Top Dividend Stocks For 2024

Image Source: Pixabay

What are some of top dividend stocks for 2024? After the eventful year that was 2023, it’s confusing to say the least.

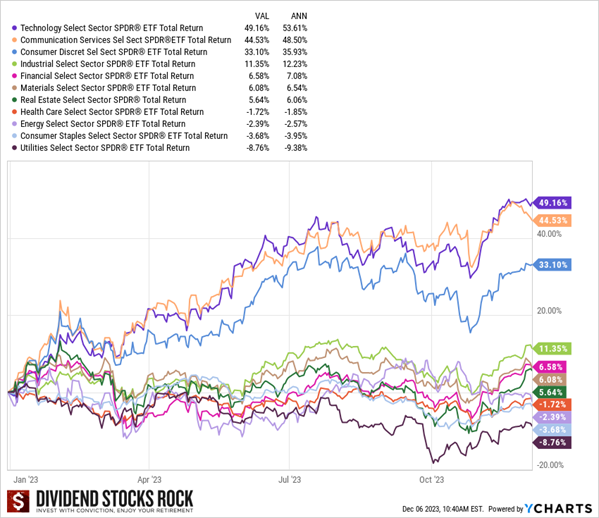

Depending on which sectors and markets you were invested in in 2023, you either had a great year or saw your portfolio value decline. As you can see in the graph below, the technology sector dominated the market, but mostly due to a very few big players. The U.S. market outperformed the Canadian market by a wide margin.

In the U.S. we saw that the surging technology sector was followed by the communication services sector. It wasn’t the AT&T and Verizon of this sector that pushed it to such heights but rather tech-focused communications stocks such as Meta (META), Alphabet (GOOG), and Netflix (NFLX). I must add the communication services ETF in the graph is a isn’t really a good representation; it skews the results favorably because it’s 47% invested in Meta and Alphabet.

While the energy sector was the savior in 2022, it was flat in 2023. The utility sector is the biggest loser, hurt by higher interest rates and poor performance from all renewable energy stocks.

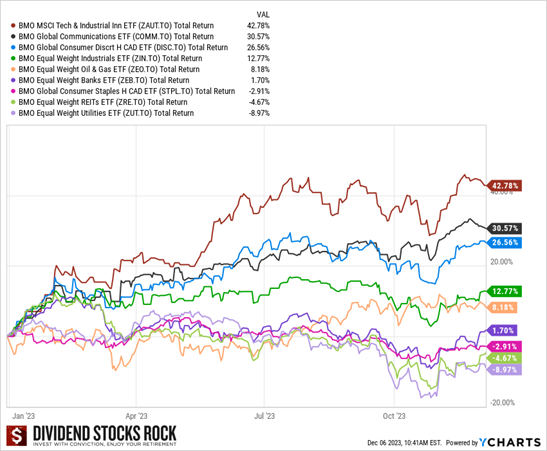

We see similar trends in Canada, but with a stronger performance from the energy sector than in the U.S. Take the BMO’s technology, communications, and consumer discretionary ETFs with a grain of salt because each includes several U.S. stocks. Banks and telecommunications companies were disappointed in 2023 as did utilities and REITs.

What’s next?

We live in a strange world: inflation hurts consumers’ budgets forcing them to tighten their belt with high interest rates putting even more pressure on them and yet, the unemployment rate remains low because of our aging population.

In the second half of 2023, we saw signs that higher interest rates were finally catching up with the economy and slowing it down. Inflation has lowered, GDP isn’t as strong (Canada even reported a negative GDP late in 2023), and unemployment rates on both sides of the border are going up by a bit.

New inflation data hints at a pause in interest rate increases. We might even talk about rate cuts later in 2024. However, we won’t see 2% mortgages or debentures in 2024. Companies will have to deal with higher interest rates when refinancing. We’ll continue to feel the lagging impact of those interest rate increases for many years.

If you focus on your portfolio yield, you were unhappy with your results in 2023 and my guess is that it won’t be easy in 2024 either.

That said, the secret is to stay loyal to an investment strategy that works for you. For me, that strategy is to invest in dividend growers that I have researched well and in which I am very confident. That helps me to not panic about every whim of the market or each bit of bad news about the economy.

A full podcast series on How to Invest 2024 is available to you now! Get your plan for the year ready!

Today, I share with you two stocks that are among my Top Picks for 2024. The selection methodology of those companies is explained in this article.

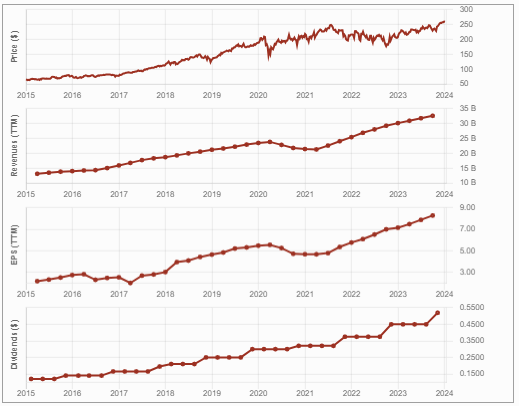

Visa (V)

- Market cap: $531B

- Yield: 0.79%

- Revenue growth (5yr, annualized): 9.64%

- EPS growth rate ((5yr, annualized): 13.38%

- Dividend growth rate (5yr, annualized): 16.89%

Visa is sometimes a tech stock, sometimes a financial stock, and it could be seen as a consumer discretionary considering the volume of transactions and cross-border spending that go through each day. It has recently reached its all-time-high (again), but I think there is more room for expansion, especially if we talk about rate cuts for 2024. This is the type of company that always looks overpriced so you might as well jump into the ship while it’s sailing full speed.

Mastercard and Visa dominate a wide majority of transactions. What I like about them the most is they don’t carry the burden of consumers’ debt. They leave that to banks while they focus on money transactions.

If you are looking for something spicier, I’d have a look at Bank OZK. It’s a classic regional bank with a special segment for Real Estate development in New York and Miami. Their RESG (Real Estate Specialties Group) segment is their growth machine. They will live and die by the sword. In the meantime, OZK increases its dividend by $0.01 quarterly!

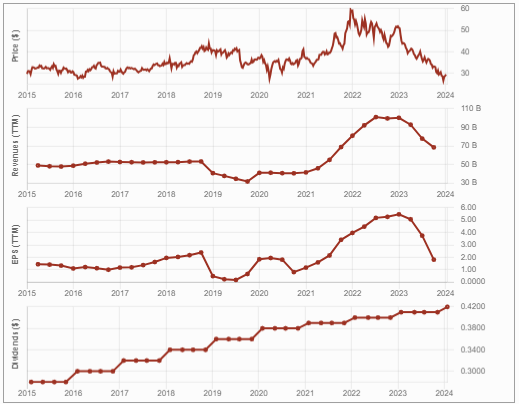

Pfizer (PFE)

- Market cap: 162B

- Yield: 5.85%

- Revenue growth (5yr, annualized): 13.81%

- EPS growth rate ((5yr, annualized): 9.22%

- Dividend growth rate (5yr, annualized): 4.56%

I added PFE to the DSR Mike’s buy list last summer. It seems that move was a bit premature. Pfizer’s results were difficult to analyze in 2023 as COVID products sales sank like a rock. Excluding the COVID hype, PFE reported growing sales in 2023. Shares have fallen to a ridiculous price pushing its forward PE below 10, now back to about 15. While the company is known to pay an average yield around 4% over the past 5 years, the current yield is at 5.85%. In 2023, Pfizer announced the acquisition of cancer-focused big pharma Seagen for $43B. Pfizer believes Seagen could contribute more than $10B in revenues by 2030, with potential significant growth beyond 2030. The transaction was completed in December 2023.

The market does not seem to like the decision, and the stock price has been falling ever since. At current prices, an investor can enjoy the generous yield and with patience, see some interesting capital appreciation after the Seagen acquisition is digested. It looks like an interesting play in the healthcare industry, considering Pfizer’s historic business model and drug pipeline.

More By This Author:

Buy List Stock for January 2024: PepsiCo

2023 Year-End Sector Review – Part 2

U.S. Stock Treats For The New Year