The 6 Segments Of The Semiconductor Value Chain Now Up 31% YTD

An Introduction

As explained by Jatin Khera (see here) the semiconductor industry plays a crucial role in driving technological advancements and innovations and is also a key enabler for the growth of other industries, such as automotive and healthcare and, as such, the semiconductor value chain is an essential aspect of the growing semiconductor industry. Therefore, understanding the semiconductor value chain and the companies involved in it is crucial for anyone interested in technology and its impact on the global economy and that is what this article does. Read on.

What Is the Semiconductor Value Chain?

The semiconductor value chain refers to the various stages involved in the production and distribution of semiconductor devices such as microprocessors, memory chips, and sensors which are used in a wide range of electronic devices, including smartphones, computers, and automobiles. The semiconductor value chain is a complex and dynamic process that involves multiple companies, each with their own specialized roles.

What Impact Will AI Have On the Semiconductor Value Chain?

AI is becoming an increasingly important tool along the whole value chain currently contributing $5B to $8B annually which only reflects about 10% of AI’s full potential within the industry. According to a report by McKinsey (see here), AI could potentially generate $35B to $40B in savings (i.e. value) annually within the next 2-3 years and rise to $85B to $95B beyond that timeframe which represents about 20% of the industry's current annual revenue. 28-32% of the reduction in spending will occur in research and design, 13-17% in cost of goods sold, (including depreciation), and 10-14% in SG&A spending (source, page 28). While 51-63% of this value will inevitably be passed on to customers, the competitive advantage of capturing it, particularly for early movers, will be impossible to ignore and this article should provide any potential investor with insights as to where the greatest investment opportunities are.

This article identifies 6 links (i.e. segments) in the value chain, explains their areas of focus and the major publicly traded and pure-play* companies in each and their stock performances last week, in descending order, and YTD.

- Fabless: up 14.7% last week; up 45.3% YTD

- Area of Focus: Fabless (fabrication-less) manufacturers design and sell hardware devices and semiconductor chips while outsourcing their fabrication (or fab) to a specialized manufacturer

- Broadcom (AVGO): up 23.3% last week; up 55.4% YTD

- Marvell (MRVL): up 11.7% last week; up 21.5% YTD

- Qualcomm (QCOM): up 4.2% last week; up 48.9% YTD

- Nvidia (NVDA): up 3.0% last week; up 166.3% YTD

- Monolithic Power (MPWR): up 1.3% last week; up 21.9% YTD

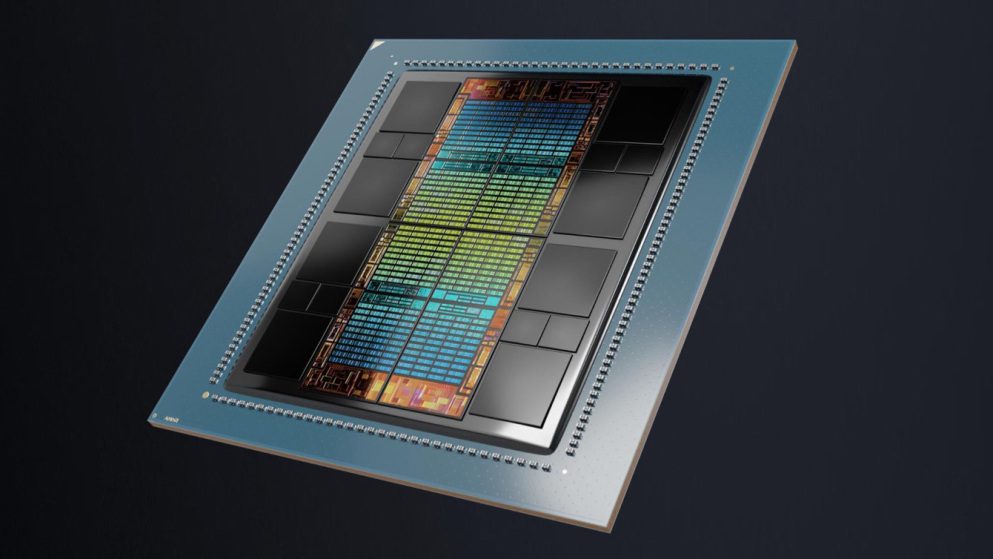

- Advanced Micro (AMD): down 4.3% last week; up 8.3% YTD

- Area of Focus: Fabless (fabrication-less) manufacturers design and sell hardware devices and semiconductor chips while outsourcing their fabrication (or fab) to a specialized manufacturer

- High Bandwidth Memory: up 6.6% last week; up 59.4% YTD

- Electronic Design Automation: up 5.4%; up 22.4% YTD

- Foundries: up 4.7% last week; up 33.5% YTD

- Area of Focus: A semiconductor foundry, also known as a fab, does not create its own integrated circuit products but, instead, specializes in manufacture chips based on designs provided by other semiconductor companies.

- Equip/Material Suppliers: up 4.7% last week; up 35.6% YTD

- Areas of Focus: Semiconductor suppliers provide essential equipment for manufacturing semiconductors such as lithography machines, etching, test and packaging equipment, automation and inspection systems and production materials such as chemicals, gases, wafers and packaging.

- Integrated Device Mfgrs: down 0.9% last week; up 9.9% YTD

- Areas of Focus: *IDMs are not pure-play providers as they design, manufacture in house, and sell integrated circuit products as opposed to just one aspect of the semiconductor industry

- Renesas Technology (RNECF): up 0.3% last week; up 10.2% YTD

- NXP Semiconductors (NXPI): down 0.1% last week; up 11.1% YTD

- Analog Devices (ADI): down 0,2% last week; up 18.2% YTD

- Intel (INTC): down 0.3% last week; down 33.4% YTD

- Infineon Technologies (IFNNY): down 0.5% last week; down 0.7% YTD

- Texas Instruments (TXN): down 0.8% last week; up 13.2% YTD

- Microchip Technology (MCHP): down 1.6% last week; up 1.2% YTD

- Areas of Focus: *IDMs are not pure-play providers as they design, manufacture in house, and sell integrated circuit products as opposed to just one aspect of the semiconductor industry

In summary, the above 6 segments of the semiconductor value chain were up 5.0, on average, in the week ending June 14th and are now up 31.3% YTD.

More By This Author:

Pure-Play Cybersecurity Software Stocks Portfolio Up 5% W/e June 14th

Pure-Play Custom Design Software Stocks Were Up +5%, On Average, W/e June 14th

What Are Stock Splits? What AI-Focused Companies Are Planning To Do Soon?

Disclosure: None

This article has been composed with the exclusive application of the human intelligence (HI) of the author. No artificial intelligence (AI) technology has been deployed. ...

more