Decoding Bearish Analog And The Warning Signs You Can't Ignore

Photo by Yiorgos Ntrahas on Unsplash

Watch the video extracted from the WLGC session before the market open on 6 Feb 2024 below to find out the following:

- The bearish analog structure that the S&P 500 could be unfolding

- The 3 warning signs that you can't ignore.

- How to position your trading strategy in this over-extended market.

- The immediate downside target according to the bearish analog.

- and a lot more...

Video Length: 00:05:32

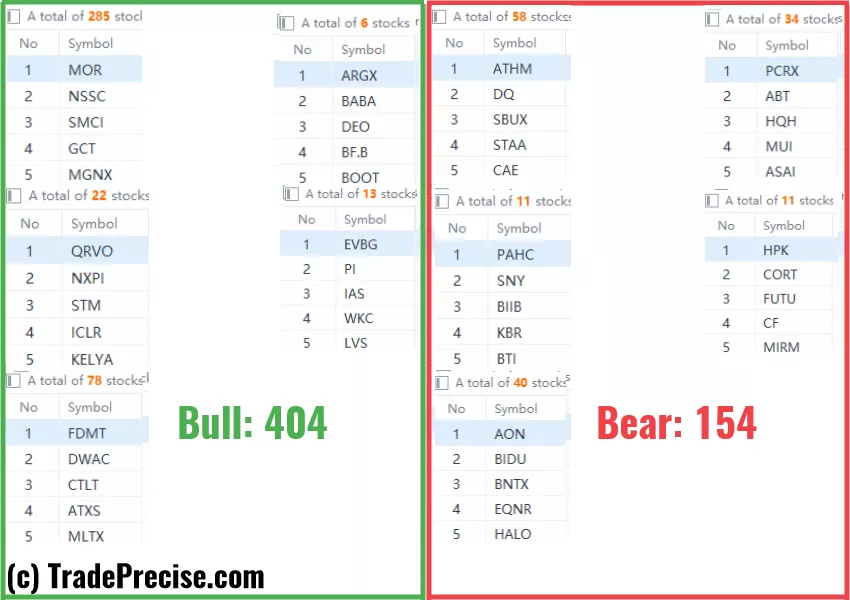

The bullish vs. bearish setup is 404 to 154 from the screenshot of my stock screener below. Despite being a positive and healthy market environment, the deterioration in both the long-term and the short-term market breadth prompted a red flag.

The bearish condition (not the timing) is here and a confirmation from the price action (plus the volume) will give the green light for the bear. The extent of the potential pullback could be dependent on the market rotation as discussed in the tweet below:

"Looking at $IWM or the $RTY. This is not overbought at all. That is a rally, a two legged pullback, tested a support, reversal, and then forming a small flag. This is a small flag and a breakout yesterday." #Russell2000 pic.twitter.com/7e3aHMkqTl

— Ming Jong Tey (@MingJong) January 31, 2024

13 “low-hanging fruits” (ALXO, SRPT, etc…) trade entries setup + 11 actionable setups (ACLX etc…) plus 16 “wait and hold” candidates have been discussed during the live session before the market open (BMO).

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

More By This Author:

How Russell 2000’s Rise Signals Opportunities Beyond S&P 500?

Will This Game-Changing Rotation Rock The S&P 500?

Coiling For A Breakout; Up Or Down?

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.