There Is More Value In The Financial Sector Than Any Other Sector

Financial Sector Stocks

Thanks to the great recession of 2008 and 2009, there is more value to be found in the financial sector than any other of the 11 sectors.

In this video, Chuck Carnevale, Co-Founder of FAST Graphs, a.k.a. Mr. Valuation will analyze the financial sector, focusing on the value it offers after the 2008 recession. He will discuss the criteria he used to select 91 companies for a portfolio. He will provide insights into transaction and payment processing servers.

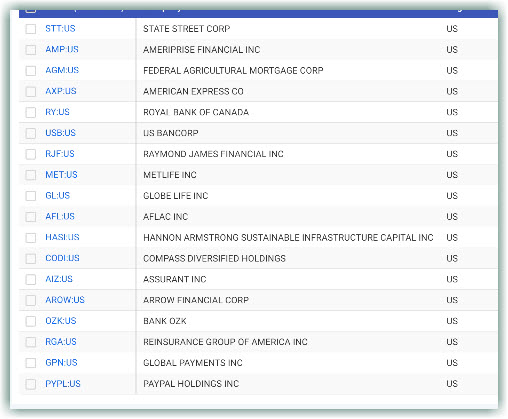

In this video Chuck will go over State Street Corp (STT), Ameriprise Financial (AMP), Federal Agricultural Mortgage Corp. (AGM), American Express (AXP), Royal Bank of Canada (RY), US Bancorp (USB), Raymond James Financial (RJF), MetLife Inc (MET), Globe Life (GL), Aflac Inc (AFL), Hannon Armstrong Sustainable Infrastructure Capital (HASI), Compass Diversified Holdings (CODI), Assurant Inc (AIZ), Arrow Financial (AROW), Bank OZK (OZK), Reinsurance Group of America (RGA), Global Payments (GPN), PayPal Holdings (PYPL).

Video Length: 00:27:58

More By This Author:

Does The Energy Sector Have The Energy To Offer Good Investments?

Communication Services Sector Buy Them Cheap Enough For Growth & Income

Finding Investable Companies In The Industrial Sector Is Hard To Do

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit ...

more