Tech Shares Rally On Amazon, OpenAI, But Participation Is Narrow

Image source: Pixabay

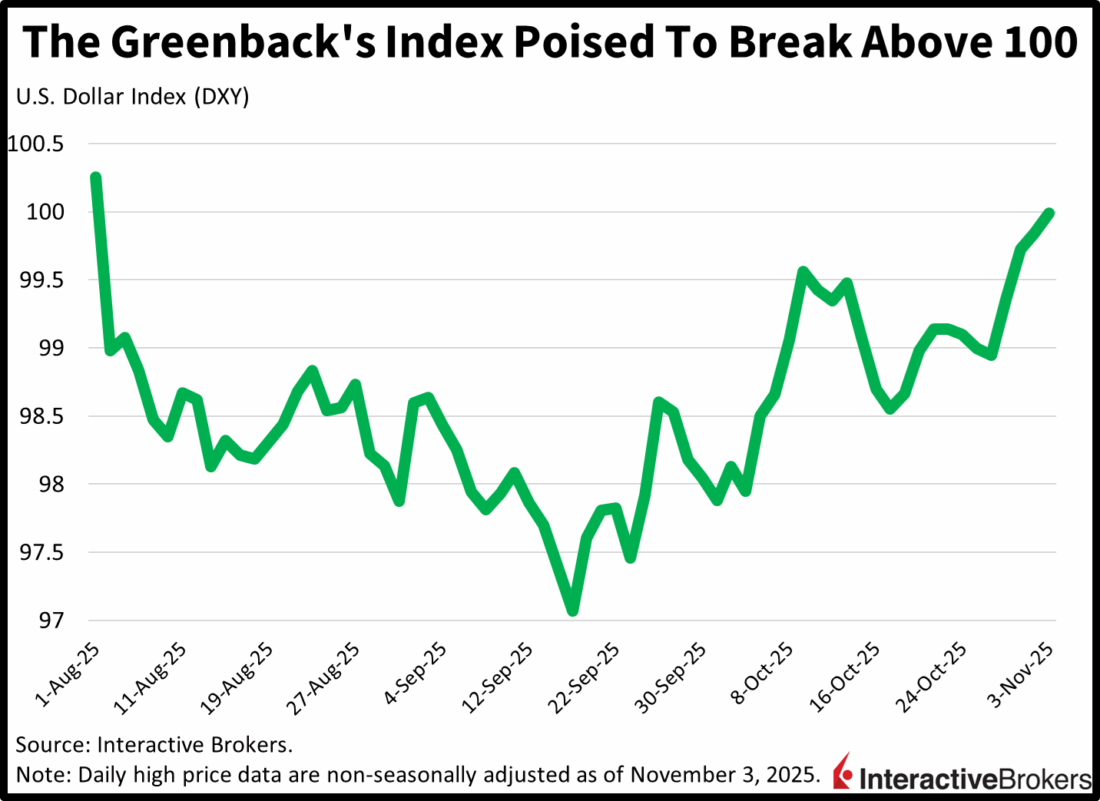

Tech shares are advancing following news that OpenAI will pay Amazon AMZN $38 billion to tap the company’s cloud services, which is bolstering enthusiasm that additional blockbuster deals are likely. Equity gains, however, are narrow with only 2 of the 11 major sectors climbing while the other nine decline. Emblematic of the bifurcation are the more cyclical Dow Jones Industrial and Russell 2000 indices suffering losses while the S&P 500 and Nasdaq 100 gain. Intraday data certainly didn’t broaden participation, as ISM’s manufacturing PMI missed estimates, with demand, employment and production all weakening and driving the eighth consecutive month of contraction. Treasurys are sinking, too, as last week’s hawkish Fed meeting continues to have fixed-income watchers dialing down the probability of a December rate cut and incrementally decreasing the number of reductions expected in 2026. Yields are ascending in relative uniformity across the curve, but duration is leading the bear-steepening rise, albeit modestly. The recent reversal toward increasingly restrictive monetary policy expectations amidst a growing economy has the greenback rallying, and it almost exceeded its physiologically important level of 100 on its DXY benchmark earlier this morning. Meanwhile, volatility protection instruments are catching strong bids as participants brace for the potential for corporate earnings turbulence while seeking to protect annual performance close to year-end. Forecast contracts are additionally seeing interest especially as they relate to tomorrow’s elections. Conversely, bitcoin and the commodity complex ex-energy are getting hit, as tighter financial conditions and heavier US tender weigh on speculative appetites and global economic activity projections.

US Manufacturing Remains in Contraction

The Institute for Supply Management’s (ISM) Purchasing Managers’ Index for Manufacturing signaled that elevated prices, restrictive interest rates and tariff uncertainty are creating challenges for sales. The headline October score of 48.7 missed the 49.5 median estimate and slipped from September’s 49.1 while remaining below the contraction-expansion threshold of 50. Weak transaction activity hurt production, employment and backlogs as firms reduced outputs and headcounts while relying on older orders to keep busy in a sluggish environment. Nevertheless, customer charges increased despite softening purchase volumes. But cost pressures slowed from 61.9 to a still high 58.

Greenback, Yields, Poised to Rise

The Federal Reserve’s hawkish tilt last week alongside robust corporate earnings and a growing economy are widening the differences in central bank policies, which is supporting the US dollar and pointing to higher domestic yields. Furthermore, tariffs and restrictive policy are poised to weigh on foreign activity more so than domestically, which together are likely to produce losses for Treasurys and a rally in the greenback. The dollar is having a bearish 2025 but has recouped much of its drop from the year-to-date low on Sept. 17, and in my view, has additional upside potential. The paths to advancing rates and currency is particularly wide with just one factor standing in their way—a rapidly deteriorating labor market. While layoff announcements have been mounting lately, the aggregate health of employment conditions, as evidenced by ADP, Revelio and LinkedIn, remain healthy.

International Roundup

Quarterly Inflation Surges in Australia

Australia’s monthly price pressures eased in October but accelerated during the third quarter relative to the year-ago period, according to the Melbourne Institute Inflation Gauge. The index eased from 0.4% month over month (m/m) in September to 0.3% last month. Conversely, during the third quarter, prices were 3.2% higher relative to the same period of 2024. In the second quarter of this year, prices ascended only 2.1% year over year (y/y).

So far this year, the Reserve Bank of Australia has trimmed its cash rate target three times, bringing the benchmark from 4.35% to 3.6%. During the central bank’s October meeting, policymakers noted that household consumption and disposable income strengthened more than expected while the labor market was still tight. They also noted that services inflation was surprisingly persistent.

While Building Permits Jump

Permits for housing construction in Australia climbed 12% m/m in September, surpassing the economist consensus estimate of 5.1% and reversing from August and July declines 6% and 8.2%. While the headline number was strong, growth was led by private sector dwellings excluding houses, which was up 26% m/m. The category consists of condominiums, townhouses, row houses and other multi-unit residential properties. Permits for private houses, or single-family detached units, advanced only 4%. On a y/y basis, the number of total dwelling units approved was up 15.3% after a 3% gain in August.

South Korea Manufacturing Sinks Back into Contraction

South Korea’s goods producing sector sank into contraction in October after its September output hit a 13-month high, according to the S&P Global South Korea Manufacturing PMI. After climbing from 48.3 to 50.7 in September, the gauge dropped to 49.5, slightly below the contraction-expansion threshold of 50. It was the eighth month in the past nine to record a decline. Output, new orders and employment weakened with head count sinking for the first time in three months. Firms said South Korea’s weak economy and tariffs were hurting demand. Additionally, operating expenses were higher as tariffs and a weak exchange rate jacked up import costs. On an encouraging note, businesses were able to pass the loftier costs onto clients. It was the 11th straight month of higher gate prices. Confidence also improved modestly as manufacturers anticipate that mass production of new products would help increase activity.

China Manufacturing Growth Slows

China’s manufacturing sector recorded its third straight month of growth in October, but the rate of expansion slowed with S&P Global’s RatingDog China General Manufacturing PMI falling from 51.2 in September to 50.6. Trade uncertainty caused demand to sink into contraction while confidence hit a six-month low. Firms also trimmed gate prices, a result of lower input costs and strong competition. Conversely, production growth continued, and the employment sub-index hit its highest level since August 2023.

More By This Author:

Stocks Post An Outstanding October

Buy Rumor, Sell News, Buy Dip

Relative Complacency Rules

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more