The Top 10 Tech Stocks Now, Ranked By Expected Returns

Investors have traditionally purchased technology stocks for their outsized growth potential. But in recent years, tech stocks have also embraced paying dividends as a way to reward shareholders. And while the tech sector is still the primary place to look for growth stocks, it is now a strong source of value and income stocks as well.

At the same time, some investors may be turned off by tech stocks, as many are inconsistently profitable or trade for sky-high valuations. With this in mind, we have created a list of large-cap tech stocks that are profitable and hold reasonable valuations. Many even pay dividends, with the potential to increase their dividends on a regular basis.

The list is derived from the most well-known tech sector exchange traded fund, the Technology Select Sector SPDR Fund (XLK).

Tech Stock #10: Corning (GLW)

- 5-Year Annual Expected Returns: 9.2%

Corning operates in five segments: Display Technologies, Optical Communications, Specialty Materials, Environmental Technologies, and Life Sciences. The $22 billion market cap company generates over $1.5 billion in annual core earnings.

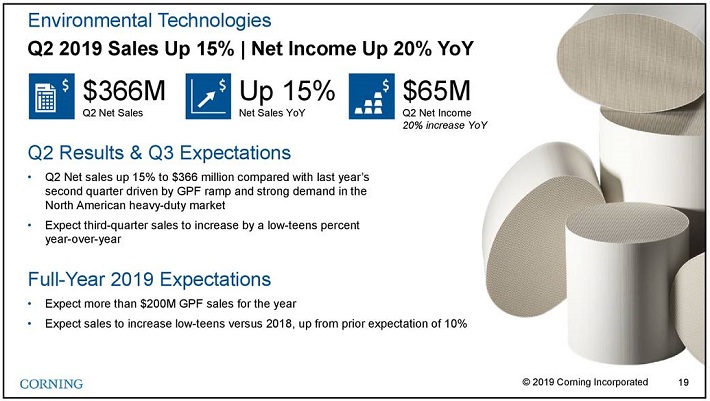

On July 30th, Corning released second-quarter results. Corning reported $2.99 billion in core sales, representing an 8% year-over-year increase compared to Q2 2018, as four of the company’s five segments posted double-digit growth. Core earnings came in at $410 million, a 14% increase, while core earnings-per-share increased 18%. Environmental Technologies was the strongest performer for Corning last quarter.

Source: Earnings Slides

Corning also updated its full-year 2019 outlook. Display Technologies and Optical Communications sales are anticipated to grow by a low-to-mid single digit percentage, while Environmental Technologies is expected to grow by over 10% to lead the company’s growth.

Corning has strong growth prospects ahead. The company enjoys a leading position in fiber-optic cables, LCD’s, screens, and specialty glass. Smart phone glass will continue to be an important part of the business, but increased optical fiber usage from areas like the Internet of Things, 5G mobile technology and autonomous driving could also drive future growth. Share repurchases will also help boost earnings-per-share growth, as Corning has approved a $5 billion share buyback program.

Corning stock has a price-to-earnings ratio of 14.8, which is just below our fair value P/E estimate of 15. Therefore, valuation changes will only add 0.4% to Corning’s annual returns. Total returns will be based primarily from expected EPS growth (6%) and the 2.8% dividend yield, producing total expected returns of 9.2% per year through 2024.

Tech Stock #9: Intel Corp. (INTC)

- 5-Year Annual Expected Returns: 10.0%

Intel is the largest manufacturer of microprocessors in the world. The company ships about 85% of the world’s microprocessors. Intel also manufactures products like servers and storage devices that are used in cloud computing. Intel generates annual revenue above $69 billion and the stock has a current market capitalization of $225 billion.

Intel released financial results for the second quarter on July 25th. The company earned $0.92 per share, which was $0.08 higher than analysts had expected, but represented a 13.4% decrease from the previous year. Revenue declined 2.7% to $16.5 billion, but topped estimates by $825 million.

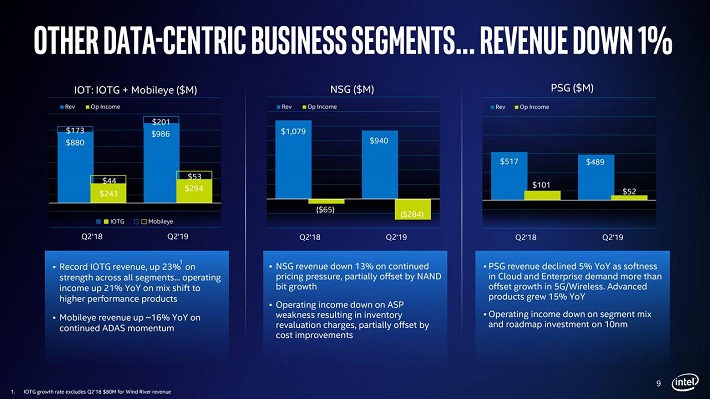

Overall, the data-centric businesses declined 7% year-over-year. Revenues for Data Center decreased 10% to $5 billion. Declines in cloud and government revenue more than offset a 3% gain in the communications service provider business.

Source: Earnings Slides

Going forward, we expect 5% annual EPS growth for Intel. Revenue growth will be fueled by new growth areas such as the Internet of Things, or IoT. Intel has a big lead in this emerging growth segment, as its Internet of Things Group grew revenue by 12% to nearly $1 billion last quarter.

Separately, Intel’s $15 billion acquisition of Mobileye is a growth catalyst. Mobileye’s revenue was a record $201 million, an improvement of 16% from the previous year.

Intel stock trades with a 2019 P/E ratio of 11.5, compared with our target P/E of 13 which we believe to be fair value for a highly profitable industry leader. Expansion of the P/E ratio could boost annual returns by 2.5% annually over the next five years.

Intel stock also has a current dividend yield of 2.5% right now. Combined with annual EPS growth estimates of 5%, Intel stock has a total expected return of 10% annually through 2024.

Tech Stock #8: International Business Machines (IBM)

- 5-Year Annual Expected Returns: 10.6%

IBM is a global giant with $80 billion in 2018 revenue, while the stock has a market capitalization of ~$127 billion. The company has five business segments: Cloud & Cognitive Software, Global Business Services, Global Technology Services, Systems, and Global Financing.

IBM reported mixed second-quarter results. Revenue declined 4.2% to $19.16 billion, while organic revenue fell a more modest 1.6%. Diluted EPS grew 8% to $2.81 in the quarter, and beat expectations by $0.09 per share. By segment, operational revenue increased 3.2% in Cognitive & Software; and 3.4% in Global Business Services. Offsetting growth in these areas was a 3.5% organic revenue decline in Global Technology Services; an 18% decline in Systems; and an 8.5% decline in Global Financing.

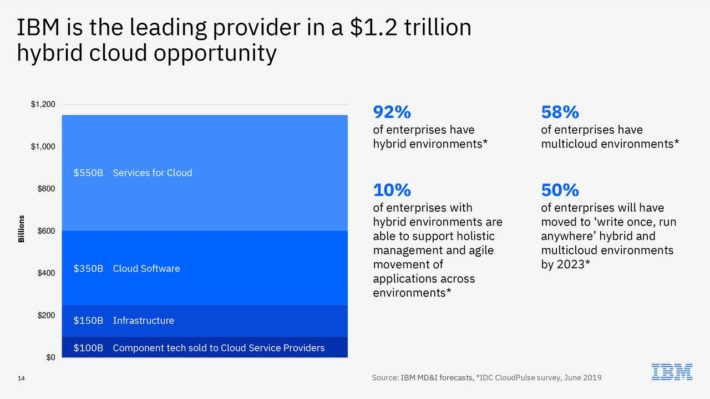

On July 9th, IBM announced it closed on its $34 billion acquisition of Red Hat Inc. to boost its cloud platform.

Source: Investor Presentation

Red Hat generates annual revenue of about $3 billion and operates in the open-source software market, primarily distributing technology products used in data centers.

IBM’s strategic initiatives will generate the company’s future growth. For example, total cloud revenue increased 8% to $19.5 billion over the past 12 months, with more to come from Red Hat. We expect 3% annual earnings growth through 2024.

Based on expected earnings-per-share of $13.90 for 2019, IBM stock holds a price-to-earnings ratio of 10.3. Our fair value estimate for IBM is a price-to-earnings ratio of 12.0, a slight discount to its average price-to-earnings ratio over the past 10 years. If its stock valuation increases to the fair value estimate, it would generate annual returns of 3.1% if it occurs over a 5-year period.

In addition, 3% expected annual earnings growth and the 4.5% dividend yield bring total expected returns to 10.6% per year over the next five years.

Tech Stock #7: NetApp (NTAP)

- 5-Year Annual Expected Returns: 11.7%

NetApp Inc. calls itself the “data authority for hybrid cloud” providing services to simplify and empower a company’s use of its data. Last year, products made up 59% of the company’s revenues, software maintenance accounted for 16% of revenues, and hardware maintenance and other services equaled the remaining 25%.

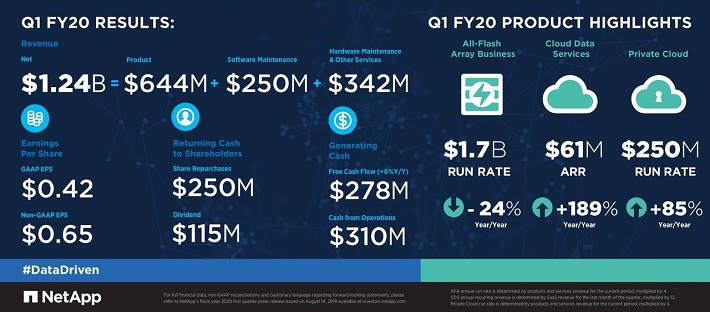

The $13 billion market cap company is expected to generate over $6 billion in sales this year and earn over $1 billion in net income. On August 14th, NetApp released Q1 fiscal year 2020 results for the period ending July 26th, 2019.

For the quarter the company reported net revenue of $1.24 billion, compared to $1.47 billion in Q1 of fiscal 2019 and below prior guidance of $1.315 billion to $1.465 billion. Top line results were especially weak, as $90 million of enterprise software license agreements from the year-ago period did not repeat this quarter.

Source: Earnings Slides

Adjusted net income came in at $157 million or $0.65 per share, below $1.04 in Q1 fiscal year 2019 and its own prior guidance of $0.78 to $0.86.

The company has multiple growth opportunities, as businesses migrate to public and private clouds. Moreover, increased spend in the industry related to upgrading to faster, higher capacity and more efficient storage solutions ought to bode well for the business, especially in the short-term.

However, NetApp operates in an industry with large storage competitors. Further, NetApp’s legacy network storage business is in decline.

That said, NetApp stock appears to be undervalued. The stock trades for a P/E ratio of 13.5, compared with our fair value estimate of 15. A higher valuation multiple could boost annual returns by 2.1% per year through 2024. In addition, we expect 6% annual EPS growth, and the stock has a 3.6% dividend yield for total expected returns of 11.7% per year.

Tech Stock #6: Skyworks Solutions (SWKS)

- 5-Year Annual Expected Returns: 12.5%

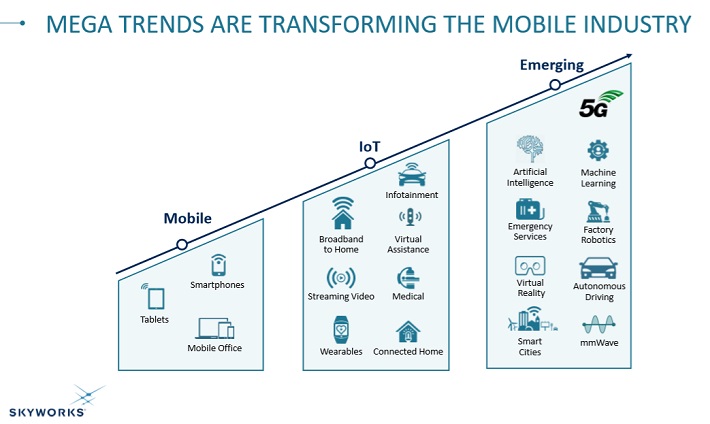

Skyworks Solutions is a semiconductor company that designs, develops, and markets proprietary semiconductor products used around the world. Its products include antenna tuners, amplifiers, converters, modulators, receivers, switches, and more.

Source: Investor Presentation

Skyworks’ products are used in a diverse range of industries, including automotive, connected home, industrial, medical, smartphones, and defense. Skyworks has a market capitalization of $14 billion.

On August 7th, Skyworks reported third quarter results. The company reported $0.83 in diluted GAAP EPS, which was down from $1.57 from the same period last year. On a non-GAAP basis, the company reported $1.35 in diluted EPS for the quarter.

Revenue declined 14% from the same period last year. Ongoing global uncertainty and a slowing growth rate of its primary customer, Apple Inc. (AAPL), are contributing to Skyworks’ challenged results.

However, the company raised its quarterly dividend 16% from $0.38 to $0.44 per share, and also cited strong confidence and cash flows in the core business despite external volatility in the industry. The company gave midpoint guidance of $1.50 in non-GAAP diluted EPS for the fourth quarter.

Skyworks has enjoyed tremendous growth over the past decade, thanks to the proliferation of smart phones that use its chips—in particular the iPhone. The company increased its EPS by 27% per year over the past 10 years, and by approximately 20% over the past five years.

However, analysts expect earnings to decline through 2019 and for sluggish growth over the next couple of years. The global semiconductor is in a severe downturn, and smartphone growth has flatlined. Overall, we expect 9% annual EPS growth through 2024.

Skyworks stock trades for a P/E ratio of 13.2. We consider a P/E ratio of approximately 14 to be fair, at least until the company can demonstrate a wider customer base and diversify away from its smart phone focus. Still, an expanding valuation multiple could boost annual returns by 1.2% per year.

In addition, expected EPS growth of 9% annually plus the 2.3% dividend yield result in total expected returns of 12.5% per year through 2024.

Tech Stock #5: Xerox Holdings Corp. (XRX)

- 5-Year Annual Expected Returns: 12.7%

Xerox Corporation traces its lineage back to 1906. Through a series of mergers and spinoffs, the Xerox we know today was formed. Xerox spun off its business processing unit last year (now called Conduent) and now focuses on design, development and sales of document management systems. The company produces $9+ billion in annual revenue and has a market capitalization of nearly $7 billion.

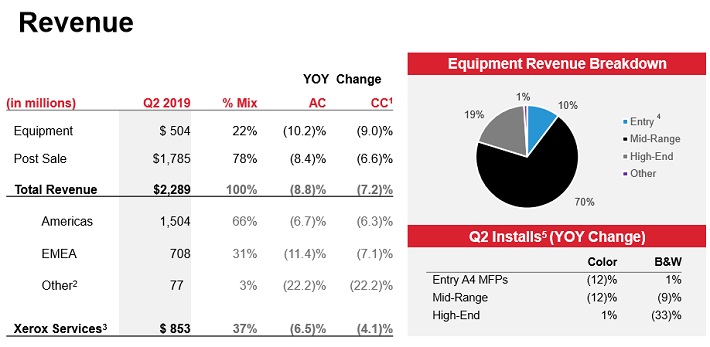

Xerox reported mixed second-quarter earnings. Total revenue declined 7.2% against the year-ago period on an adjusted constant currency basis. Equipment sales fell 10.2%, while Post-Sale revenue declined 8.4%.

Source: Earnings Slides

Adjusted earnings-per-share rose from $0.80 in the year-ago period to $0.99 in Q2 thanks to cost savings and a lower share count. Xerox reiterated earnings-per-share guidance at $3.80 to $3.95 after Q2.

Xerox has been focused on its Project Own It, the company’s enterprise-wide initiative to simplify its operations, drive continuous improvement, and free up capital to reinvest in future growth. It expects this program to drive at least $640 million in cost savings this year.

Xerox is not a high-growth business, as the company is still moving beyond its hardware-based past. However, it is a highly profitable company, which means it can return cash to shareholders via buybacks and dividends. The company intends to buy back ~$600 million of its own shares in 2019, and the stock has a current dividend yield of 3.3%.

Xerox trades for a P/E ratio of 7.8, based on expected 2019 EPS of $3.88. Our fair value estimate is a P/E ratio of 11, meaning an expanding valuation could boost annual returns by 7.1% per year through 2024. In addition to 2.5% expected annual EPS growth and the 3.3% dividend yield, total returns could reach 12.9% per year.

Tech Stock #4: HP Inc. (HPQ)

- 5-Year Annual Expected Returns: 13.0%

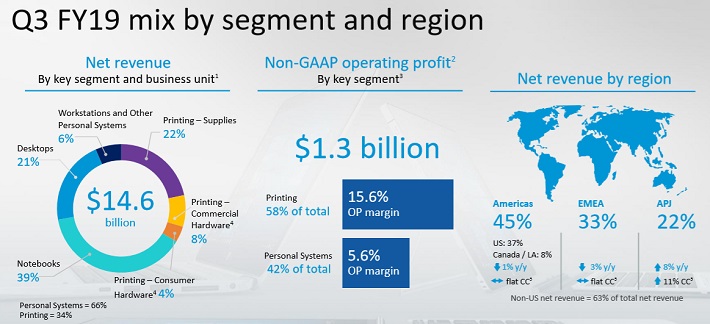

HP Inc. is the result of Hewlett-Packard spinning off its enterprise technology infrastructure, software and services business, known as Hewlett Packard Enterprise Company (HPE). After the spin-off, HP Inc. now creates technology mainly in two segments: its portfolio of printers and through personal systems (computers and mobile devices). HP Inc. generated $59 billion in revenue last year, and the stock has a market capitalization of $28 billion.

HP reported its second quarter (fiscal 2019) results on May 23. The company reported revenue of $14.0 billion for the quarter, while organic revenues (adjusted for forex movements) were up 2.3% year over year. Personal Systems revenue grew by 4.7% at constant currency rates, whereas Printing revenues declined by 1.7% versus the previous year’s quarter.

Source: Earnings Slides

The company returned $900 million to shareholders during Q2, primarily via share repurchases. Non-GAAP earnings-per-share equaled $0.53 per share. Earnings-per-share increased 10% versus the prior year’s quarter. The company anticipates non-GAAP diluted earnings-per-share of $2.14 to $2.21 for fiscal 2019. For this year, management anticipates that earnings-per-share will grow between 5% and 10%.

HP is a leader in its printing and personal computing markets, but these are areas that face challenges as consumers continue to shift to mobile devices. The adoption of 3D printing could help, as HP is already entrenched in this industry, but so far, the majority of profits are generated by traditional printers and printing products. Through a low revenue growth rate, and a solid pace of share repurchases, we expect ~5.8% annual EPS growth through 2024.

HP stock trades for a P/E ratio of 8.7, below our fair value estimate of 10.5. An expanding valuation could add 3.8% to HP’s annual returns. Combined with expected EPS growth and the 3.4% dividend yield, HP’s annual returns could reach 13% per year through 2024.

Tech Stock #3: Broadcom Inc. (AVGO)

- 5-Year Annual Expected Returns: 13.1%

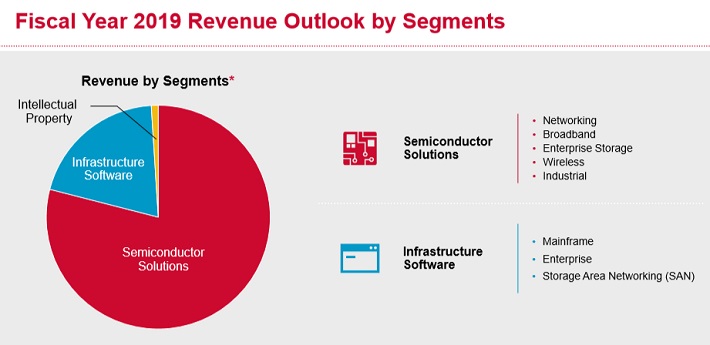

Broadcom designs, develops and sells semiconductors under the following business units: Wired infrastructure, wireless communication, enterprise storage and industrial. Its offerings include data center chips, factory automation, energy systems and power generation, broadband access, and home connectivity.

Source: Investor Presentation

Broadcom is a fabless semiconductor company, which means that the products it designs are manufactured by other companies (so-called foundries). Broadcom stock has with a market capitalization of $110 billion.

Broadcom reported its fiscal third quarter earnings results on September 12th. The company generated revenues of $5.52 billion during the quarter, which represents an increase of 9.1% compared to the prior year’s quarter. Broadcom reported earnings-per-share of $5.16 for the third quarter, up 4% year-over-year.

The company forecasts revenues of $22.5 billion, implying a revenue growth rate of 8% versus 2018. Revenue guidance includes the impact of the acquisition of CA Technologies, which closed in late 2018.

Broadcom’s profitability has exploded over the last decade. Indeed, its earnings-per-share rose more than tenfold between 2010 and 2018. This earnings growth was driven by a significant amount of M&A, the most important one being the merger between Broadcom and Avago Technologies.

Broadcom has since made several other major takeovers, including its acquisition of Brocade for $6 billion that closed in late 2017, and its takeover of CA that closed in late 2018.

By moving towards acquisitions in the software industry with its CA takeover, Broadcom has found a new way of generating inorganic growth. Broadcom’s biggest market is wireless communication, where the company owns a strong connectivity portfolio that includes advanced LTE, Bluetooth 5.x, Wi-Fi, GNSS (GPS, Galileo, etc.), and more.

Broadcom is also well-positioned in the enterprise storage market, where it provides switching and other connectivity solutions and storage products such as SSD controllers.

These markets will continue to grow, and even without any major acquisitions, Broadcom’s revenues should continue to grow as well. The combination of acquisitions and organic growth should result in solid revenue growth and increasing tailwinds from improving economics of scale, while buybacks positively impact growth as well. We anticipate 9% annual EPS growth through 2024.

Broadcom stock trades for a P/E ratio of 12.9, close to our fair value estimate of 13. Expansion of the P/E ratio will only slightly add to returns, by 0.2% per year through 2024. Earnings growth and the 3.9% dividend yield will account for the bulk of shareholder returns. Total returns are expected to reach 13.1% per year over the next five years.

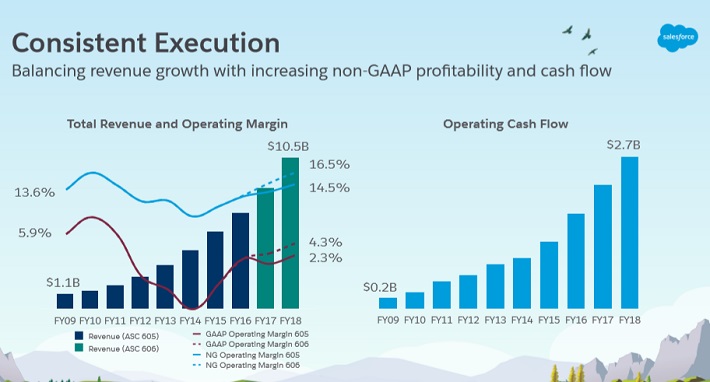

Tech Stock #2: Salesforce Inc. (CRM)

- 5-Year Annual Expected Returns: 13.5%

Salesforce is a customer relationship management technology company that provides tools for companies to improve their relationships with clients. The company provides a cloud platform for companies to manage contracts, customer interactions, requests, and contacts.

Salesforce has been among the S&P 500 Index’s strongest growth companies over the past several years.

Source: Investor Presentation

The company currently has a market capitalization of $115 billion, and the company generates in excess of $16 billion of annual revenue. Salesforce reported Q2 earnings on 8/22/19 and results were once again outstanding, including a guidance raise. Revenue grew 23% in constant currency, to $4 billion. Subscription and support revenue increased 22% year-over-year. In addition, professional services revenue increased 14%.

Salesforce does not pay a dividend as it’s spending heavily on sales growth and new technology development in the fields of artificial intelligence, automation and the Internet of Things. But its growth investments have clearly worked to the benefit of shareholders, as the company has more than doubled its revenue-per-share in the past five years.

We expect 20% annual growth through 2024. On a valuation basis, the stock trades for a price-to-sales ratio of 7 based on 2019 expected revenue. We value growth stocks like Salesforce by price-to-sales instead of price-to-earnings, as the company’s EPS is highly volatile from year to year. Our fair value P/S ratio is 5, which indicates the stock is overvalued.

If the P/S ratio contracts to the fair value estimate, shareholder returns would be reduced by 6.5% per year through 2024. However, such a high rate of expected growth (20% annually) means total returns are still expected to reach 13.5% annually through 2024.

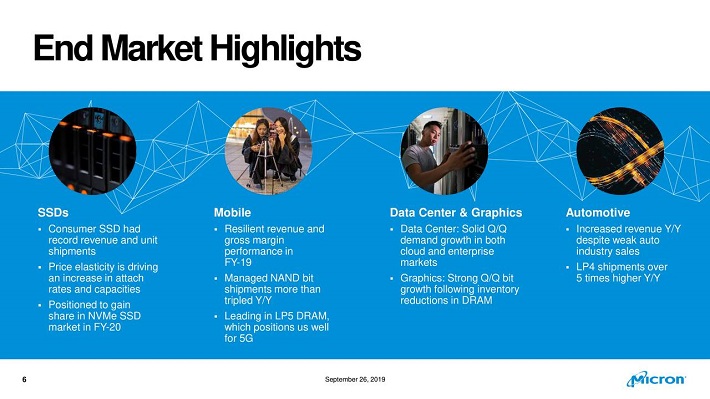

Tech Stock #1: Micron Technology (MU)

- 5-Year Annual Expected Returns: 14.4%

Micron Technology Inc is one of the top three producers of DRAM in the world, as well as one of the world’s top six NAND producers. DRAM refers to volatile dynamic random-access memory that computers, servers, smartphones, and embedded devices use to operate. NAND refers to non-volatile flash memory that serves as data storage for all these devices. With a market capitalization of $48 billion, Micron produced approximately $30 billion in revenue in 2018.

On September 27th, Micron reported fiscal fourth-quarter financial results including weak guidance. Revenue of $4.9 billion declined 42% but did beat expectations by $310 million. Adjusted EPS of $0.56 also beat expectations, by $0.08 per share. Micron saw particularly strong growth in SSDs and Automotive segment sales last quarter. However, the company lowered its outlook for DRAM sales for the full year.

Source: Earnings Slides

The major point of uncertainty for Micron is the situation with Huawei. Sales to Huawei declined sequentially last quarter and were even below what the company had expected before the U.S. ban took place. The company has applied for waivers with the government, but if those are not granted, future results could be negatively impacted.

Still, we estimate 15% annual EPS growth over the next five years from consensus 2019 EPS estimates, although the actual growth rate will be highly variable depending on how the current semiconductor pricing cycle plays out and subject to potential political tail risks involving ongoing international trade disputes.

Based on expected EPS of $5.99, Micron stock trades for a P/E ratio of 7.2. Our fair value estimate is a P/E ratio of 7, meaning the stock is slightly overvalued. A declining valuation could reduce annual returns by 0.6% per year over the next five years However, expected annual EPS growth of 15% could lead to total annual returns of 14.4% per year through 2024.

Final Thoughts

For many years, the technology sector was exclusively for risk-takers. The technology sector has always been attractive for growth investors, but now it also holds appeal for value and income investors. Tech stocks are often associated with small, speculative businesses such as start-ups that typically struggle to turn a profit.

But today, there are many large, highly profitable tech companies with reasonable valuations. Many tech stocks have now pay dividends to shareholders. And thanks to their strong growth, dividend-paying tech stocks have the ability to raise their dividends each year.

The 10 tech stocks on this list have high annual expected returns through 2024, thanks to a combination of earnings-per-share growth, expansion of the P/E multiple, and in many cases dividends.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more