The Bears Had Their Chance - But Here’s The Hidden Strength Keeping The Uptrend Alive

Image Source: Pixabay

Discover why this quiet breakout, shallow pullbacks, and hidden demand strength could keep the uptrend alive — and where the S&P 500 next target might be.

Watch the video from the WLGC session on 29 Jul 2025 to find out the following:

- What hidden signals in supply and demand suggest this uptrend is still sustainable?

- Where are the key support levels if the market faces another push down?

- Why didn’t the bears take control despite the rejection tails and low volume breakout?

- And a lot more…

Video Length: 00:02:48

Breakout Attempts and Supply

There was a recent breakout attempt, followed by a slight rejection, but crucially, there isn’t excessive supply hitting the market. This absence of heavy selling pressure is a positive sign for the bulls.

Demand Tail & Support

A “demand tail” appeared on Tuesday, indicating buyers stepping in. The supply level remains lower than in past downward moves or periods of supply absorption, further reinforcing a healthy market structure.

Volume & Consolidation

Despite a low-volume breakout, bears haven’t managed to drive prices lower. Instead, Wednesday saw a localized volume increase, pushing prices upwards in a steady, grinding fashion.

Price Targets & Support

The immediate upside target is the middle part of the current up channel, around 6,600.

On any downside attempts, 6,300 serves as an important support level, likely to prompt a bounce without breaking the uptrend structure.

Trend & Volatility

The ongoing upswing remains intact—both immediate and long-term trends are pointed upward.

Recent rally has been marked by smooth, low-volatility price action compared to previously sharper pullbacks, suggesting the strength of this move.

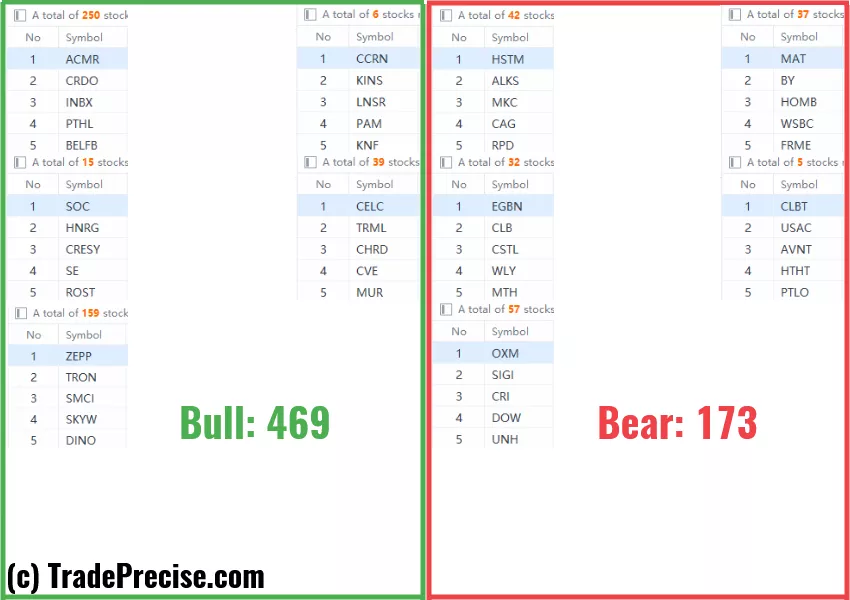

Market breadth and the number of bullish setups continue to reinforce the bullish thesis.

TLDR

The uptrend is sustainable, the dip-buyers are active, and barring any significant supply spikes, the S&P 500’s path of least resistance remains up.

Market Environment

The bullish vs. bearish setup is 469 to 173 from the screenshot of my stock screener below.

(Click on image to enlarge)

3 Stocks Ready To Soar

17 actionable setups such as VIK, DCO, BKE were discussed during the live session on 29 Jul 2025 before the market open (BMO).

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

More By This Author:

Could Demand Exhaustion Trigger A Sharp Pullback Into Seasonally Weak Months?

Forget The Golden Cross: These Overlooked Clues Could Signal The Market’s Next Big Move

This Zone Could Set The Stage For The Next Market Surge

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.