U.S. Stock Treats For The New Year

Image Source: Pexels

Here are U.S. stock treats to consider this new year. a growing consumer discretionary, a resilient consumer staple, and a dividend-growing healthcare stock. Have a peek.

McDonald’s (MCD)

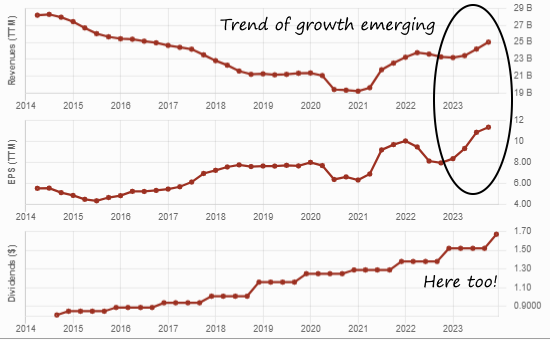

I’m adding McDonald’s to my list for 2024. We increased MCD’s ratings on DSR in 2023 because its dividend triangle continues to strengthen; revenue and earnings increasing steadily again and dividend growth continuing.

McDonald’s Dividend Triangle

McDonald’s plans a record pace of expansion in the coming year and is targeting expansion from 40,000 to 50,000 restaurants by the end of 2027. This will be the fastest growth plan in McDonald’s history.

MCD enjoys strong brand recognition and benefits from its recession-resistant business model to fuel more sales even during tough economic times. The world’s largest fast-food retailer has proven attentive to its customers and has introduced many changes to its menu over the years, such as an all-day breakfast and healthier options including many chicken items. Notably, MCD wants to expand McCrispy into wraps and tenders.

MCD has increased its dividend yearly since 1977. MCD grew both its cash flow from operations and free cash flow over the past 10 years. Through its re-franchising process, the restaurant chain improved its earnings and shows a payout ratio that is well under control. The company enjoys financial flexibility, but the dividend growth policy could slow down as the company’s payout ratio continues to rise. The dividend increase was only 3% and was then a more generous 6.98% in 2021. Thanks to stronger numbers, MCD increased its payout by 10% in 2022 and by another 10% in 2023!

Costco (COST)

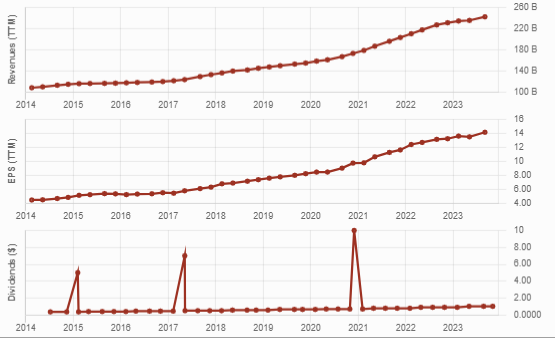

With Costco, I’m going for strength and growth potential. While there are opportunities in the chocolate, snacks and soft drinks industries, COST remains a solid pick for years to come. I added COST to my retirement account (not disclosed at DSR) in 2023 after listening to the Acquired Podcast on the company. COST has been showing a perfect dividend triangle for 10 years now. I had the numbers, but I lacked the narrative. How can Costco continue to grow from there? I got my answer in the podcast; it’s easier to find a good story about a stock, than to find great numbers!

Costco’s Dividend Triangle – Near Perfection!

COST is the definition of “Heads, I win; tails, I don’t lose much!”. COST shows an impressive growth trajectory and is now expanding its business outside of North America. It shows an impressive membership renewal rate that is above 90%. It targets consumers who can afford to buy in bulk, i.e. wealthier than the average. In case of a recession, these consumers will be less affected by the economy and likely will continue to shop at Costco.

COST has a low yield (~0.64%), but its growth rate is phenomenal. Over the past 5 years, it raised its dividend by 75%! In the same period, it also issued 2 special dividends. COST’s membership model has helped the company generate lots of cash. In other words, expect strong high single-digit dividend growth in the coming years. With its very strong dividend triangle it’s a keeper, but if you want to invest, be prepared to pay a premium. COST isn’t cheap. In fact, an investment in Costco is an investment in a company that will continue to grow. An investor must be ready to pay a premium for it.

UnitedHealth Group (UNH)

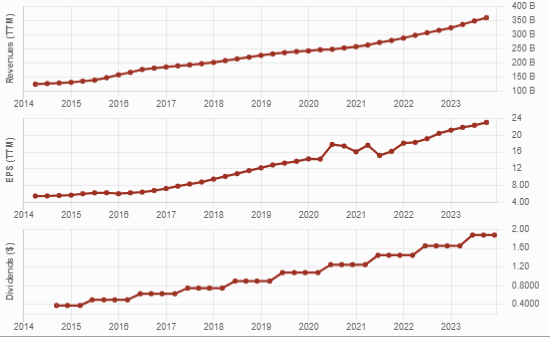

Last but not least is this all-star dividend grower with an almost perfect dividend triangle. United Healthcare Group is a perfect example of a low-yield, high dividend growth stocks.

UnitedHealth Group Dividend Triangle – Doesn’t get much better than this

United UNH is the largest private health insurance provider in the U.S. What strikes us when we analyze UNH is its ability to constantly be one step ahead of peers by pre-emptively adapting its business model to industry and political happenings. They offer medical insurance, pharmacy benefits, and healthcare services as a one-stop shop. This helps their customers manage their healthcare costs more effectively than with most alternatives. This is how revenue and EPS increase year after year without much fluctuation. The stock trades at a forward PE ratio of 19.75 while the 5-year average sits at 22.81.

Regulatory risk will always exist; politicians could aim for a healthcare revamp where the government would offer public healthcare, and possibly drive out private healthcare system players. However, the chances of this happening are low, and it would likely take many years and decades to implement. There might be some potential headwinds down the line, but we trust that UNH will, as it has before, find ways to adapt its business. An increase in unemployment could also hurt UNH’s business.

It acquires Change Healthcare for $8B in 2022. We believe there is more growth to come from UNH but are mindful of its valuation, as it may be on the higher end.

Before you click Buy

As always, do you due diligence before buying any stock I suggest are potential gems. Learn more about them, ensure they fit with your investments thesis and your portfolio and, if you do buy them, monitor their results quarterly. Enjoy!

More By This Author:

2023 Year End Sector Review

Common Investing Mistake: Income Obsession (& More)

Learn To Love Company Debt