Communication Services Sector Buy Them Cheap Enough For Growth & Income

Communication Services Sector Stocks

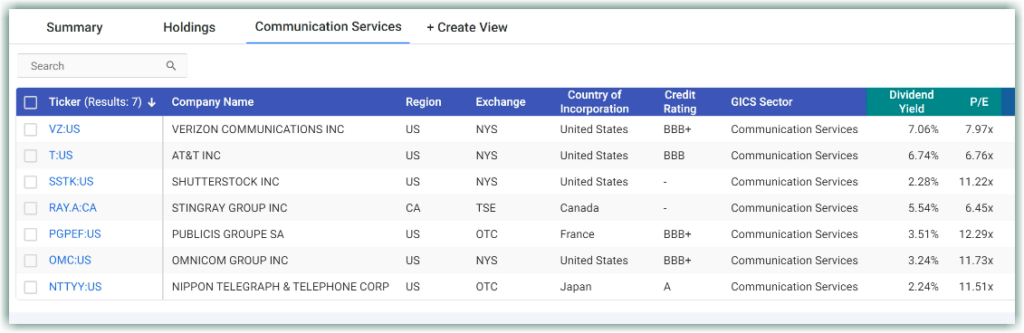

In this video, Chuck Carnevale, provides a detailed analysis of seven stocks in the Communication Services Sector, focusing on their valuation, growth potential, and dividend yields. In a similar fashion to the Utility Sector, the Communications Services Sector is primarily thought of as lower-growth or moderately slow-growth income producers. But if you buy them cheap enough, they can also produce great profits in the long run.

Stingray Group is a Canadian company I’m not real familiar with, but it’s been undervalued for a long time. Publicis Groupe is a French company, it’s one of the ones I threw in here from a different country to give you some perspective.

(Click on image to enlarge)

Omnicom is kind of a more growthy version of the Communication Services Sector but it has lower yield. And then Nippon Telegraph & Telephone, which is a Japanese A-rated company. We will also review Shutterstock, AT&T, and Verizon.

FAST Graphs Analyze Out Loud on the Communication Services Sector reviewing Nippon Telegraph & Telephone (NTTYY), Omnicom Group (OMC), Publicis Groupe (PGPEF), Stingray Group (RAY.A.CA), Shutterstock (SSTK), AT&T (T), Verizon Communications (VZ).

Video Length: 00:19:09

More By This Author:

Finding Investable Companies In The Industrial Sector Is Hard To Do

Healthcare Sector Stocks: Consistent Above-Average Growth And Income

Utility Stocks For Income And Growth Thanks To Rising Interest Rates

Disclosure: Long OMC, T, VZ.

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks ...

more