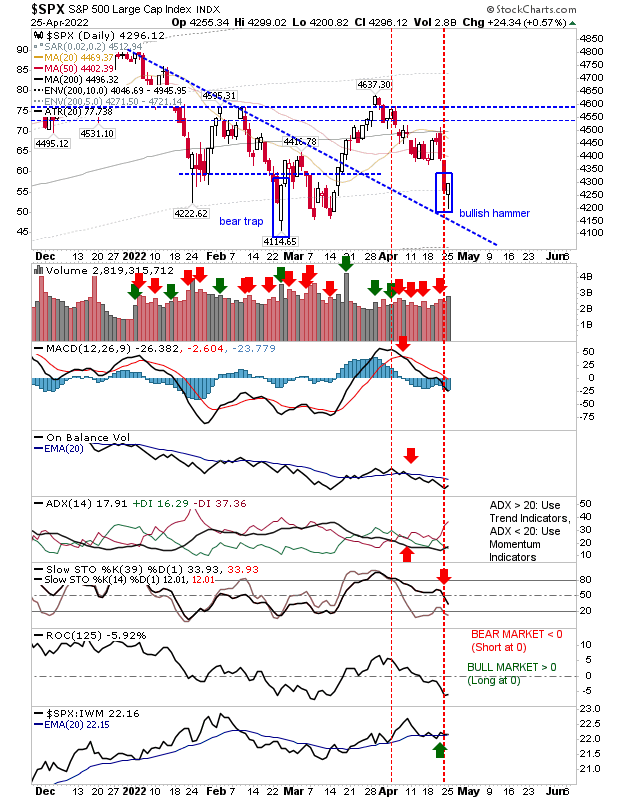

Contributor and chartist Declan Fallon says Buyers Stop The Rot But Damage Done in analyzing yesterday's action in the markets.

"Today's recovery has offered the potential for a bottom and the end of the decline from March highs, but it leaves lead indices vulnerable to the undercut.

One day's buying does not necessarily equate to a reversal, but today's action will give aggressive buyers something to work with (using a loss of today's lows as a stop). Best of the action was the S&P (SPX) as it ended with a bullish hammer, but reversal candlesticks need oversold momentum to strengthen their credentials and we don't have that here."

"The Russell 2000 (IWM) is the index I want to see do well to firm up a long term low. Today's finish recovered support and offers an opportunity for a new long trade. On a momentum level, it's oversold, but in relative terms it's outperforming. Tomorrow is a new day.

The Nasdaq (QQQ) closed with an accumulation day, although the index is underperforming relative to the S&P, it did close with a bullish piercing pattern. Of the three indices it's the weakest, but let's see what it can do.

One day's buying is no guarantee that the sell-off is done, but it was good to see bullish reversal candlesticks and the presence of price support. Aggressive buyers can look to trade this situation, but be ready to bail if things turn south."

See Fallon's article for the Russell 2000 and Nasdaq charts.

Moving to crypto news TM contributor Ara Zohrabian notes that Bitcoin Falls After Failing To Rebound Above $41,450 .

"Bitcoin (BITCOMP) retreated after unsuccessful test of Fibonacci 23.6 last week: it was unable to close above $41,450 as bears retained firm control of crypto market. A glance at the Bitcoin price daily chart reveals the bearish trend continues and there are no sign the trend may reverse soon!"

"The cryptocurrency market tracked global stock market’s retreat last week. The stocks selloff deepened after Fed chair Powell confirmed that a half-point interest rate hike was “on the table” when the Fed meets in May. As of last Monday, the entire crypto market had fallen about 19%, according to data from CoinMarketCap...

Data from Google’s search trends suggest retail interest in Bitcoin and other major cryptocurrencies could be declining...Worldwide searches for Bitcoin have reached mid-2020 levels as of April 22, 2022. This does not mean the total number of searches for that term is decreasing, but just means its popularity is decreasing compared to other searches. Experts explain this decline by shifting of investor interest to new cryptocurrencies known as altcoins."

Hmm and hmm.

Straddling between peaks in the "Valley of Volatility" can be daunting for investors. In today's "Where to Invest Department" we take a look at hot coffee and real estate.

Contributor Wayne Duggan discovers Why This Starbucks Analyst Says Stock Valuation Is At 'Historical Low'.

"Starbucks Corporation (SBUX) is off to a brutal start to 2022, but Bank of America analyst Sara Senatore said on Monday that there's reason for optimism after taking a close look at Starbucks' quarterly demand trends."

"Based on historical trends, Senatore estimated Starbucks' first-quarter Americas same-store sales growth at about 21%, slightly above the reported number of 18% growth...She also said there is a strong historical correlation between Starbucks monthly active users and total dollars loaded, which are spent in subsequent quarters. MAU growth slowed from 13% in the fiscal second quarter to 10% in the fiscal first quarter, but remained steady at about 12% on a three-year basis...

She said China weakness and potential labor cost increases in the U.S. have weighed on the stock in 2022. "That said, the current valuation is at an historical low on a relative basis (1.0x relative P/E vs 5-yr average of 1.5x) suggesting these headwinds are approaching being fully discounted," Senatore said.

Bank of America has a Buy rating and $110 price target for Starbucks...

Starbucks' Americas business seems perfectly healthy, so it's reasonable to assume that a potential 2022 rebound in Starbucks shares will rely heavily on a recovery in China. After the recent sell-off, Starbucks shares are attractively valued on a historical basis, trading at a forward earnings multiple of just 20.5."

See the full article for more details.

TalkMarkets contributor Tim Plaehn suggests to Buy These Two REITs For Rising Rates And Possible Recession.

"Commercial mortgage REITs offer a much safer way to get a high dividend yield. These companies use a lot less leverage and have more conservative understanding standards for their loans. As we invest in the face of a possible recession, the best course is to invest in the largest and most conservatively managed companies in any sector.

As of the end of 2021, Blackstone Mortgage Trust (BXMT) had a commercial mortgage loan book of $23.6 billion...

The loan-to-value ratio for the portfolio at the end of December stood at 64.4%. The low LTV provides a significant cushion if the economy goes into recession.

Blackstone has paid a $0.62 per share quarterly dividend since the second quarter of 2015. If profits exceed the mandatory REIT payout level, the company will pay a special end-of-year distribution. BXMT currently yields 7.8%."

"Starwood Property Trust (STWD) reported a year-end loan portfolio worth $24.1 billion of floating-rate assets. In 2021, the company made $16.7 billion of new investments...Over the last five years, Starwood Property Trust has expanded its portfolio beyond most commercial real estate lending. As of the end of 2021, the portfolio LTV stood at 61%...

The Starwood Property Trust dividend has been steady at $0.48 per share per quarter since the 2014 first quarter. As with BXMT, if STWD needs to pay more to stay within the REIT 90% payout, expect a special dividend at the end of the year. The shares currently yield 8.0%.

These two commercial finance REITs have portfolios with conservative LTVs and floating-rate loans. They provide great yields and excellent rising interest rate participation."

Read the full article for additional particulars.

As always, caveat emptor.

Have a good rest of week. Israelis will observe Yom Hashoah, Holocaust Remembrance Day beginning sundown Wednesday, April 27 thru Thursday, April 28. Take time to remember, as well.

Image: Yad Vashem