US Homebuilders Abandon Single-Families In June As They Brace For Rate Shock

With homebuilder sentiment collapsing at its fastest rate on record in July (ex-COVID lockdowns), one could be forgiven for thinking these same homebuilders would have been slowing building starts and permit applications in June, but analysts expected improvement in June from May's ugliness.

Both Starts and Permits dropped in June (-2.0% MoM and -0.6% MoM respectively), with starts below expectations (+2.0% exp but May revised up to -11.9% from -14.4%)) and permits above expectations (-2.7% exp)...

(Click on image to enlarge)

Source: Bloomberg

This is the third straight monthly decline in Permits (forward-looking).

Having surged up to the highest levels since 2006, Housing Starts and Permits (SAAR) have plunged as mortgage rates surged and affordability collapses. Starts and Permits SAAR are at their lowest since Oct 2021...

(Click on image to enlarge)

Source: Bloomberg

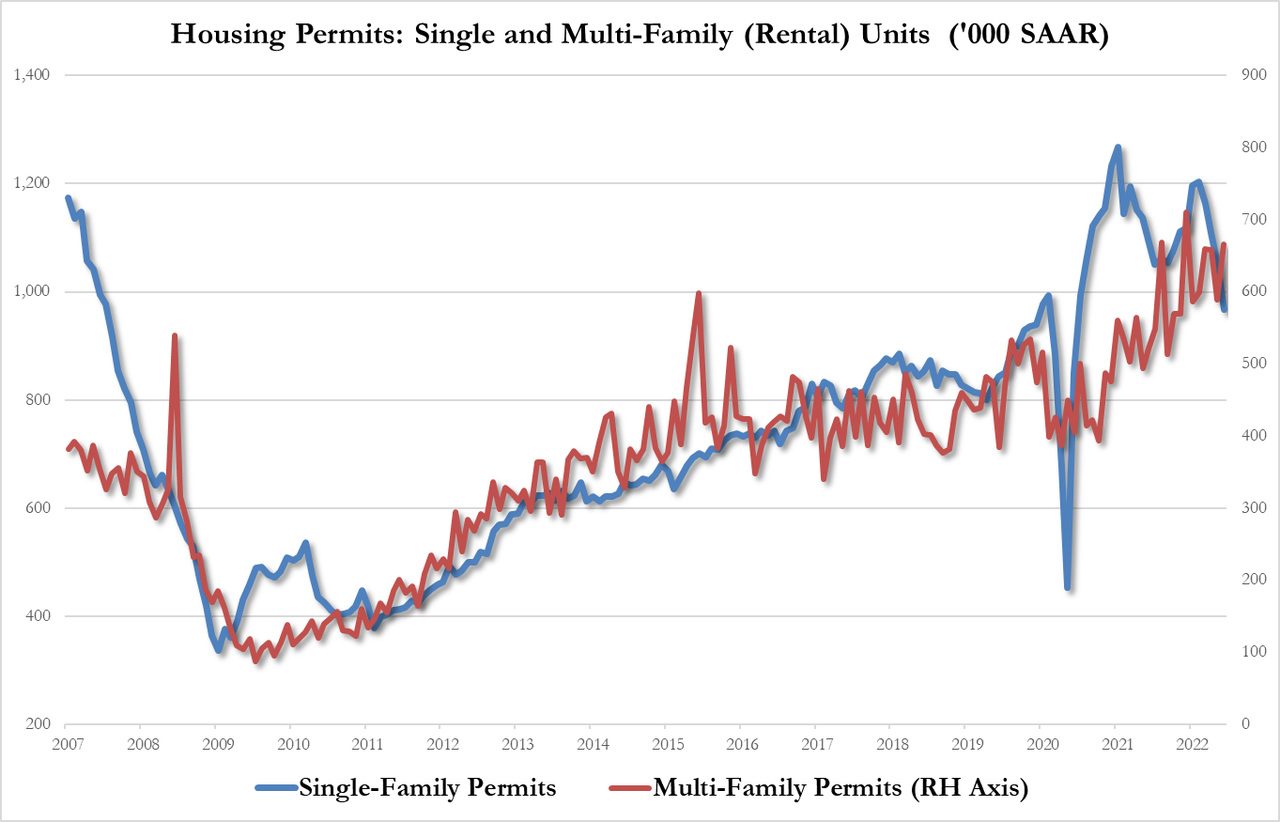

But the headline print hides the real details - homebuilders are shifting their attention completely away from single-family construction and focusing on renter-nation.

The headline permits print was seen by 'renter nation' demands as single-family housing permits dropped -8.0% SAAR to just 967K, the lowest since June 2020, but Multi-fam permits jumped 13.1%, to 666K SAAR, the highest since December 2021

(Click on image to enlarge)

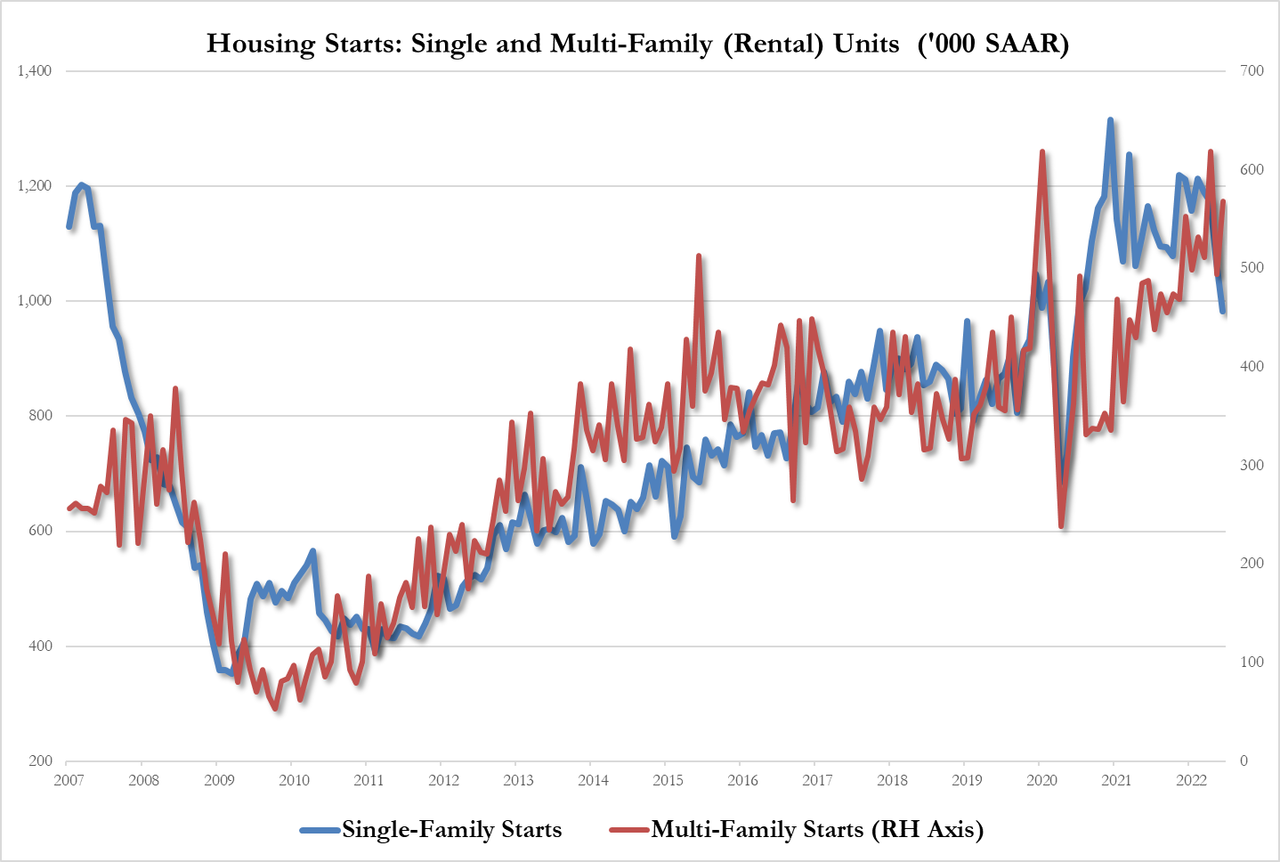

The same pattern was seen in starts.

Single Family starts to tumble 8.1% to 982K SAAR, lowest since June 2020, but, like permits, Multi-Family starts to jump 15.0% to 568K, highest since April

(Click on image to enlarge)

Finally, judging by the homebuilder sentiment (for July), permits are set to fall considerably further...

(Click on image to enlarge)

Source: Bloomberg

And that means fewer single-family housing starts... and worsening inventory issues (so demand is plunging, but supply is plunging even faster)...

(Click on image to enlarge)

Presumably - as homebuilder sentiment signaled - the builders are abandoning single-family buyers in anticipation of the impact of soaring rates on buying demand, and instead focusing on 'renter nation', and the end of The American Dream.

That's quite a box you have got yourself into Mr.Powell.

More By This Author:

China Has Dumped Over $100 Billion Of U.S. Treasuries In The Last 6 MonthsApple Plunge Drags Down Market After Reports Of Hiring And Spending Slowdown

Key Events This Week: Is Europe About To Snap

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more