Tesla Pumps And Dumps After Earnings Beat; Sells 75% Of All Bitcoins

As previewed earlier, analysts are expecting Tesla to announce revenue of $16.88billion, with consensus calling for earnings per share of $2.91. Automotive gross profit margin is expected to be about 26.9% and regulatory credit sales are expected to be about $312 million. Operating profit is estimated to be $2.6 billion. Here is a convenient summary of what to expect:

- Adjusted EPS: $1.83

- Revenue: $16.88 billion

- Automotive gross margin: +26.9%

- Gross margin: +24.3%

- Capex: $1.61 billion

- Free Cash Flow: $573.2 million

- Cash and cash equivalents: $18.92 billion

- Customer deposits: $1.07 billion

Additionally, analysts will be looking for more information on the countless scandals surrounding Elon Musk, which include but are not limited to:

- Musk's $40+ billion Twitter purchase in the midst of being litigated in a Delaware Chancery Court, the results of which may have an impact on Musk's holdings in Tesla

- Tesla's two new factories coming online despite the company laying off workers from its San Mateo office and cuts of as much as 3.5% of its global workforce this past quarter

- Tesla's head of AI and Autopilot resigning from the company just days ago

- A broad, ongoing NHTSA investigation into Tesla's Autopilot and Full Self Driving features

- Elon Musk's 76-year-old father running around claiming he's been put on Earth to inseminate as many "high class" women as possible

Oh, and of course, the earnings themselves.

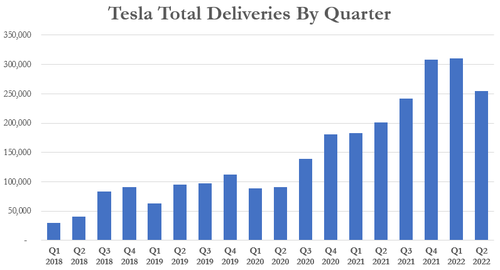

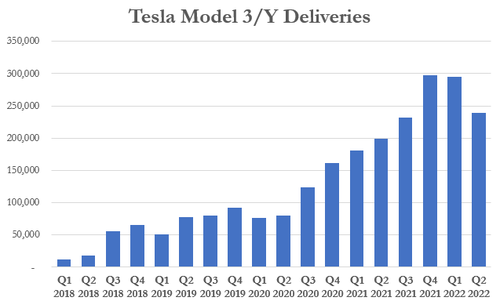

We already know actual the deliveries: recall, for Q2 2022 the company delivered just 254,695, missed expectations amid widespread concern about the company's business in China, which has been hampered by Covid lockdowns and supply chain issues. The company said that "in the second quarter, we produced over 258,000 vehicles and delivered over 254,000 vehicles, despite ongoing supply chain challenges and factory shutdowns beyond our control."

Despite this, the company's June month was the highest vehicle production month in Tesla’s history, according to Bloomberg. The company's deliveries represent a 26.7% gain in deliveries from last year and a drop from last quarter's record of 310,048.The drop marked the lowest delivery quarter since Q3 2021 for Model 3/Y vehicles.

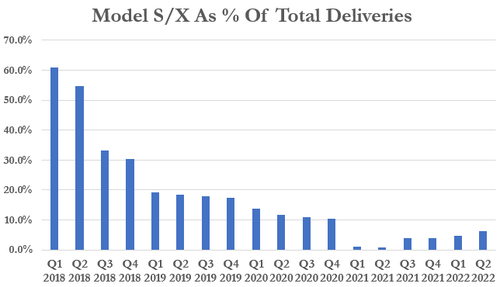

The company was originally expected to deliver 295,000 vehicles, but analysts had reduced their estimates to around 256,000 prior to the numbers coming out. Tesla delivered 238,533 Model 3 and Model Ys for the quarter, and 16,162 Model S and Model X vehicles. As you can see, the company's phase-out of the Model S and Model X looks to have continued, despite a slight uptick:

So yes, it should be an interesting quarter for Tesla, as this was the first time in two years that the company delivered fewer vehicles than in the prior quarter. There are obvious reasons for that dip -- supply-chain headaches and lockdowns in China -- but it will be very curious to see how much it all eats into Tesla’s gross margins and its overall profit. Wall Street expects the former to dip to about 24% (and Bloomberg Intelligence concurs), or about 500bps lower than Q1. The Bloomberg Consensus for adjusted EPS is at $1.83 per share.

And speaking of China, Bloomberg notes that another reason it’s so important for Tesla in the near term is that it is taking the company a little longer (and a lot of money) to get its new factories outside Austin, Texas, and Berlin up and running. CEO Elon Musk called the plants "gigantic money furnaces" in May, and said they were each losing billions of dollars for the company. Musk explained that, in Texas, this has to do in part with Tesla’s new battery cells not being ready for prime time. Instead of being able to make lots of Model Ys with the new 4680 cells, Tesla has instead had to hedge and build a bunch that are powered by the older 2170 cells.

Indeed, resolving production ramp-up problems in Austin and Berlin will also be a crucial factor in whether or not Tesla can still hit its goal of 50% year-over-year growth in vehicle deliveries.

Then there are the cost issues: raw material costs, especially battery materials and their impact on EV prices, will likely impact TSLA earnings sooner or later. Last quarter, Musk said lithium was the “single biggest cost growth” item for Tesla, and a limiting factor for EV production. He’s also pivoted to different battery chemistries to offset the cost of nickel. While Tesla has been a pioneer in cutting direct deals with miners to ensure it has enough raw materials, that doesn’t mean it’s immune. Could a battery-materials shortage affect production -- especially if Tesla is having trouble getting its more energy-dense 4680 batteries off the ground in Austin? Are there any new deals that could help ease its procurement woes?

Last but not least, Q2 was hellish for Tesla’s share price, which lagged significantly behind the broader market, especially as technology and riskier growth stocks bore the brunt of a wider market selloff, with investors choosing to take shelter in safer assets amid worries about the impact of an economic recession. To make matters worse, Tesla’s own troubles -- ranging from supply-chain snafus, climbing raw-material costs and Musk’s pursuit of social-media company Twitter Inc. -- have further weighed on the shares.

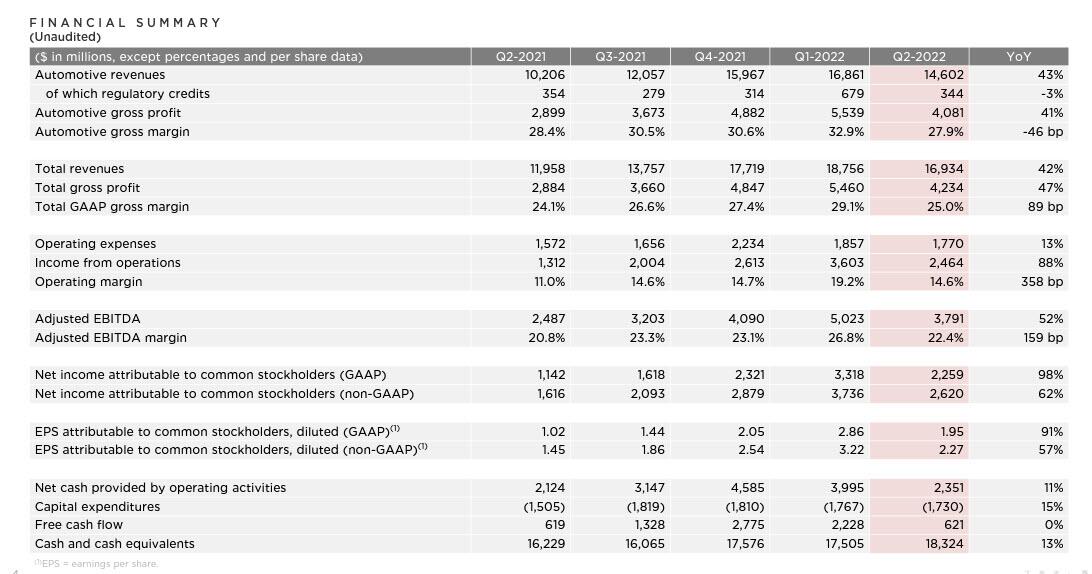

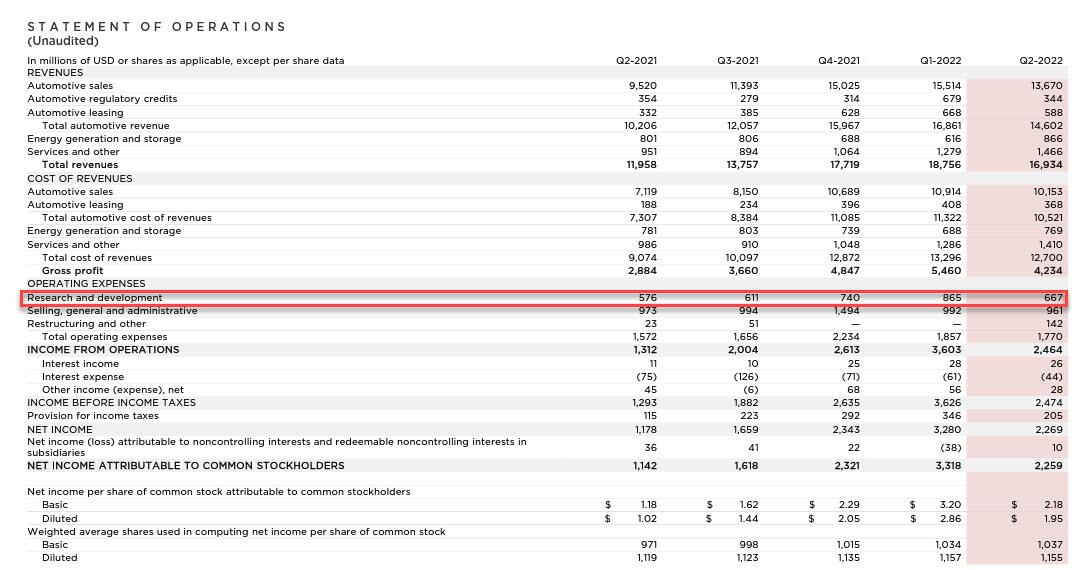

So with all that in mind, here are the numbers that Tesla just reported for Q2 moments ago (pdf link):

- Revenue $16.93BN, +42% Y/Y, modestly beating Est. of $16.88BN

- Adj EPS $2.27, beating Est. $1.83 up 57% Y/Y(GAAP EPS $1.95, up 91%)

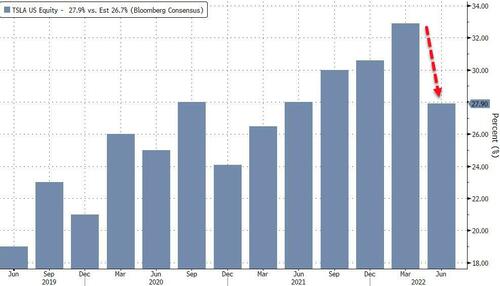

- Automotive Gross Margin27.9%, beating Est. 26.9%

- Gross Margin 25.0% beating Est. 24.3%, but sliding drop 33% in Q1.

- Adjusted EBITDA $3.791BN, up 52% Y/Y

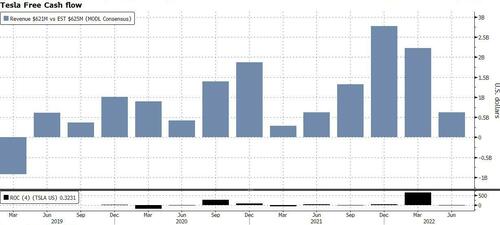

- Free cash flow $621 million, unch Y/Y, missing estimate of $625.2 million

- Cash and cash equivalents $18.32 billion, +13% y/y, missing the estimate of $18.92 billion

- CapEx was $1.73 billion, more than the exp. of $1.66BN: quarterly capex first broke $1 billion in the third quarter of 2020, and it’s been trending higher ever since as Musk launched construction of two new assembly plants in Austin and Berlin.

- Tesla still sees 50% avg annual growth in vehicle deliveries

(Click on image to enlarge)

While the margin beat expectations, the trend is hardly Elon's friend, especially if input costs continue to rise:

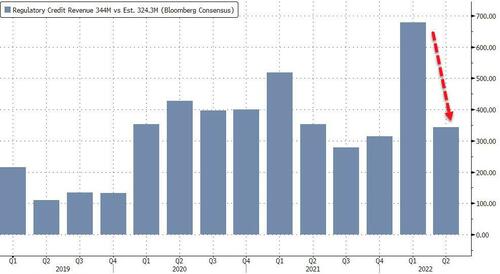

The company revealed that revenue from regulatory credits slumped dramatically to just $344, down 3% Y/Y, and down almost 50% from the $679 last quarter!

While margin compression was to be expected, it is, as Bloomberg writes, a big win for Tesla to be able to keep its profit and margins up during a down quarter: "The company sounds confident that it will have a strong second half, though it is making sure to warn that there are challenges ahead in Austin and Berlin with respect to ramping up vehicle production there. Which, of course, seems to mean the “gigantic money furnaces” are not going to stop burning any time soon."

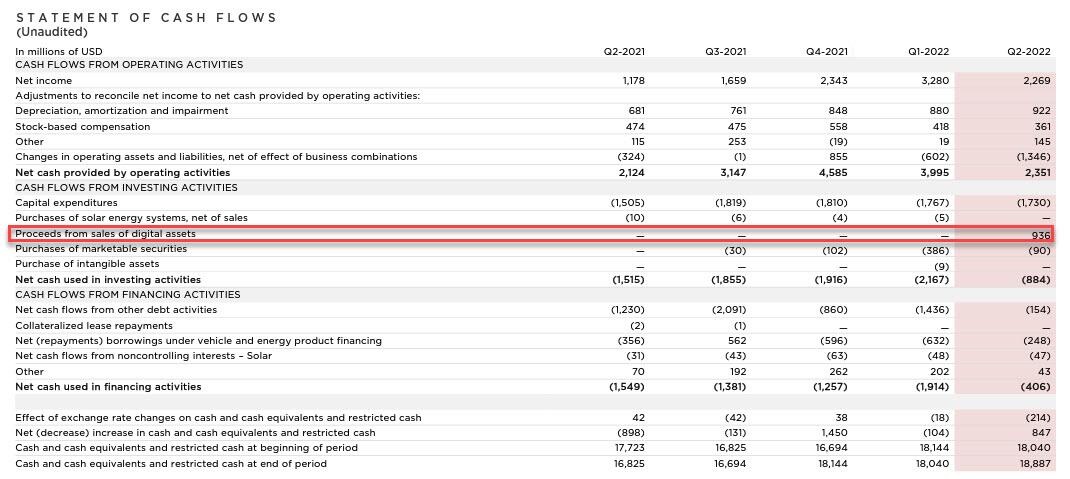

Perhaps even more importantly, Tesla revealed that it had converted 75% of its previously purchased bitcoin into fiat: "As of the end of Q2, we have converted approximately 75% of our Bitcoin purchases into fiat currency. Conversions in Q2 added $936M of cash to our balance sheet."

So while TSLA was desperately gathering cash ($1.3 billion between reg credit and bitcoin sales), it was not investing in growth: in Q2 R&D spending was down $198MM or 23%. Hardly what a growth company wants to show:

(Click on image to enlarge)

Remarkably this means that without the sale of bitcoin, Tesla's free cash flow of $621 million would have been negative for Q2!

(Click on image to enlarge)

Said otherwise, that last bar in the FCF chart would have been red without the bitcoin sale.

Commenting on output, the company said that In Q2, it achieved "record production rates across the company. However, we saw a continuation of manufacturing challenges related to shutdowns, global supply chain disruptions, labor shortages, and logistics and other complications, which limited our ability to consistently run our factories at full capacity."

Tesla also said it continued to experience import delays for solar components. But it says it’s expanded its supplier base.

Some comments on the company's California and Texas factories:

Our Fremont Factory made a record number of vehicles in Q2.We see opportunities for further production rate improvements. In Texas, we have added flexibility to produce vehicles with either a structural battery pack or legacy battery pack. The next generation of 4680 battery cell machinery has been installed in Texas and is in the process of commissioning. Factory output in Texas continues to grow.

... Shanghai:

While the Shanghai factory was shut down fully and then partially for the majority of Q2, we ended the quarter with a record monthly production level. Recent equipment upgrades will enable us to continue to increase our production rate further.

... and Berlin:

Thanks to strong production rate improvement towards the end of Q2, our team in Germany produced more than 1,000 Model Y vehicles in a single week, using 2170 cells. We expect the production rate to continue improving through the rest of the year.

In other words, according to Tesla, the pace of production ramps at Austin and Berlin factories “will be influenced by the successful introduction of many new product and manufacturing technologies in new locations and ongoing supply chain related challenges.” Which, as Bloomberg notes, at the very least, that sounds like they are still working through how to ramp up Model Y production with 4680 cells in Austin.

Of course, as noted in the preview, It’s all about the second half of the year, and this is what Tesla had to say:

“With each of the Fremont and Shanghai factories achieving their highest-ever production months and new factory growth, we are focused on a record-breaking second half of 2022.”

That would be quite a feat if the US slides into what Musk called an "inevitable" recession.

In any event, Tesla also continues to see a 50% average annual growth in vehicle deliveries, easing investor concerns of a slowdown in production:

“We plan to grow our manufacturing capacity as quickly as possible,” the company said in its release. “Over a multi-year horizon, we expect to achieve 50% average annual growth in vehicle deliveries. The rate of growth will depend on our equipment capacity, factory uptime, operational efficiency and the capacity and stability of the supply chain.”

Moving on, Tesla also said it’s ramping production at its dedicated Megapack factory to address growing battery-storage demand.

Also worth a quick note, we had the first Cybertruck spotting in a long time. The company was kind enough to mention that it is working on it. Of course, the pressure is on with Rivian, Ford, and GM bringing out their electric trucks sooner.

“We are making progress on the industrialization of Cybertruck, which is currently planned for Austin production subsequent to Model Y ramp.”

Elsewhere, there wasn't a single mention of Tesla’s sleek solar roof. Musk, of course, used the roof product as rationale to buy struggling rooftop installer SolarCity. The roof has been difficult to manufacture and challenging to install. Energy-storage deployments for Tesla decreased by 11% year-over-year. The reason: semiconductor challenges “which are having a greater impact on our energy business than our automotive business.”

* * *

Summarizing the Tesla letter, Bloomberg's Gabrielle Coppola is skeptical. She writes that "this investor letter feels full of uncertainty to me. Tesla says it’s ramping up well in Berlin, Austin, and Shanghai, and June production was a record, but their guide for the year is pretty squishy. The market was looking to see if Tesla will stick to its 50% sales growth forecast this year."

They are saying maybe we’ll make it, and if you average it out over time it’ll be 50%: “Over a multi-year horizon, we expect to achieve 50% average annual growth in vehicle deliveries. The rate of growth will depend on our equipment capacity, factory uptime, operational efficiency, and the capacity and stability of the supply chain.”

Others, such as TSLA cheerleader Gene Munster remained cheerful:

“The bottom line is it wasn’t pretty, but it was a lot better than what a lot of investors were expecting. They are doing a good job navigating a difficult environment. They are maintaining their 50% growth rate, which is a bit of a surprise. I thought they might back off from that.”

That squishiness has moved to the broader market, and while the stock spiked as much as 5% initially in response to the solid beats, TSLA has since faded all the gains and is now red after hours.

(Click on image to enlarge)

Despite the wobble in the postmarket rally, Bloomberg reminds us that if the stock manages to just stay positive in regular trading today that would mean seven straight sessions of gains for the shares. The last time the company had such a long winning streak was back in March.

The company's Q2 shareholder deck can be found here.

More By This Author:

China Spent 72% More On Russian Oil In June As Moscow Remains Top Chinese Supplier; Saudi Volumes Tumble

Euro Surges On Report ECB Looking "Closely" At 50bps Rate Hike As Lagarde Rushes To Complete "Italian Bond Purchase" Mechanism

US Homebuilders Abandon Single-Families In June As They Brace For Rate Shock

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more