Will This Game-Changing Rotation Rock The S&P 500?

Image Source: Pexels

Watch the video extracted from the WLGC session before the market open on 23 Jan 2024 below to find out the following:

- The characteristics that could suggest a temporary pullback or consolidation in the market.

- How is the Russell 2000's recent outperformance impacting the broader market dynamics?

- Is the recent breakout signaling a genuine bullish trend, or are there potential pitfalls ahead?

- The upside target for the S&P 500 and the key levels to watch out for.

- and a lot more...

Video Length: 00:08:23

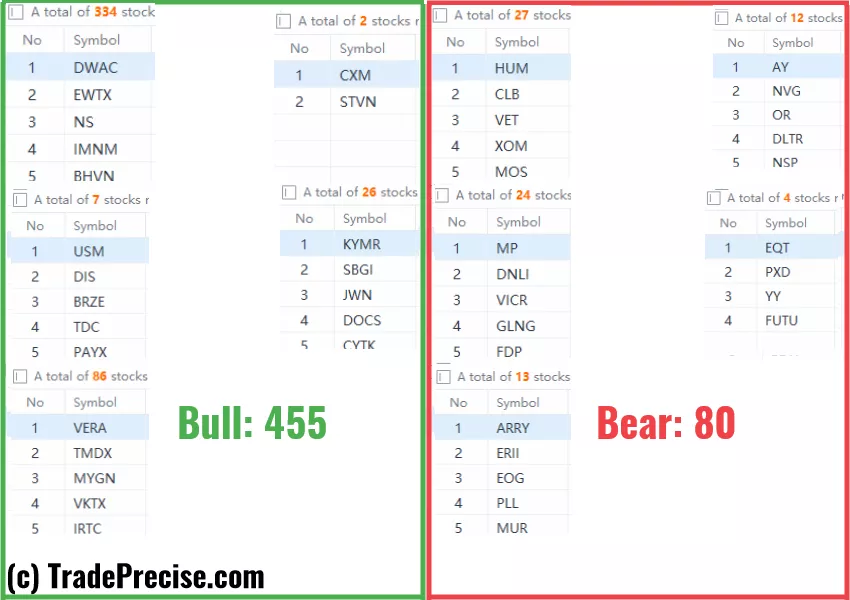

The bullish vs. bearish setup is 455 to 80 from the screenshot of my stock screener below. This is again back to a positive and healthy market environment based on the number of setups available.

However, the key remains in the market breadth, discussed in detail during the live session (How to Judge If The Rally Is Sustainable with the Market Breadth).

7 “low-hanging fruits” (WSM, FLT, etc…) trade entries setup + 16 others (UBER etc…) plus 11 “wait and hold” candidates have been discussed during the live session before the market open (BMO).

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

More By This Author:

Coiling For A Breakout; Up Or Down?

Start Of Something Big Or Just A Temporary Pause?

Has The Rally Lost Steam? Price, Momentum, And Volume Hold The Clues!

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.