The NVDA Earnings Effect And What It Means For The Current Market Momentum

Image Source: Unsplash

Watch the video extracted from the WLGC session before the market open on 27 Feb 2024 below to find out the following:

- Discover the 2 key support zones crucial for determining market trends and potential corrections

- The confluence zone that will make or break the S&P 500.

- The preliminary supply (early distribution) you need to be aware of.

- and a lot more...

Video Length: 00:05:27

Market Environment

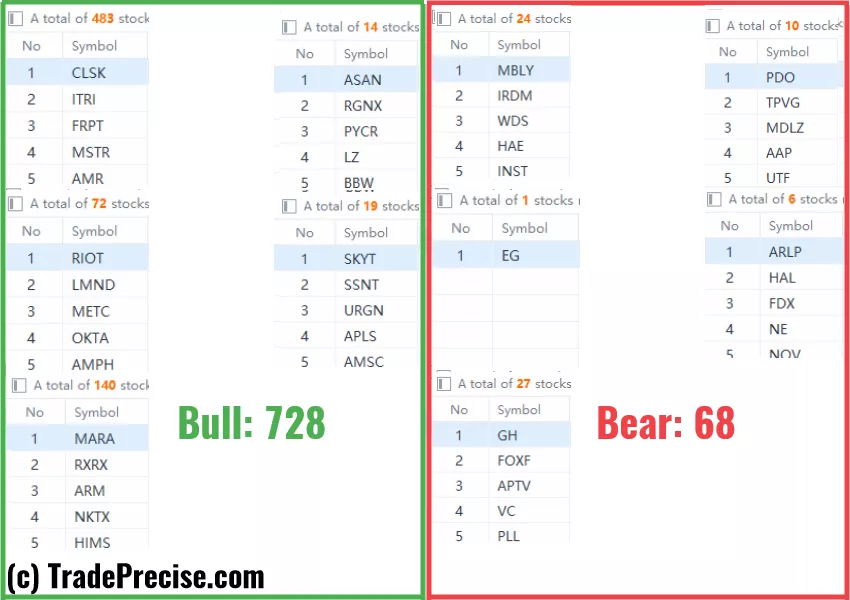

The bullish vs. bearish setup is 728 to 68 from the screenshot of my stock screener below.

The market again is back to complacency mode as reflected in the numbers of the bullish setup above.

So far, the preliminary supply showed up previously and the market is overextended and overbought. However, as long as the confluence zone as discussed in the video is holding up, there is no confirmation for a market pullback.

Most importantly, lots of the trade entry setups are working.

10 “low-hanging fruits” (CLF, SHAK, etc…) trade entries setup + 19 actionable setups (INBX, etc…) plus 4 “wait and hold” candidates have been discussed during the live session before the market open (BMO).

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

More By This Author:

Is The Stock Market Ready To Plunge? The Warning Signs Are Here

Overbought, Overextended - What's The Buzz In S&P 500 Now?

Decoding Bearish Analog And The Warning Signs You Can't Ignore

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.