The Earnings Picture Is Good, But Not Great

Image: Bigstock

We continue to see the ongoing Q3 earnings season as a replay of what we witnessed in the June-quarter reporting cycle when estimates and sentiment had weakened so much that the actual results ended up looking a lot better in comparison.

Having seen results from about a third of S&P 500 members by now, we can see that results are by no means great, but they are not bad either. It is all about expectations and those had been adjusted lower ahead of the start of this earnings season.

Importantly, many in the market appeared ready for earnings to ‘fall off the cliff’, with management teams guiding lower. We have seen some of that, but for the most part the long-feared development has not materialized, at least not yet.

The banks got us off to a good start this reporting cycle, with most of them not only coming out with strong Q3 results but also providing reassuring commentary for Q4. Results from other spaces like food and beverage operators and the air carriers were also broadly favorable. The strong UPS (UPS - Free Report) results and reaffirmed guidance confirmed that FedEx’s (FDX - Free Report) doom-and-gloom report earlier was mostly due to company-specific factors.

At the risk of repeating ourselves, earnings are by no means great and a broad-based slowdown is unfolding in front of us. Take Tech for example, where the early signs are pointing to some chinks in the armor from the likes of Microsoft (MSFT - Free Report) whose guidance for the cloud computing business was on the weaker side. This comes on top of the slowing trend in digital advertising that we saw again in the Alphabet (GOOGL - Free Report) report.

We knew coming into the Microsoft release that its PC-centric business faced rougher seas given the post-Covid drop off in PC demand, but the tell-tale signs of moderation in cloud demand may have read-through for other vendors in the space like Amazon (AMZN - Free Report). Importantly, it would suggest that the Tech sector’s weak spots may not be restricted to digital advertising and semiconductors but might also include other areas of enterprise spending.

The cost headwinds have been with us for a while, as have the foreign-exchange translation issues. All of this collectively is weighing on estimates for the current and coming periods, as we have been pointing out in this space.

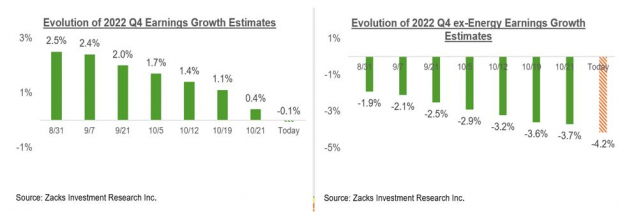

We saw this in the run up to the start of the Q3 earnings season and the trend continues with respect to estimates for the current period (2022 Q4) and full-year 2023. The charts below show how earnings growth expectations for the 2022 Q4, as a whole, and on an ex-Energy basis, have evolved in recent weeks.

Image Source: Zacks Investment Research

The chart below shows how the expected aggregate total earnings for full-year 2023 have evolved on an ex-Energy basis.

Image Source: Zacks Investment Research

As you can see above, aggregate S&P 500 earnings outside of the Energy sector have declined -8.1% since mid-April, with double-digit percentage declines in Retail, Construction, Consumer Discretionary, and Tech. Estimates have been coming down in the Industrial Products, Medical and Transportation sectors as well.

The Overall Earnings Picture

The chart below that provides a big-picture view of earnings on a quarterly basis.

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture on an annual basis, with the growth momentum expected to continue.

Image Source: Zacks Investment Research

Please note that a big part of this year’s growth is thanks to the strong momentum in the Energy sector whose earnings are on track to grow +138.7%. Excluding this extraordinary Energy sector contribution, earnings growth for the rest of the index would be down -0.4%. This relatively flat earnings picture for this year is also in-line with the economic ground reality.

Earnings next year are expected to be up +5.1% as a whole and +6.8% excluding the Energy sector. This magnitude of growth can hardly be called out-of-sync with a flat or even modestly down economic growth outlook. Don’t forget that headline GDP growth numbers are in real or inflation-adjusted terms while S&P 500 earnings discussed here are not.

As mentioned earlier, 2023 aggregate earnings estimates on an ex-Energy basis are already down -8.1% since mid-April. Perhaps we see a bit more downward adjustments to estimates over the coming weeks, after we have seen Q3 results. But we have nevertheless already covered some ground in taking estimates to a fair or appropriate level.

This is particularly so if whatever economic downturn lies ahead proves to be more of the garden variety rather than the last two such events. Recency bias forces us to use the last two economic downturns, which were also among the nastiest in recent history, as our reference points. But we need to be cautious against that natural tendency as the economy’s foundations at present remain unusually strong.

More By This Author:

Here's What To Expect From Big Tech Earnings

Can Bank Stocks Maintain The Recent Momentum?

Why Is The Market So Down On Big Bank Stocks?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more