“The Only Game In Town” Stock Market (And Sentiment Results)…

Intel Update

Every battle is won before it is ever fought.

That’s exactly how we’d characterize being Intel shareholders over the past ~18 months.

When we began building our position, this was a stock you couldn’t give away. At $18–19/share, Intel had been kicked to the curb and left for dead. The foundry business was hemorrhaging cash, the legacy business was bleeding share, and to top it off, you had the administration publicly calling on CEO Lip-Bu Tan to resign. You can imagine the sideways looks we got for pitching the stock.

Fast forward just a few months and a 180%+ rally later, the stock was sitting at four-year highs heading into earnings and was suddenly all anyone wanted to talk about. The same analysts who were downgrading in the hole were now doubling price targets overnight, in classic “opinion follows trend” fashion.

For us, this was a movie we had seen many times before.

Right when everyone starts getting excited about a story, headlines begin to hit every day and buzz starts to pick up, those are usually good indicators that a stock is getting ahead of its skis. Whether it was Albemarle with robots driving endless lithium demand or Amazon and Google returning to favor on bets of an AI future, these mood swings are something to be taken advantage of, not swept up in.

This sentiment was part of the reason we took roughly half of our INTC position off the table on strength heading into earnings, booking a 2.5x gain in ~18 months. We walked through the full thought process behind trimming the position in detail on last week’s podcast.

The decision comes down to how we originally underwrote the investment.

When we started buying Intel, the stock was trading below book value of ~$22/share. In other words, the business could have been broken up or liquidated the next day and we still would’ve gotten our principal back and then some. That was our margin of safety.

We valued the legacy CPU and server business, where Intel still leads in a mature albeit slower-growth category, at ~$45–50/share. As the refresh cycle turned and demand normalized, we saw this alone as a fairly straightforward double over a reasonable time frame.

The third leg of the thesis was the foundry and advanced AI chip opportunity. We always viewed this as the speculative portion of the investment, what we would call the whipped cream and cherries on top.

With the stock trading as high as $55 heading into earnings, we were effectively being overpaid for a fully recovered legacy business. At that point, the market was clearly riding on hopes of a near-term foundry customer announcement, with headlines and rumors driving the story.

Hope should never be an investment thesis.

As we’ve seen time and again, the market pendulum swung from unjustified pessimism at $18 straight to irrational exuberance at $55, with almost no pause in between. Markets overshoot on the downside and overshoot on the upside. That’s simply human behavior. Our job isn’t to predict it, but to exploit it, which is exactly what we chose to do.

Importantly, trimming the position does not mean we no longer believe in Intel.

We continue to see significant long-term upside as the story plays out, with a materially higher stock over time. If that weren’t the case, we would have exited the position outright and not thought twice. The only difference today is that our remaining stake is now effectively a free flier beyond house money. It allows us to maintain exposure to Lip-Bu Tan working his magic on what we have always viewed as the speculative portion of the investment, while having already locked in material, outsized gains.

If there’s one person capable of executing that vision, it’s Lip-Bu Tan.

He first earned his miracle-worker reputation at Cadence Design, stepping in after the stock had fallen 86% and going on to deliver a 68x bagger over the next 14 years. A $1 million investment became $68 million. With a resume like that, we’d be silly not to stick around for what could be another Midas-touch turnaround.

The only change is that we’ve already locked in material gains and redeployed capital into the next unloved opportunity while we wait. The position has gone from high-conviction bet to low-risk call option on one of America’s most strategically important assets. Those are odds we’ll take all day.

Q4 Earnings Breakdown

10 Key Points

1) Intel topped expectations across the board for the fifth straight quarter. Revenue of $13.7B (-4% Y/Y and flat Q/Q) beat the prior guidance midpoint of $13.3B and Street consensus of $13.4B. Adjusted EPS of $0.15 (+15% Y/Y) nearly doubled both prior guidance and Street estimates of $0.08.

2) Adjusted gross margins of 37.9% (-420 bps Y/Y and -210 bps Q/Q) came in well above prior guidance of 36.5% and Street estimates of 36.1%. Management guided Q1 gross margins to 34.5%, weighed down by lower revenues (supply constraints) and the ramp of Panther Lake, which has a dilutive cost structure that is expected to improve throughout the year and turn accretive. Management expects Q1 to mark the trough, with margins expanding toward the 40% target thereafter.

3) Intel started shipping the Intel Core Ultra Series 3 processors (formerly Panther Lake) during the quarter, marking the first AI PC platform built on the new 18A manufacturing process. Management exceeded its original expectation of delivering the first Panther Lake SKU by year-end 2025, instead shipping the first three SKUs during the year. Early reaction to Panther Lake has been strong, with high demand and performance on industry-standard benchmarks running 50–100% better than peers. Successful high-volume ramp of Panther Lake on 18A is a key driver behind increased engagement and traction with external customers on this node.

4) While INTC did not announce any external customers for 14A, management signaled that they are actively engaged with several potential customers and believe firm supplier decisions will begin in the second half of the year, extending into the first half of 2027. This timeline could make the planned Investor Day in the second half of 2026 a great platform to announce external customer commitments. Importantly, 14A performance and yield improvements remain on track, with PDKs now viewed by customers as industry standard. Advanced packaging is also seeing better-than-expected early engagement, with initial customer discussions suggesting these opportunities could be well north of $1B each, versus prior expectations of these opportunities being worth hundreds of millions.

5) The Data Center and AI Group (DCAI) reported revenue of $4.7B (+9% Y/Y and +15% Q/Q), beating consensus estimates of $4.4B and posting its strongest sequential growth this decade, driven by robust demand amid ongoing AI infrastructure buildouts. Segment operating margins expanded to 26.4% (vs. 8.6% last year and 23.4% last quarter), marking the fifth straight quarter of margin expansion. Both traditional server and networking revenue were up double digits Q/Q and Y/Y, with all signs pointing to another strong year of growth for the segment.

6) Client Computing Group (CCG) revenue for the quarter was $8.2B (-7% Y/Y and -4% Q/Q), roughly in line with management’s prior expectations as they continue to balance constrained supply. AI PC units grew 16% sequentially, with management estimating the client consumption TAM was greater than 290M units in 2025, marking two straight years of growth off the post-COVID bottom in 2023 and the fastest TAM growth since 2021. Segment operating margins fell to 27% (down from 36.4% last year and 31.6% last quarter), with higher memory and rising component pricing potentially limiting revenue opportunities for CCG in 2026.

7) Intel Foundry posted revenue of $4.5B (+4% Y/Y and +6.4% Q/Q), with external foundry revenue of $222M driven by projects with the U.S. government and the de-consolidation of Altera. The segment posted an operating loss of $2.5B (-55.7% operating margins), $188M worse Q/Q, driven by the early ramp of Intel 18A. Management expects Q1 revenue for the segment to be up double digits, driven by a mix shift toward EUV wafers and improved pricing for Intel 18A.

8) Adjusted free cash flow improved to $2.2B during the quarter, compared to an outflow of $1.5B last year, bringing full-year adjusted FCF to an outflow of $1.6B. Importantly, INTC generated $3.1B in the second half, as cash from operations more than doubled half on half, with management eyeing a return to positive adjusted FCF for the full year in 2026.

9) Management continues to simplify the organization and right-size the cost structure, with adjusted operating expenses of $16.5B in 2025, down 15% Y/Y. Total INTC employee headcount has now fallen to 85.1K, down from 108.9K last year and 88.4K last quarter. Looking ahead to 2026, management expects full-year operating expenses of ~$16B.

10) Q1 guidance came in softer than expected as INTC continues to work through industry-wide supply shortages, which are expected to be at their lowest levels in Q1 before steadily improving throughout the year. Q1 revenue is expected to come in at $12.2B at the midpoint (-11% Q/Q), below Street estimates of $12.55B, with adjusted EPS expected to be flat and below Street estimates of $0.05. Management noted that without the temporary supply bottleneck, revenues would have been well above the seasonal range due to strong demand for server CPUs.

Earnings Call Highlights

Boeing Update

Boeing closed out 2025 on a strong footing, delivering a lights-out quarter that removed any remaining doubt about where we are in the recovery.

Q4 revenue hit $23.95B, the strongest quarterly print since 2018.

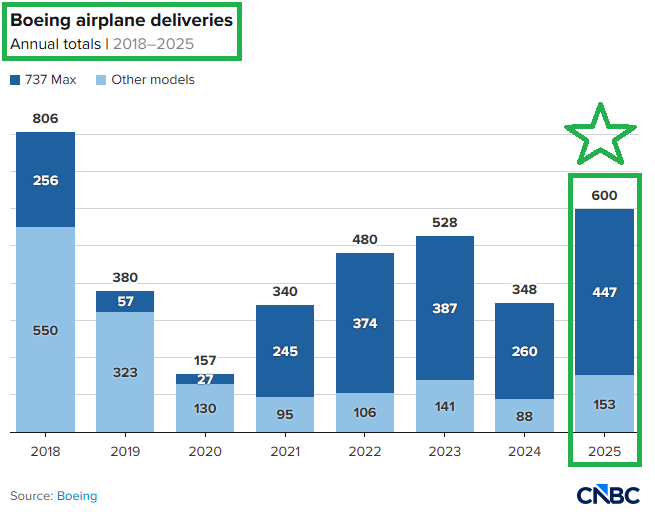

Commercial deliveries reached 160 in the quarter and 600 for the full year, marking the best annual output since 2018.

To top it off, the backlog swelled to a record high $682B (+$46B Q/Q), giving Boeing more than a decade of production runway as the “world’s greatest salesman” continues to work overtime.

A lot of credit goes to CEO Kelly Ortberg. As we have long said, it’s remarkable what happens when you put a leader with true, hands-on engineering experience in charge of a company building some of the most complex machines on the planet. So far, this has proven to be exactly the medicine Boeing needed, with production, quality, and culture all moving decisively in the right direction.

This was a stock, much like INTC at $18, you couldn’t give away in the $130s last year. Besides both of these names being near doubles from the lows (and in INTC’s case, well more than that), they share one key thing in common: these are national champions backstopped by Washington, competing in what are already or rapidly becoming legal duopolies. When opportunities like this are served up on a silver platter, we buy them until the cows come home.

In Boeing’s case, the story is as straightforward as it gets: deliver more airplanes, generate more cash. After years of missteps and nearly $38 billion of cumulative cash burn, Boeing is finally starting to do just that. 2026 is now set up for a recovery to $1–3B of positive free cash flow, setting the stage for the long-awaited $10B+ milestone by 2028. As production ramps further and one-time headwinds roll off, that $10B figure increasingly looks like a pit stop rather than the final destination, with a credible path to materially higher free cash flow over time.

Kelly Ortberg joined CNBC post-earnings, delivering a great high-level update on the state of the turnaround and what to expect in the year ahead:

Q4 Earnings Breakdown

10 Key Points

1) Boeing posted Q4 revenue of $23.95B (+57% Y/Y), beating consensus expectations of $22.58B and marking its highest quarterly revenue total since 2018. Adjusted EPS of $9.92 was lifted by the sale of the Digital Aviation Solutions unit (+$11.83 per share impact). Excluding the impact of this gain, adjusted EPS improved by $9.10 Y/Y.

2) The commercial segment posted revenues of $11.4B (+139% Y/Y) during the quarter, bringing full-year revenues to $41.5B (+82% Y/Y). Commercial deliveries totaled 160 in the quarter (+181% Y/Y), lifting full-year deliveries to 600 (+72% Y/Y), the highest level since 2018. Boeing booked 336 net commercial airplane orders during the quarter and 1,173 for the year, marking 2025 as one of the strongest order years on record. Commercial backlog reached a record $567B with more than 6,100 aircraft, with both the 737 and 787 sold firmly into the next decade. Management expects total commercial deliveries to increase ~10% in 2026.

3) The Defense, Space & Security segment posted revenue of $7.4B (+37% Y/Y) during the quarter and $27.2B (+14% Y/Y) for the full year, driven by stabilizing operational performance and volumes. Management remains focused on reducing the risk profile of BDS development programs through tighter underwriting standards and continues to expect the segment to return to historical performance levels over time. Defense backlog grew to a record $85B, with 26% of orders coming from customers outside the US.

4) The Global Services segment posted revenues of $5.2B (+2% Y/Y) during the quarter and $20.9B (+5% Y/Y) for the full year. Adjusted for the sale of the Digital Aviation Solutions unit, BGS revenue grew 6% during the quarter, with adjusted operating margins of 18.6%. Both the commercial and government businesses again delivered double-digit margins during the quarter, while the segment achieved a record $28B of orders for the year and exited with a record backlog of $30B.

5) Boeing generated $375M of adjusted free cash flow during the quarter, compared to a $4.1B burn last year and ahead of expectations of $272M, marking the second straight quarter of positive free cash flow after six consecutive quarters of cash burn. For the full year, free cash flow was an outflow of $1.9B, a significant improvement from the $14.3B burn in the prior year. Management expects to generate $1-3B of free cash flow in 2026, with the first half pressured by normal seasonality and the second half turning positive and accelerating sequentially. Several one-off headwinds are weighing on 2026 results (Spirit deal, delayed certifications and deliveries, BDS charges, DOJ payment). Excluding these items, Boeing would have generated high single-digit free cash flow of ~$6-7B. Most importantly, management believes the company remains well on track to reach the long-awaited $10B free cash flow target, with potential for meaningful upside beyond that level over time.

6) Boeing received the greenlight during the quarter to increase 737 program production to 42 aircraft per month, with KPIs continuing to improve and on-time delivery performance improving threefold Y/Y. The program remains on track to increase production to 47 later in the year, with management noting no supply chain constraints for the ramp and that supply does not become a challenge until the step from 47 to 52. Management expects 737 deliveries to increase to ~500 in 2026, compared to 447 delivered in 2025, implying materially improved production as 2025 included 55 aircraft drawn from inventory, which is now down to just 1 remaining carryover.

7) The 787 program began transitioning to production of 8 aircraft per month and remains focused on stabilizing at that rate. Operational metrics continue to improve, with average rework hours reduced by nearly 30% in 2025. The next planned rate increase to 10 aircraft per month remains targeted for later this year, with no material supply chain constraints identified beyond lingering seat issues, which management views as more of a delivery timing factor than a production limitation. Demand for the 787 remains exceptional, with Boeing booking 395 net orders during the year, the program’s highest annual order total to date. Management expects to deliver 90-100 aircraft for the full year, up from 88 in 2025.

8) Balance sheet cleanup continues, with cash and marketable securities of $29.4B at year end, up $6.4B Q/Q. Consolidated debt increased modestly to $54.1B from $53.4B in the prior quarter, driven by retained debt from the Spirit transaction. Boeing also maintains access to $10B of undrawn credit facilities, with preserving its investment-grade credit rating remaining a top priority.

9) Boeing completed both the $8.3B Spirit acquisition and the $10.6B disposal of the Digital Aviation Solutions business during the quarter, shoring up the balance sheet and increasing control over the supply chain, a key factor as production rates continue to ramp.

10) Boeing recognized a $565M charge related to the KC-46 Tanker program, driven by higher estimated production support and supply chain costs. While disappointing to see another charge following the $128M taken in 2024, management emphasized that the issue is discrete and does not have broader implications for other BDS programs. Focus now shifts to the next tanker opportunity beyond the current program of record, with an emphasis on tighter underwriting to ensure the contract is profitable.

Earnings Call Highlights

General Market

The CNN “Fear and Greed Index” ticked up to 66 this week from 55 last week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) fell to 88.46% equity exposure this week from last week’s 96.01%.

Our podcast|videocast will be out sometime today. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Not a solicitation.

More By This Author:

“The Toll Takers Of AI” Stock Market (And Sentiment Results)…

“When Boring Wins” Stock Market (And Sentiment Results)

“A Healthier Smile Ahead” Stock Market (And Sentiment Results)

Long all mentioned tickers.

Disclaimer: Not investment advice. For educational purposes only: Learn more at more