China Spent 72% More On Russian Oil In June As Moscow Remains Top Chinese Supplier; Saudi Volumes Tumble

Remember when sanctions on Russia were meant to cripple the country's economy and destroy the ruble, and then all the deep state plans imploded spectacularly as the Russian current account surplus soared to a record, and the ruble hit decade highs? Well, thank China for all that (which the Biden regime will never stand up against as Beijing possesses all that compromising Hunter/Joe information).

According to the latest Chinese customs data, Russia held the top spot as China's biggest oil supplier for a second month in June as Chinese buyers (alongside India) cashed in on Moscow's deeply discounted supplies, slashing more costly shipments from Saudi Arabia, which instead target the energy hyperinflation-ravaged wasteland that is Europe.

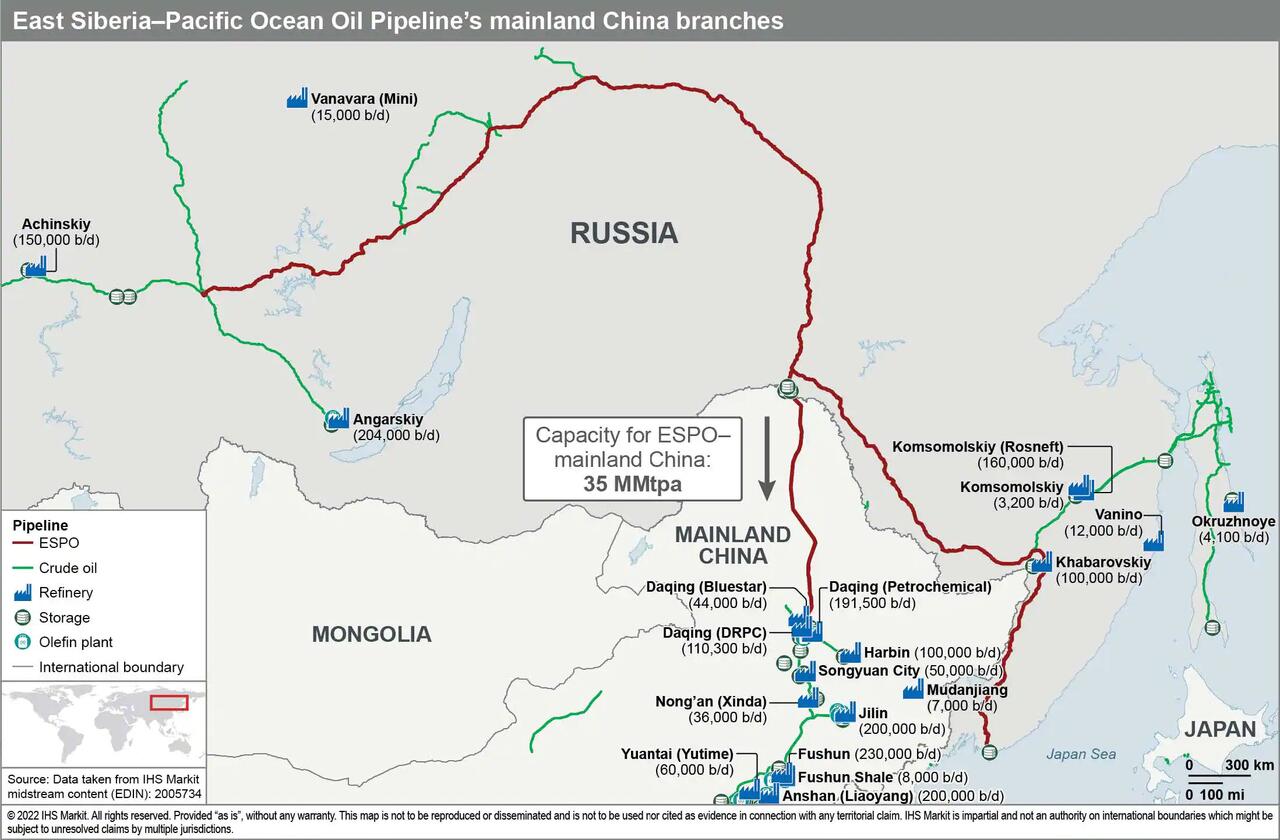

Imports of Russian oil, including supplies pumped via the East Siberia Pacific Ocean (ESPO) pipeline and seaborne shipments from Russia's European and Far Eastern ports, totaled 7.29 million tonnes, up nearly 10% from a year ago, according to data from the Chinese General Administration of Customs.

(Click on image to enlarge)

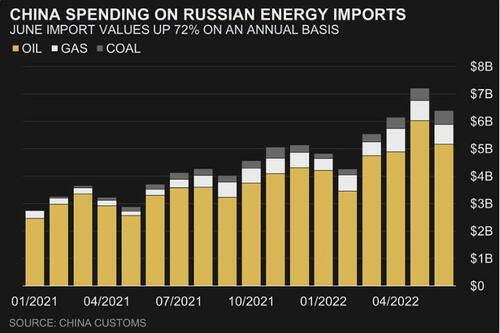

Despite the pervasive discounts slapped on Russian oil, this translated into much higher dollar terms too: China spent 72% more on Russian energy purchases in June from a year earlier, according to Bloomberg. Chinese buyers spent a combined $6.4 billion, up from $3.7 billion in the same month the previous year, according to customs data released today.

It brings China’s total outlay on Russian energy from March to June to $25.3 billion, nearly double the $13.5 billion spent in the same four months of 2021!

Still, as Reuters calculates, Russian supplies in June, equivalent to about 1.77 million barrels per day (bpd), were below May's record of close to 2 million bpd, a level analysts had expected to be maintained, likely as a result of continued covid zero shutdowns across China which limited demand.

Russia's gain is Saudi Arabia's loss: China imported 5.06 million tonnes from Saudi Arabia, or 1.23 million bpd, down from 1.84 million bpd in May and 30% below the level in June last year.

On a year-to-date basis, Chinese imports from Russia totaled 41.3 million tonnes (1.67 million bpd), up 4% on the year but still trailing behind Saudi Arabia, which supplied 43.3 million tonnes (1.75 million bpd), a volume 1% below year-ago level.

China's total crude oil imports sank in June to near a four-year low as rigid lockdowns to contain the spread of coronavirus reduced fuel demand. The rise in imports from Russia also displaced supplies from Angola and Brazil.

Notably, the Customs data showed China imported 260,000 tonnes of Iranian crude oil last month, its fourth official shipment of Iran oil since last December. Despite U.S. sanctions on Iran, China has kept taking Iranian oil, usually passed off as supplies from other countries. These supplies, roughly 7% of China's total crude oil imports, are facing competition from the growing Russian flows

On the other hand, customs reported zero imports from Venezuela. State oil firms have shunned purchases since late 2019 for fear of falling foul of secondary U.S. sanctions, although that doesn't explain their eagerness to indicate Iranian imports.

And indeed, hinting that there's more than meets the eye, imports from Malaysia, often used as a transfer point in the past two years for oil originating from Iran and Venezuela, soared 126% year-on-year to 2.65 million tonnes.

Separately, data also showed China's imports of Russian liquefied natural gas (LNG) totaled 520,530 tonnes, the second highest monthly volume since at least the start of 2021. Russian LNG imports for the first half of 2022 - mostly from the Sakhalin-2 project in the Far East and Yamal LNG in Russian Arctic - were up almost 30% on the year to 2.36 million tonnes, the data showed. This is against a 21% year-on-year fall in the nation's total LNG imports during the same period.

More By This Author:

Euro Surges On Report ECB Looking "Closely" At 50bps Rate Hike As Lagarde Rushes To Complete "Italian Bond Purchase" Mechanism

US Homebuilders Abandon Single-Families In June As They Brace For Rate Shock

China Has Dumped Over $100 Billion Of U.S. Treasuries In The Last 6 Months

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more