Pure-Play Cybersecurity Software Stocks Portfolio Up 5% W/e June 14th

Image Source: Pixabay

An Introduction

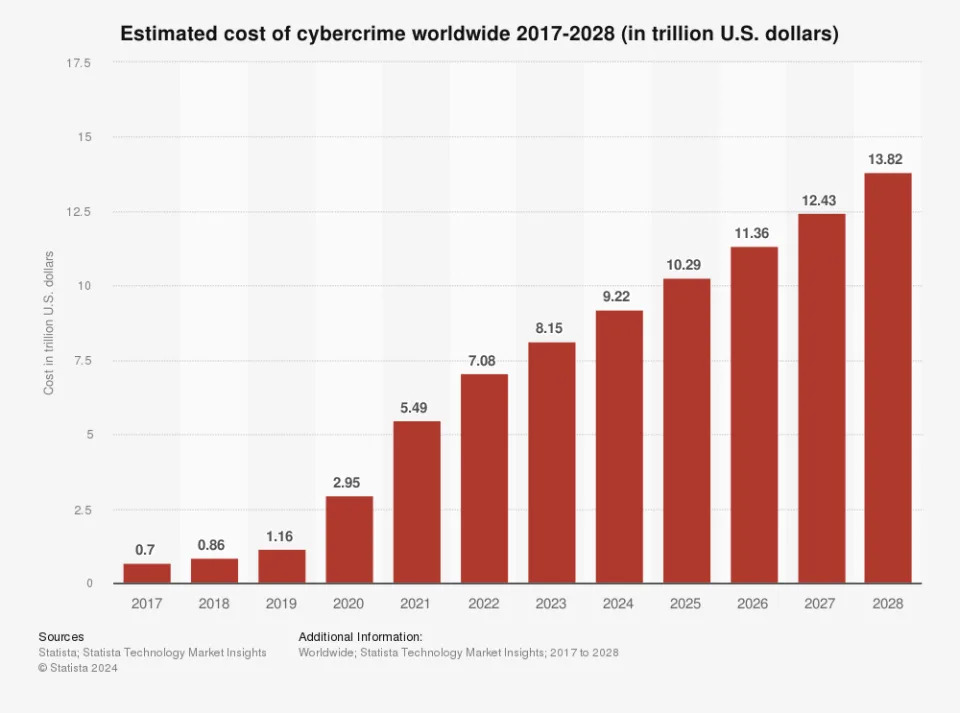

The damage inflicted by cybercrime resulted in $8.15 trillion in global costs in 2023 and could reach as high as $10.29 trillion by 2025 (see report here) and, as such, it goes without saying that sophisticated cybersecurity to protect networks, systems and other digital infrastructure from malicious attacks is more crucial than ever.

(Click on image to enlarge)

Image source: Statista

As shown in the graph above, the money a company spends recovering from cyberattacks is, indeed, costly but it also adversely affects the reputation cost to companies when customers lose their trust in a company to keep their information secure. As such, it has virtually become mandatory for any company with digital operations to pay a relatively modest fee upfront to avoid a possible much costlier future expense down the road and, as a result, corporate spending on cybersecurity is forecast to grow at a CAGR of 13.8% between now and 2030 (source).

What Are Pure-Play Companies?

Pure-play companies concentrates all their efforts on a single line of business, and in this context, it’s cyber security software. Of the 63 cybersecurity companies in the sector (see here) only 7 are publicly traded pure-play companies, and they are included in our new Pure-Play CyberSecurity Software Stocks Portfolio which replaces the munKNEE Cyber Security Stocks Portfolio which contained some non-pure play constituents.

The Pure-Play CyberSecurity Software Stocks Portfolio

Below are:

- how the constituents performed last week, in descending order,

- their performances YTD,

- their market capitalizations, and

- the most recent news, analyses and commentary on some of them.

- CrowdStrike Holdings (CRWD): UP 10.4% last week; UP 51.0% YTD

- Market Capitalization: $95B

- Most Recent News, Analyses, and Commentary:

- Palo Alto Networks (PANW): UP 5.1% last week; UP 8.3% YTD

- Market Capitalization: $103B

- Most Recent News, Analyses, and Commentary:

- Fortinet (FTNT): UP 1.8% last week; DOWN 3.8% YTD

- Market Capitalization: $45B

- Most Recent News, Analyses, and Commentary:

- Zscaler (ZS): UP 1.8% last week; DOWN 16.9% YTD

- Market Capitalization: $27B

- Most Recent News, Analyses, and Commentary:

- Tenable Holdings (TENB): UP 0.1% last week; DOWN 12.9% YTD

- Market Capitalization: $5B

- Most Recent News, Analyses, and Commentary:

- None

- Check Point Software (CHKP): UP 0.1% last week; UP 2.4% YTD

- Market Capitalization: $18B

- Most Recent News, Analyses, and Commentary:

- None

- Gen Digital (GEN): DOWN 1.3% last week; UP 6.9% YTD

- Market Capitalization: $15B

- Most Recent News, Analyses, and Commentary:

Conclusion

On average the above 7 pure-play cybersecurity software stocks were UP 5 0% last week and are now UP 14.4% YTD.

Cybersecurity ETF

Investing in a basket of cyber security stocks is a quick and easy way to get investment portfolio exposure to this critical segment of the tech sector. The Global X Cybersecurity ETF (BUG), for example, consists of 31 stocks and has an expense ratio of 0.51%.

More By This Author:

Pure-Play Custom Design Software Stocks Were Up +5%, On Average, W/e June 14th

What Are Stock Splits? What AI-Focused Companies Are Planning To Do Soon?

Pure Play Quantum Computing Portfolio Down 2% W/e June 14th

Disclosure: None

This article has been composed with the exclusive application of the human intelligence (HI) of the author. No artificial intelligence (AI) technology has been deployed. ...

more