What Will Q3 Earnings Season Tell Wall Street?

Image Source: Unsplash

We are off to a rough start for the early 2022 Q3 results that have been coming out. All of these early reports have been from companies reporting results for their fiscal quarters ending in August, which we count as part of our September-quarter tally.

We have seen such Q3 results from 17 S&P 500 members already. Our comment about the ‘rough start’ that these results show isn’t just about the disappointing results from the likes of FedEx (FDX - Free Report), Nike (NKE - Free Report), Carnival (CCL - Free Report), and others, but how so few of these companies have been able to beat estimates that had already come down. The proportion of these 17 index members beating EPS and revenue estimates is the lowest in the last 5 years.

It is premature to read too much into these early results. But it does appear that the market’s anxieties about corporate profitability may be coming to fruition this earnings season.

The flip side of this argument is that if results turn out to be less bad than what reports from FedEx, Carnival and others suggest, then the market will be relieved and we may see a replay of what we saw in the Q2 earnings season when results weren’t great, but they weren’t bad either.

That said, the strong U.S. dollar has joined the pre-existing headwinds of logistical challenges and inflationary pressures in weighing on corporate profitability. We will have to wait and see whether the Q3 reporting cycle will bring in the long-feared earnings downturn.

As we have been pointing out here, estimates have been coming down, with the overall revisions trend remaining negative even after accounting for the persistent favorable revisions trend enjoyed by the Energy sector.

You can see this in the revisions trend to Q3 estimates in the chart below.

Image Source: Zacks Investment Research

If we look at the evolution of Q3 earnings growth expectations on an ex-Energy basis, the expected growth rate has dropped from +2.1% on July 6th to -6.0% today.

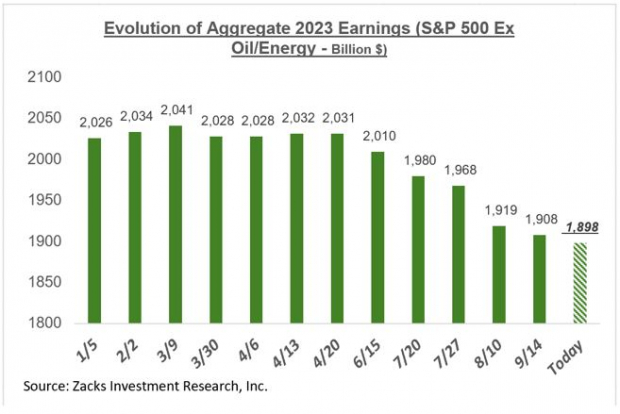

The chart below shows how the expected aggregate total earnings for full-year 2023 have evolved on an ex-Energy basis.

Image Source: Zacks Investment Research

As you can see above, aggregate S&P 500 earnings outside of the Energy sector have declined -6.6% since mid-April, with double-digit percentage declines in Retail (down -15%), Construction (-16.9%), Consumer Discretionary (-11.7%), and Tech (-11.5%). Estimates have been coming down in the Industrial Products, Medical and Finance sectors as well.

The Overall Earnings Picture

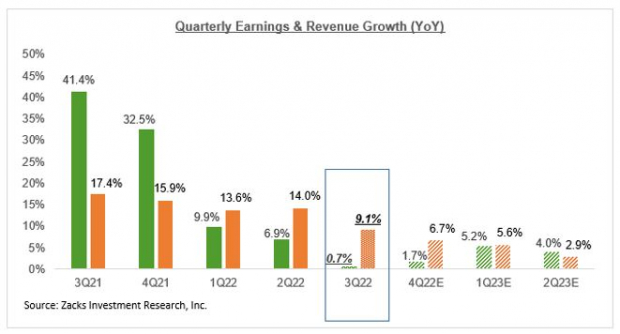

Beyond Q2, the growth picture is expected to modestly improve, as you can see in the chart below that provides a big-picture view of earnings on a quarterly basis.

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture on an annual basis, with the growth momentum expected to continue.

Image Source: Zacks Investment Research

Please note that a big part of this year’s growth is thanks to the strong momentum in the Energy sector whose earnings are on track to grow +138.4% this year. Excluding this extraordinary Energy sector contribution, earnings growth for the rest of the index would be up only +0.4%. This flat earnings picture for this year is also in-line with the economic ground reality.

Earnings next year are expected to be up +6.1% as a whole and +7.8% excluding the Energy sector. This magnitude of growth can hardly be called out-of-sync with a flat or even modestly down economic growth outlook. Don’t forget that headline GDP growth numbers are typically in real or inflation-adjusted terms while S&P 500 earnings discussed here are not.

As mentioned earlier, 2023 aggregate earnings estimates on an ex-Energy basis are already down -6.6% since mid-April. Perhaps we see a bit more downward adjustment to estimates over the coming weeks, after we have seen Q3 results. But we have nevertheless already covered some ground in taking estimates to a fair or appropriate level.

This is particularly so if whatever economic downturn lies ahead proves to be more of the garden variety rather than the last two such events. Recency bias forces us to use the last two economic downturns, which were among the nastiest economic downturns in recent history, as our reference points. But we need to be cautious against that natural tendency as the economy’s foundations at present remain unusually strong.

More By This Author:

Previewing Q3 Earnings Season After Rough Reports From Nike And Micron

Are Earnings Estimates Out Of Sync With The Economy?

Recession Fears And The Earnings Outlook

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more