Stock Screener Analysis: Why Andersons Inc. Stock Is A Buy

Each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals.

One of the cheapest stocks in our Stock Screeners is:

Andersons Inc (ANDE)

Andersons Inc is diversified company with its main focus in agriculture sector. Its operations are segmented into Trade, Renewables, and Nutrient & Industrial. The Trade segment which generates the majority of the revenue is engaged in movement of physical commodities such as; whole grains, grain products, feed ingredients and domestic fuel products among other agricultural commodities. Geographically, the company generates majority of its revenue from United States and rest from Canada, Mexico, Egypt, Switzerland and other markets.

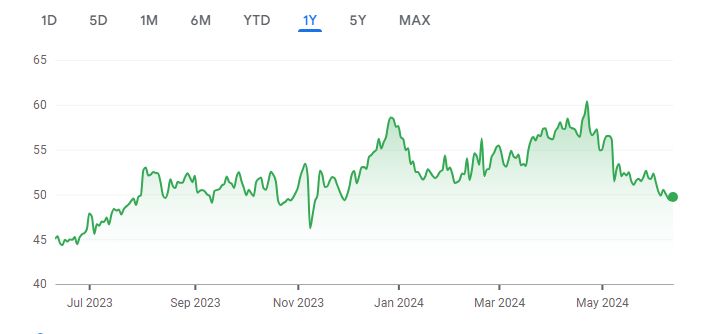

A quick look at the share price history (below) over the past twelve months shows that the price is up 10.33%. Here’s why the company is undervalued.

Source: Google Finance

Key Stats

Market Cap: $1.69 Billion

Enterprise Value: $2.29 Billion

Operating Earnings

Operating Earnings: $254 Million

Acquirer’s Multiple

Acquirer’s Multiple: 8.80

Free Cash Flow (TTM)

Free Cash Flow: $888 Million

FCF/MC Yield %:

FCF/MC Yield: 52%

Shareholder Yield %:

Shareholder Yield: 1.50

Other Indicators

Piotroski F Score: 5.00

Dividend Yield %: 1.5

ROA (5 Year Avge%): 8

More By This Author:

Warren Buffett: The Hidden Costs of High Stock Market Activity

Why eBay Inc Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

Netflix Inc DCF Valuation: Is The Stock Undervalued?

Disclosure: None.