Buy Rumor, Sell News, Buy Dip

Image Source: Pixabay

We have been noting that the “half-life” of dips has been steadily shrinking. It was once normal for major indices to take occasional days-long breathers even during the most powerful bull runs. Recent events indicate that the relentless urge to buy every dip, no matter how fleeting, has shrunk the length of those respites to mere minutes. The activity of the S&P 500 (SPX) in yesterday afternoon’s and this morning’s sessions offer excellent evidence to bolster that assertion.

The first example occurred after Chair Powell dropped the following bombshell during the start of his press conference:

A further reduction in the policy rate at the December meeting is not a forgone [sic] conclusion—far from it.

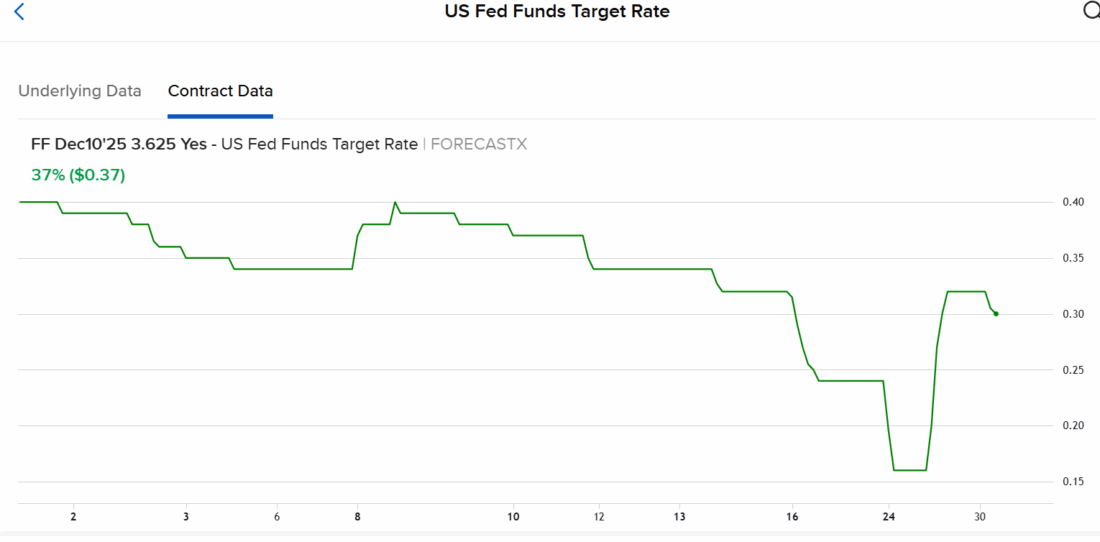

Clearly this was not welcome news for those traders who had been expecting a third cut before the end of the year. CME futures were pricing in at least a 92% chance of a December cut to follow the near 100% probability of yesterday’s cut. Those slipped to below 70% after Powell’s comment. The pricing on IBKR ForecastTrader was not quite as extreme, pricing in no less than a 15% chance of a December rate target above 3.625%, but the views now roughly match those shown by the CME.

Will the US Fed Funds Target Rate be set above 3.625% at the FOMC meeting ending December 10, 2025?

(Click on image to enlarge)

Source: IBKR ForecastTrader

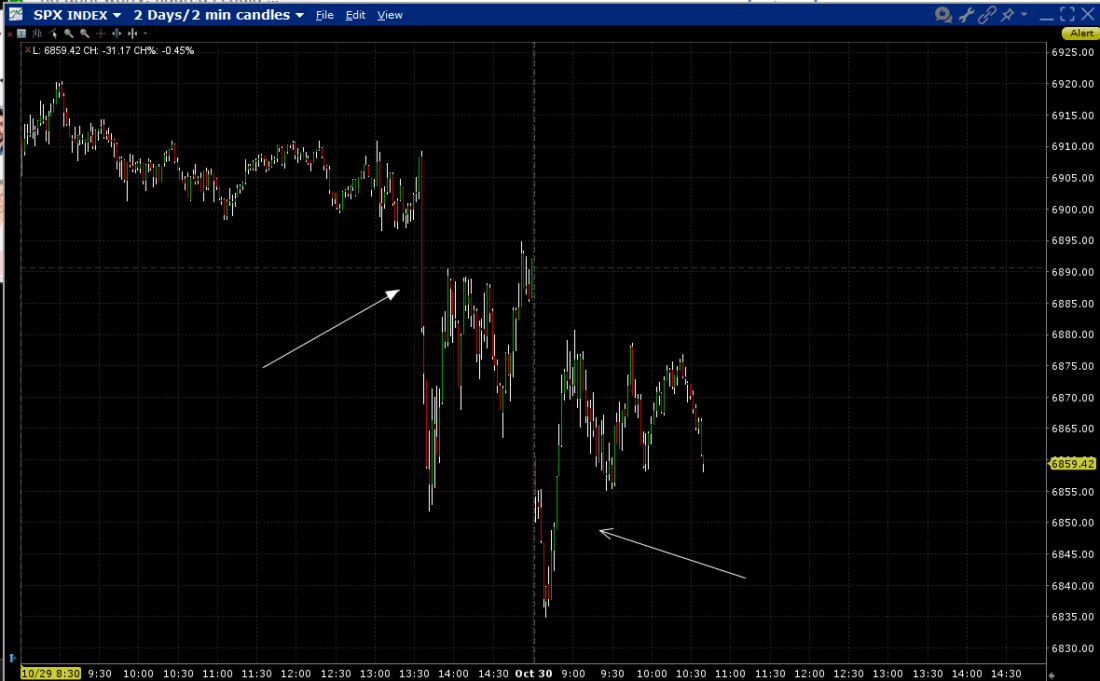

The reaction in stocks and bonds was swift and sudden. Rates across the Treasury yield curve rose by about 10 basis points and SPX fell by nearly 1% almost immediately. The difference is that bond prices held their losses while stocks quickly recovered from theirs after churning at the lows for just a few minutes. By the end of the day, SPX was almost exactly unchanged.

SPX 2-Days, 2-Minute Candles

(Click on image to enlarge)

Source: Interactive Brokers

This was a near exact repeat of the activity at during the September FOMC press conference.We noted that day’s 1% drop and bounce back to near-unchanged levels. The plunge occurred later in that press conference, but the rebound was even more swift.

To be fair, it is not unreasonable to expect air pockets during events like discussions from the Fed Chair. Any comments from a key central banker have the potential to move markets, and thus traders know to be a bit wary while they are occurring. Market makers become more defensive, widening bid/ask spreads and reducing the size of their quotes. That in turn means that a wave of buying or selling has the potential to move markets more than they otherwise might. Hence the big drops and rebounds that occur.

But we also saw something similar just after this morning’s open even as no fresh news was breaking.Investors had no shortage of meaningful data to digest since yesterday’s close.Alphabet’s (GOOG, GOOGL) well-received earnings, Microsoft’s (MSFT) modest disappointment, and the shock of Meta Platforms’ (META) outsize tax bill were being discussed since yesterday afternoon, and overnight we learned that President Trump and Premier Xi reached a deal framework that more or less returned us to the status quo that prevailed before the last escalation of trade and tariff threats.On balance, it was understandable why we might have seen some early profit-taking.But once again, the buyers stepped in quickly and we traded at only modestly lower levels throughout the morning.

This takes us to an extreme question: might we reach a point where the desire to buy every dip erases dips altogether? That sounds ridiculous, but if the half-life of dips continues to shrink, might it reach such a short time interval that any dips are too short to capture? Or alternatively, if dip buying is so foolproof, might some traders and investors take the mindset that why bother selling if you’re going to be proven wrong almost immediately? That sounds downright scary. If everyone is fully invested, who would be left to buy if some investors indeed decided to change course? We’re not at that point – at least not yet – and perish the thought that we actually get there!

More By This Author:

Relative Complacency RulesBig Week (And Full Steam) Ahead

All Clear From CPI

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more

Detailed data shares impressive analyses. Explore and experience to gain greater access to effective strategic and competitive strategies in the market.

Scratch Games, thanks!