Ray Dalio Is Wrong – A Debt Heart Attack Isn’t Coming

Let me start by saying that I love Ray Dalio. I dedicated an entire chapter in my forthcoming book to his work on portfolio construction. But like all macro investing strategists he’s going to get things wrong on occasion. And I think this one is a biggie so let me explain, respectfully, why I think Ray Dalio is wrong about a potential debt-induced heart attack in the USA.

This was all sparked by recent comments Mr. Dalio made in the FT about how a “debt inducted heart attack” was coming to the USA within 3 years.1 He said:

“The great excesses that are now projected as a result of the new budget will likely cause a debt-induced heart attack in the relatively near future,” he said. “I’d say three years, give or take a year or two.”

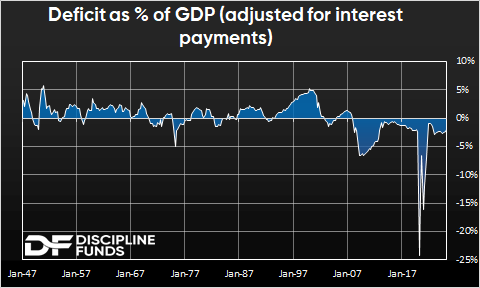

Like many (most?) people he assumes that the demand for US Dollars (and ultimately US debt) is driven primarily by US government debt issuance. But we know this has been wrong for a long time. After all, the national debt in the USA has surged from $500 billion to $37 trillion in the last 50 years. As a percentage of GDP it has soared from 33% to 120%. And over most of this period the rate of inflation has been in decline as inflation peaked in 1980 at 14.5% and has remained relatively subdued ever since. The one exception was Covid when the government went on a money printing rampage and did indeed cause high inflation. But that spending binge is now over. In fact, if you adjust the deficit for interest payments the deficit as a percentage of GDP is just 2%.

Now, you might ask why someone would adjust the deficit for interest payments? After all, the government really is paying over a trillion dollars a years in interest. Yes, but the government isn’t the only creator of money in the financial system. And in Capitalist economies like the USA private credit markets are generally far more important. And the primary point of raising interest rates is to choke private credit markets. So, even though the government might be paying more in interest the private credit system has been slowing steadily ever since. For instance, in the year before the Fed started raising rates total private credit to the non-financial private sector increased by $3 trillion. In the last year private credit increased $850 billion. The rate of growth has declined from its peak of 8.4% in Q1 2022 (not coincidentally when the Fed began raising) and has slowed to just 2% as of Q1 2025. That’s a big reason why inflation has come down. While people have been keenly focused on US government debt increases they’ve largely overlooked the slowdown in private credit, which has played a much larger role here.

But that only touches on the near-term inflation impact. On a more secular basis I just don’t see how Dalio will end up being right. After all, we’re staring at the largest disinflationary trend (Artificial Intelligence) that human beings have ever seen. This is going to put enormous pressure on wages and employment while increasing the efficiency with which we produce everything. This tech trend is far from even starting and it is a huge headwind to inflation. And that doesn’t even touch on the demographic headwind we’re staring at. The USA is an aging population with a slowing birth rate and more protectionist immigration policies. That is also a huge disinflationary headwind.

The bottom line is that yes, we know following Covid that the government can cause big inflation if it tries hard enough. But this isn’t Covid any more. In fact, when you adjust aggregate government policy for how restrictive the Fed still is, we have only a modest net inflationary impact from the deficit at present. And then when you layer on these huge macro headwinds in tech growth and demographics I think the argument for high inflation and a debt induced heart attack become far less convincing.

And look, I am not just being a pollyanna here. Every single person in the USA (and the world) should be hoping that the world’s most important economy and reserve currency doesn’t undergo what Ray Dalio is predicting because, if that does happen, we have much bigger problems on our hands than sovereign debt. And in that world the only investment that will serve you well is the one you can load with bullets.

1 – Big mistake here. A smart economist knows to provide a prediction or a time horizon, but never both at the same time.

More By This Author:

Where Did The Integrity Go?

Payrolls, Privates And Perspective

Three Things – All About That Labor Report

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more