The Canadian Stock Market Takes Leave Of The Economy

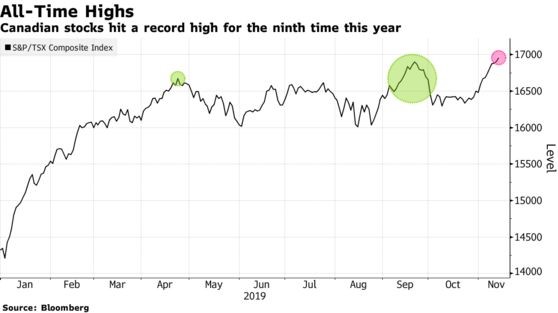

What does an investor do when the stock market ignores the economy? It seems that the Canadian investors pile into the stock market at considerable risk. The disconnect between the two is upon us once again, raising questions as to whether the stock market is reflecting reality or it is operating in its own universe ( Figure 1).

The outlook for the Canadian economy, according to the Bank of Canada, is for modest growth of 1.5% in 2020. Nothing to write home about, yet we read reports by analysts that Canada is unlike the rest of the world in that we have no reason to fear a recession. In fact, the Bank of Canada has held the line on any interest cut, despite recent cuts by the Federal Reserve and the European Central Bank. Yet, when we look under the hood of the Canadian economy, we are hard-pressed to find the source of this optimism.

(Click on image to enlarge)

Figure 1 Stock market Index

Starting in western Canada, the oil patch is experiencing one of its worst years since the 2014 oil price collapse. There are weekly reports of foreign-owned companies putting their Canadian oil and gas assets up for sale. Domestic producers are forced to merge or sell in an effort to stay in business. And, there are reports of significant layoffs as the industry contends with a world in which Canadian oil prices remain at a discount to WTI price levels. The Canadian forestry industry, situated primarily in British Columbia, is experiencing huge losses in international markets (decades-long dispute with the US) and falling prices. The agricultural sector has been hit by political disputes between China and Canada and a general worldwide weakness in many agricultural products.

So, what is holding up the Canadian economy? In the two largest metropolitan areas, Toronto and Vancouver, residential construction and re-sale homes dominate employment. Also, finance employment continues to have a firm base for further growth, as well in the high-tech sector in both cities. However, the October job report revealed large job losses in manufacturing, construction, and selective services. The Canadian job machine, so heavily touted, may have reached its peak. The question is whether the performance of the non-resource is sufficient to sustain the economic growth path projected by the Bank of Canada.

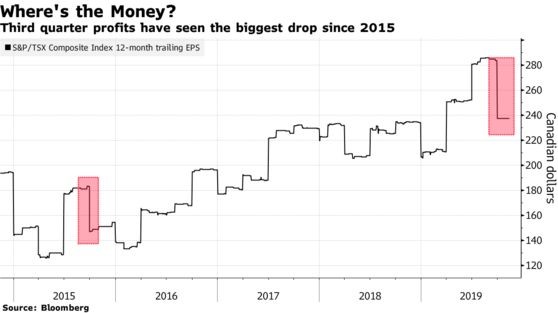

(Click on image to enlarge)

Figure 2 Canadian Profits

If the Canadian stock market is not responding to weakness in the overall economy, it seems it is also ignoring the drop off in profits (Figure 2). The picture in Canada is not too dissimilar from that in the US where the equity market seems to march to it own drummer, ignoring a broad-based slowdown and mediocre profits. As Keynes is reputed to have said, “markets can remain irrational longer than one can remain solvent”. For the time being, irrationality is the order of the day.

The stock market becomes the economy. That can't end well.

Good article. I was about to buy into Riocan to get onto the Toronto property market boom but now will not. That might be a boom with foundations on sand