Three Things – The Good Enough Portfolio

Image Source: Pexels

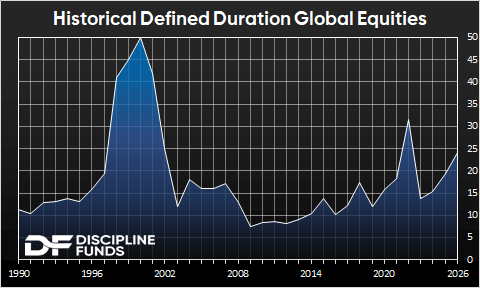

1) Near-term Highs in Global Equity Defined Durations. My Defined Duration metric is a measure of potential sequence of returns. That is, it takes expected returns and applies a specific time horizon to the instrument using a potential drawdown estimate. We know 10 year forward CAPE ratios correlate very strongly with future expected returns and especially risk adjusted returns. So, if global CAPE is about 30 and global inflation is expected to be about 3.5% then that corresponds to an expected equity real return of about 2-4% or 5.5%-7.5% nominal. Not terrible, but not great either. What’s neat about the Defined Duration concept is you can then take this and plug it into an estimate of sequence of returns. For example, if stocks fell 50% tomorrow then a 3% expected return would result in a break-even point of 24 years. This can give us a reasonable estimate of how to assess the way current valuations and future potential returns can be applied to sequence of returns risk over an estimated time horizon.1

What’s interesting about that 24 year reading is that it’s creeping quickly toward the 2022 levels and it’s really expanded in 2025. We were at about 19.4 at the end of last year and it’s increased very significantly mainly because US CAPE ratios have exploded again. So expectations for US stocks (mainly US tech) are very, very high. Historically, stocks have been about 15-20 year instruments by this metric so 24 is getting up there.

Now, I don’t think of this metric as a market timing tool though. I wouldn’t look at this and say “we need to get all out of stocks” or something like that. In my methodology it’s a temporal measure of expectations. When the metric expands you need to be more aware of higher sequence of returns risk. In other words, if you want stocks to generate their typical risk premium you might need to be more patient in an environment like today versus something like the 2015 period. So, from a financial planning perspective stocks can’t be as easily relied upon to meet financial needs across shorter time horizons. You wouldn’t want to match global equities to a 10 year liability, for example. If you’re matching equities to liabilities in today’s environment it makes sense to be more cautious with the way you’re doing that. That’s what the current global Defined Duration of 24 tells us.

A couple interesting things stand out in this environment though – first, global stocks aren’t nearly as expensive as they were in 2000. And second, that’s because the CAPE ratio of foreign stocks is just 22 compared to 40 for US equities. We have never had such a huge disparity in expectations for US vs foreign stocks. Of course, this is almost entirely due to the concentration of risk in US tech. Which again, could turn out to be totally right. I don’t know. But from a financial planning perspective I would be very cautious about how equities and especially US equities can be applied to liabilities in the current environment.

2) The Good Enough Portfolio. I really loved this article by Christine Benz in which she talks about “optimizers” and “satisficers”. Optimizers are the people who want to constantly optimize every aspect of their portfolio. They’re typically engineers and people who critically analyze everything. Satisficers are people who accept that a portfolio probably can’t be perfectly optimized so they accept something that they know won’t be optimized, but will be good enough to meet their needs. I love that framing in part because I find myself constantly caught in the middle of those views. You guys probably think I am a big nerdy optimizer. And I am to some degree. But I am also on a mission to make everything systematic so you can optimize and also be satisfied knowing that that optimization is imperfect.

On the one hand, I know that a low cost indexing portfolio is going to outperform 90% of active funds over time. But at the same time I understand that financial planning is a customized process that requires some level of personalized active management. I actually think that creating a portfolio that’s too simple can create a misalignment between assets and liabilities. For example, I often talk about how you could theoretically just buy a 60/40 ETF and call it a day. That’s about as simple as it gets and that portfolio will do “good enough”. But if you find yourself in 2008 and that portfolio is down 30% and you lose your job and you need money then that portfolio is actually very, very bad because it was too simple. You needed more complexity thru other buckets to allow you the optionality to access the cash that’s actually inside that 40% bond slice. So, simple can end up being too simple at times.

I believe the gap between satisficers and optimizers can be bridged through a sufficiently systematic process. For instance, what if you could quantitatively measure your expected liabilities across time and then match them to quantitatively constructed instruments? That would be pretty cool, huh? It would use a framework that the optimizers love with an output that the satisficers love.

Anyhow, you might have noticed the banner at the top of the website that says “coming soon: the future of investing”. That’s because I am about to unveil an asset-liability matching process that is tied directly to a systematic software process. I’ve said that asset-liability matching strategies are the future of investing and I believe I am making a big leap forward in applying these strategies in a highly customized, but streamlined way. It’s rigorously quantitative in a way that engineers will love. And its output is simple in a way that satisficers will love.

Stick around. The next two weeks are going to be fun.

3) Money Together. Doug and Heather Boneparth wrote a very important book called “Money Together”. As you can probably guess, it discusses the importance of understanding money together as spouses. I can’t tell you how many times I work with people whose spouses are completely in the dark about the family finances. It’s typically because one spouse has great interest in the finances and the other just doesn’t. But as a young(ish) financial advisor who often gets hired by older men I can’t express how important it is to loop your spouse in on the family finances. In many cases I get hired specifically for a succession event. These are among my most treasured relationships because another man is hiring me to help his wife transition when he’s gone (and yes, it’s always been men in my experience). I don’t just take this seriously. I take it very personally. And after doing that for a long time I always tell my younger clients now – “talk to your spouse about the money. That’s part of our required estate planning, okay?” This is really important. I can’t tell you how hard it is on the surviving spouse when they’re going thru the loss of their companion and then dealing with money issues they don’t understand. Good estate planning means being on the same page as your spouse before there’s a succession event.

Anyhow, Doug and Heather have written a great book on this topic. It’s one of the most important finance books I’ve read in a long time.

Well, that’s all from me. I am feeling chubby from eating too many Nerds Gummy Clusters on Halloween. Man, talk about innovation. Everyone is so enthralled with AI, but Ferrero is out here solving the world’s real problems by making Nerds less likely to fall through your fingers when you eat them.

I hope you all have a wonderful weekend and as always, stay disciplined.

1 – Of course, valuations are dynamic so when stocks collapse in 2002 and 2008 so too does the Defined Duration (because future expected returns go up). So even though we use it as an implied future return for a given snapshot in time, you have to apply the measure dynamically as markets change. In the 2002 period expected returns actually go negative so the metric technically had an infinitely high reading during the tech boom because both domestic and global equities were so incredibly expensive.

This sort of break-even methodology can be applied to any instrument. For instance, if the bond aggregate has a current real yield of 1.8% (current 10 year inflation expectations are 2.3%) and we expect that interest rates might shock our portfolio with a 2% increase in rates then we can quantify a max bond drawdown at about -11.7% (2X the current modified duration). It would take the instrument 6.9 years to break-even from this point so that’s our sequence of return risk given current market conditions. You wouldn’t want to match this instrument to anything much longer than a 7 year liability if you’re looking for high probability outcomes.

More By This Author:

Three Things - Scandals, ETFs, And Discipline

Three Things – AI, Bonds, And Gold

Three Things – Gold, Cuts And Divorces

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more