Buy List Stock For January 2024: PepsiCo

Image Source: Pexels

An old favorite is making its way as a buy list stock for me this month: PepsiCo (PEP). This aristocrat increased its dividend yearly for 50 years and, with the recent slump in its stock price, it’s worth a look.

PepsiCo Business Model

PepsiCo, Inc. is a beverage and convenience food company. The Company’s segments include Frito-Lay, Quaker Foods, and PepsiCo Beverages in North America, and beverage and food businesses in Latin America, Europe, Africa, the Middle East, Asia, Australia, New Zealand, and China. So, pretty much all around the world!

Its brands include Gatorade, Quaker, Lays, Doritos, and Cheetos.

PEP Investment Thesis

While carbonated drink sales are slowing in developed markets due to health consciousness, PepsiCo benefits from strong non-carbonated drink brands such as Gatorade and Tropicana. PEP’s snack division is a strong leader in this industry, with a 64% market share in the U.S., 60% in Brazil, and 46% in the U.K. More importantly, the 2nd place finisher for salty snacks is far behind PEP in both market share and sales volume. To improve further, PepsiCo is looking to consolidate its distribution for its two divisions.

PEP might be one of the best stock picks among blue-chip defensive stocks with strong balance sheets. Throughout 2022, the company proved resilient and continued to be in 2023. PEP’s focus on healthier snacks and beverages will likely continue to drive the top line. Finally, we still see a lot of growth potential in international markets and the Frito-Lay business.

PEP Last Quarter and Recent Activities

PepsiCo reported a solid quarter in the fall with revenue up 7% and EPS up 14% to beat analysts’ estimates. The organic sales growth was led by strong gains in Europe (+13%) and Africa/Middle East and South Asia (+17%). Pricing drove growth, with volume flat for the beverages business and down 1.5% for the foods business.

The big news hurting the stock price is related to the rise of the usage of weight loss drugs such as Ozempic, which could put pressure on snacks and soft drink sales. At the same time, management revised its EPS guidance for 2023, now expecting it to grow by 13% instead of 12%. Based on the stock price weakness, we have upgraded our DSR PRO rating of PepsiCo to 5.

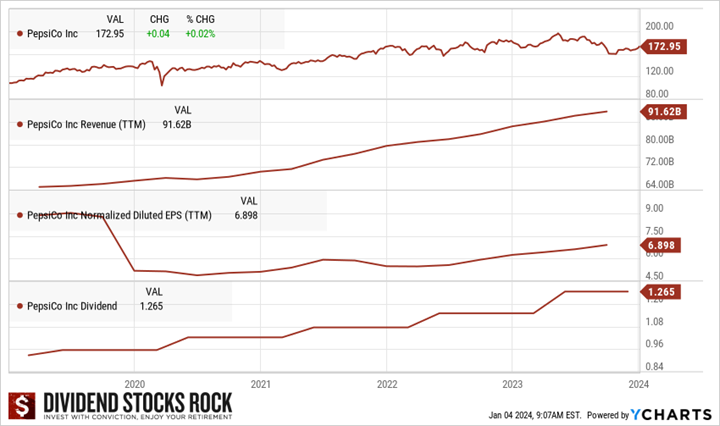

A recent stock price decline and a strong dividend triangle.

Potential Risks for PepsiCo

The Snack division saved its seat, but competition is on the rise. Companies like Hershey are eyeing the snack and breakfast markets for expansion. PEP management seems to act decisively in the ever-evolving snack foods market, but where are the future growth vectors with such rivalries? PEP’s small initiatives (like developing portable breakfasts) don’t seem sufficient to support strong growth moving forward.

Although PEP benefits from strong brand recognition and solid relationships, this does not completely solve the problem. After all, Pepsi is still the eternal 2nd behind Coke in the beverage industry. Finally, the rise of weight loss drugs such as Ozempic is making headlines; the market is concerned this will affect snacks and soft drinks (along with other “unhealthy” food options) going forward.

PEP Dividend Growth Perspective

PepsiCo has not only increased its dividend for half a century but also shows impressive growth! PEP still boasts a high single-digit dividend growth rate today. This is quite the feat for a company operating in a mature market where healthier products are introduced daily. Still, both the payout and cash payout ratios are under control. One can expect several years of strong dividend increases for this buy-list stock. In 2022, we saw a 7% dividend increase, followed by a 10% dividend increase in 2023. The latest increase is a little higher than what we have seen in the last few years and should bring confidence to shareholders.

Final Thoughts on PepsiCo

PEP shows a strong dividend triangle with a high-single-digit dividend growth rate. With its dominant position in snacks, brand recognition, and history of resilience, I just don’t believe that PepsiCo will be affected all that much by new weight loss drugs. The market was concerned enough though that its stock price dropped from nearly $200 six months ago to roughly $168. With its forward PE now around 20.75 compared to a 5-year average of 24.89, it looks like the timing is right for this consumer staples stock!

For all these reasons, I added it as a buy list stock and we upgraded it to a Strong Buy at DSR.

More By This Author:

2023 Year-End Sector Review – Part 2U.S. Stock Treats For The New Year

2023 Year End Sector Review