Three Things – Gold, Cuts And Divorces

1) Gold as insurance.

I always like it when people say things that I have said in the past. So I was pleasantly surprised to read Greg Ip writing in the WSJ that gold is a form of “insurance”.

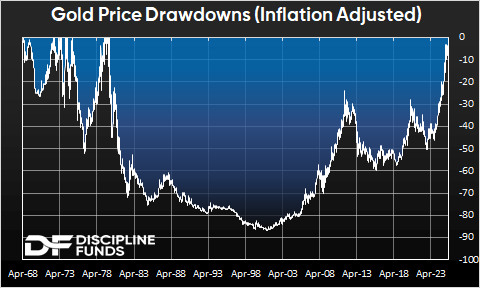

I’ve always sort of struggled with gold as an asset class. I’ve generally stated that a smallish allocation of about 5% seems about right, but I never had a formal model for justifying that. Until I created the Defined Duration methodology. When I ran the model with gold it was clear that gold operates a lot like an insurance instrument. When weird things happen gold tends to generate these sizable asymmetric returns. But it does not generate consistent and reliable cash-flow returns over time. And gold has gone through some truly insane drawdowns over time so it’s not an asset you can plan your financial life around like you can with stocks and bonds (see attached chart).

A younger Cullen might have been quicker to dismiss anything that resembled insurance. Probably because young Cullen thought he was invincible, as most young dumb men do. I say that in the most lovingly way possible to any young men reading this. But trust me, you’ll look back at some of the things you do now and wonder why you were so stupid. And as you get older you’ll also realize that life is fragile and lots of weird things happen. And you grow to love insurance because you realize you’ll probably need some form of it at some point. And I don’t think portfolio insurance is that different from general insurance. For me and my process stocks and bonds will always be the central assets in any coherent financial plan. They have to be because they’re the only instruments that generate reliable cash flows from underlying economic sources. These are your core components because they’re the things that have empirical and reliable sources of consistent cash flow. But there’s nothing wrong with owning some insurance on the fringe, if you need it. But not everyone needs portfolio insurance. In fact, I’ve argued in the past that when T-Bills yield a real return they operate as just about the best form of insurance you can ever need because they give you both inflation protection AND principal certainty. Then again, gold is an inherently long duration instrument. T-Bills are inherently short so if you want something that looks more like whole life portfolio insurance then gold is your thing while T-Bills are more like term insurance.

In the case of gold I’d argue it’s very specifically a form of inflation and fiat currency hedge that should be held for very long durations. Much like Bitcoin is. And there are lots of ways to hedge those risks. For instance, in the last few years owning foreign stocks and leveraged real estate have been very good dollar and inflation hedges. In fact, for most of us, a leveraged home was the very best inflation hedge we’ve ever bought. So it’s case contingent. If you own these things the argument for owning lots of gold is diminished.1 And if you don’t own those things then the case for owning a more accessible hedge like gold, is stronger.

Anyhow, I guess what I am getting at is that it’s good to be open-minded about these things. I have my models for how to formulate portfolios, but everyone’s different and while it might make zero sense for Joe to own gold it might serve Jane much better in the context of their own financial plans.

2) That rate cut didn’t bother me.

The Fed cut rates this week and some people were losing their minds about it. They say inflation is too high and that this risks causing inflation to go higher. And that’s not necessarily wrong. I think it’s probably a little dramatic, but at this point I can see strong arguments being made by both sides.

On the one hand, the Fed has been tight for a very long time and they’ve crushed housing and largely won the inflation battle. Yeah, inflation is still above target, but even in the high 2s it’s still below its historical average. And with employment coming in so soft in recent months I can see the argument for trying to get ahead of a potential employment problem. And on the other side I can understand people who look at booming stock prices, GDP Now at 3%+ and inflation trending higher, who conclude that this might be a time to keep things tighter.

I don’t have a really strong opinion at this point. But the cut didn’t bother me mainly because I think that 4% Fed Funds Rate is still pretty tight. I mean, that’s equating to a mortgage rate of 6.35%, which, given where house prices still are, isn’t going to spark some sort of private sector borrowing boom. And yes, I still think housing is the lynchpin in the whole inflation equation. And I don’t see a lot of signs that housing is surging back to life because of this cut. I think the Fed has a long way to go before they get rates back to a point where housing and private credit start to add meaningfully to inflation. So, a modest amount of easing isn’t the worst thing in the world in my view.

3) Did I say national divorce?

This is a super strange time to be alive. I can tell you that from my personal business perspective I’ve never been more excited about what I am working on. I have some stuff in the pipeline that I cannot wait to unfurl later this year and in 2026. I am about as optimistic as I have ever been about the work I am doing. And there seems to be a growing euphoria in the stock market that reflects something kind of similar. But from a geopolitical and social perspective I don’t think things have ever been worse in the USA. Maybe I just haven’t lived long enough, but I would say that at least in my lifetime it’s never felt this bad.

About 15 years ago I wrote this very rah, rah and optimistic piece about the USA and how the thing that makes America, America is that we’re UNITED. At the time Europe was talking about its own potential monetary divorce during the Euro crisis. And I was describing how the USA’s monetary system is functionally equivalent to Europe’s in that each state in the USA is a user of the Dollar in much the same way that countries within Europe are users of the Euro. The problem is that Europe has individual federal governments instead of having one unifying federal government that controls things like bond issuance. Oh, and they also have that history of thousands of years of hating and killing each other because of distinct social and political disagreements.

But as I sit here today I feel like the USA’s political differences are growing. And they’re growing in a way that makes me think we’re very much not united. Maybe it’s just the social media narratives and old age getting to me. But when I look at the political divide in the USA it does feel increasingly like we have some irreconcilable differences. Not me of course. I am just a perfectly independent and apolitical financial analyst. But this certainly applies to the rest of you. Bwahahahah.

Anyhow, I think we all need to go to national marriage therapy. And I am only half joking about that. Everyone in this country needs to go do some yoga, learn to meditate or do what I do when I feel out of sorts and spend 90 minutes on leg day or gardening. It’s a beautiful time of year for it. Fall baseball is in the air and Halloween is around the corner. I need to get that Fall garden finished so the bunnies can eat it all before I do. Of course it’s 75 degrees here in San Diego so it doesn’t feel like any of that to me, but when I watch the Padres lose in the playoffs to the Cubbies in Chicago I am sure it will feel like that to me. Oh wait, I just checked and it’s going to be 80 degrees in Chicago in 2 weeks so I guess that means the Padres will lose in weather they’re accustomed to. Wonderful.

I hope you have an amazing weekend. And as always, stay disciplined.

1 – I have to admit that I still struggle with the forms of gold I own. I have some physical gold locked up in a bank. It’s not a lot, but it’s enough to annoy me at times because I am fairly certain I’ll die without having ever touched it. So there’s a big piece of me that wonders – why? Why did I lock some rocks up in a bank where I pay them to keep them? I don’t even have a great answer for that. And even though they’ve gone up in value a lot I can 100% justify in my own mind just getting rid of them and trying to use the money to do something more productive than sitting around waiting for the world to end. Which is the weirdest part of why I convinced myself to own it in the first place – in case of a worst case scenario where I probably can’t even get it. Or if I did get it someone would probably kill me for it anyhow. Asset allocation is hard.

More By This Author:

The Disruption That Could Crush Inflation

Three Things – Weekend Reading: Sunday, Sept 7

Ray Dalio Is Wrong – A Debt Heart Attack Isn’t Coming

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more