Can Bank Stocks Maintain The Recent Momentum?

Image: Bigstock

The market liked what it saw in the quarterly releases from JPMorgan (JPM - Free Report), Citigroup (C - Free Report), and even Wells Fargo (WFC - Free Report) on an otherwise down day for the indexes. There was plenty to like in these results, with higher interes rates helping these big players expand their margins as demand for loans remained strong overall, despite slowing mortgage and auto originations.

The Citigroup report was relatively ‘noisy’ and less impressive on traditional profitability metrics, but the market liked the progress made on management’s restructuring plan that has been in the works for some time now.

The fact that the investment banking business was weak in Q3 was no surprise for the market. We knew that advisory fees will likely be about half of what they were in the year-earlier period, as persistent macroeconomic headwinds have been weighing on deal-making.

For JPMorgan, investment banking fees were down -47%, while the same segment at Morgan Stanley (MS - Free Report) dropped a larger -55% from the year-earlier level. Citigroup suffered an even bigger decline in investment banking revenues, down -64% YoY.

Morgan Stanley still remains an investment banking powerhouse, but it has deliberately been reducing its trading footprint, investing more in the relatively stable investment management business. Revenue in that business increased +3% from the year-earlier level and accounted for 47% of the total in Q3.

Trading revenues rose +8% at JPMorgan, with fixed income up +22% and stocks down -11% from the same period last year. Trading revenues were up only +3% at Morgan Stanley. Unlike JPMorgan and Morgan Stanley, trading revenues were down -7% at Citigroup, with the +1% gain in fixed income trading insufficient to offset the -25% decline in equities.

The strength for these banking giants lay in traditional commercial banking, with expanded net interest margins and bigger loan portfolios resulting in very strong net interest earnings. JPMorgan’s loan portfolio was up +7% from the same period last year, even though demand for rate-sensitive auto and mortgage loans were significantly down. The same unit for Wells Fargo climbed an impressive +10% YoY.

JPMorgan’s net interest margin of 2.08% in the September quarter compared to 1.8% in the preceding period. Net interest margins were up at Citigroup as well, with the sequential comparison at 2.31% vs. 2.24%. At Wells Fargo, net interest margin in Q3 came in at 2.83%, up from 2.39% in the preceding period.

The big year-over-year decline in profitability for each of these companies is primarily a function of differences in how reserves or provision for loan losses behaved in the two periods. Tough comparisons in the investment banking businesses are the other contributing factor. At JPMorgan, Q3 earnings declined -16.7% from the same period last year on +10.4% higher revenues. Quarterly earnings were down -39.4% at Citigroup and up +2.5% at Wells Fargo. For Morgan Stanley, Q3 and revenues were down -28.4% and -12% from the year-earlier level, respectively.

In terms of the Finance sector scorecard, we now have results from 22.6% of the sector’s total market cap in the S&P 500 index. Total earnings for these companies are down -16.2% from the same period last year on +4.3% higher revenues, with 88.9% beating EPS estimates and 55.6% beating revenue estimates.

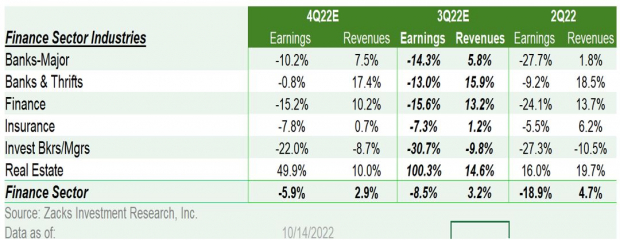

Looking at the Finance sector as a whole, total Q3 earnings for the sector are expected to be down -8.5% on +3.2% higher revenues.

For the Zacks Major Banks industry, which includes Citi and JPMorgan and accounts for roughly 40% of total Finance sector earnings, total Q3 earnings are on track to be down -14.3% from the same period last year on +5.8% higher revenues.

The table below shows the sector’s Q3 earnings and revenue expectations at the ‘medium’ industry level in the context of what the space reported in the preceding period and what is expected in the following quarter.

Image Source: Zacks Investment Research

The earnings declines expected in Q4 are essentially a replay of the forces that are shaping the Q3 numbers.

The much bigger question of the long-term profitability outlook for the banking industry is a function of the negative impact that the coming economic downturn will have on the group’s credit quality.

Skeptics of the banking industry argue that the group ends up giving away all the profits that it accumulated during the good times when the macro environment turns south. The Covid downturn was an anomaly in that respect, but there is some truth to the allegation.

We will see how the economic picture unfolds in the coming quarters, but the credit quality metrics in the reported Q3 results do not point toward any imminent deterioration.

Q3 Earnings Season Scorecard

Including results from the aforementioned big banks on Friday, we now have Q3 results from 35 S&P 500 members. We get into the heart of the reporting cycle this week, with results from more than 150 companies on deck, including results from 63 S&P 500 members.

This week’s line-up of reports is concentrated in the Finance sector, but we will get results from a host of bellwether operators in other spaces, including Netflix (NFLX Quick QuoteNFLX - Free Report) , Johnson & Johnson (JNJ Quick QuoteJNJ - Free Report) , Proctor & Gamble (PG Quick QuotePG - Free Report) and others.

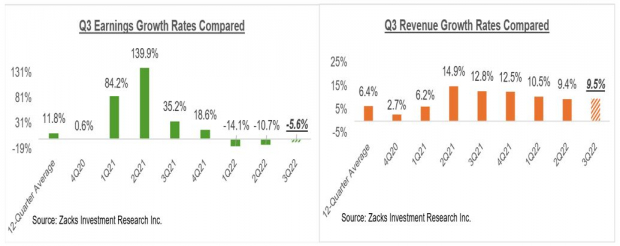

For the 35 index members that have reported results already, total earnings are down -5.6% from the same period last year on +9.5% higher revenues, with 74.4% beating EPS estimates and 54.3% beating revenue estimates.

Here is how the 2022 Q3 earnings and revenue growth rates for these 35 companies compares across different periods.

Image Source: Zacks Investment Research

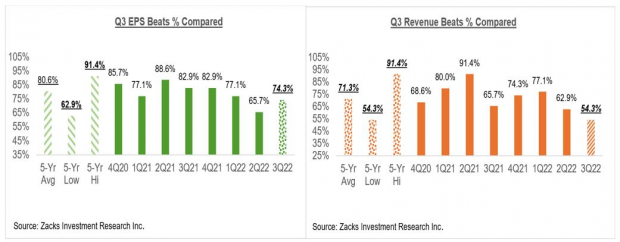

Here is how the 2022 Q3 EPS and revenue beats percentages for these 35 companies compare across different periods.

Image Source: Zacks Investment Research

As you can see here, companies are finding it hard to beat consensus estimates, even though estimates had significantly come down ahead of the start of this earnings season.

The Earnings Big Picture

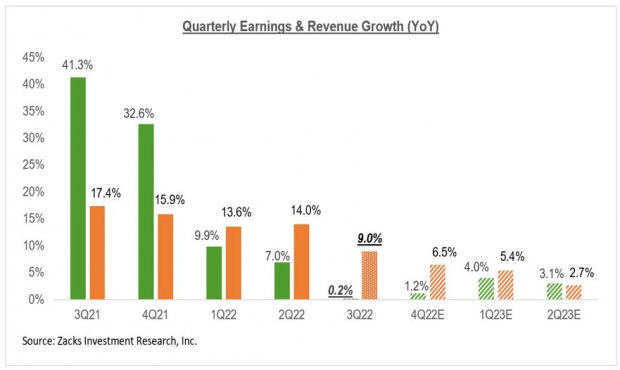

To get a sense of what is currently expected, take a look at the chart below that shows current earnings and revenue growth expectations for the S&P 500 index for 2022 Q3 and the following three quarters.

Image Source: Zacks Investment Research

As you can see here, 2022 Q3 earnings are expected to be up +0.2% on +9% higher revenues.

Don’t forget that it is the strong contribution from the Energy sector that is keeping the aggregate Q3 earnings growth in positive territory. Excluding the Energy sector, Q3 earnings for the rest of the S&P 500 index would be down -6.6% from the same period last year.

More By This Author:

Why Is The Market So Down On Big Bank Stocks?

What Will Q3 Earnings Season Tell Wall Street?

Previewing Q3 Earnings Season After Rough Reports From Nike And Micron

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more