Why EBay Inc Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

eBay (EBAY) operates one of the largest e-commerce marketplaces in the world, with $73 billion in 2023 gross merchandise volume, or GMV, rendering the firm a top 10 global e-commerce company. The company generates revenue from listing fees, advertising, revenue-sharing arrangements with service providers, and managed payments, with its platform connecting more than 130 million buyers and roughly 20 million sellers across almost 190 global markets at the end of 2023. eBay generates just north of 50% of its GMV in international markets, with a large presence in the UK, Germany, and Australia.

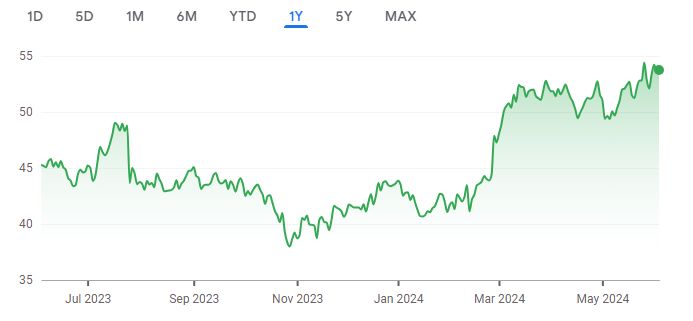

A quick look at the share price history (below) over the past twelve months shows that the price is up 18.68%. Here’s why the company is undervalued.

Source: Google Finance

Key Stats

Market Cap: $27.36 Billion

Enterprise Value: $27.37 Billion

Operating Earnings

Operating Earnings: $2.20 Billion

Acquirer’s Multiple

Acquirer’s Multiple: 12.40

Free Cash Flow (TTM)

Free Cash Flow: $1.73 Billion

FCF/MC Yield %:

FCF/MC Yield: 6.33

Shareholder Yield %:

Shareholder Yield: 7.50

Other Indicators

Piotroski F Score: 6.00

Dividend Yield: 1.90

ROA (5 Year Avge%): 10

More By This Author:

Netflix Inc DCF Valuation: Is The Stock Undervalued?Why Dell Technologies Inc Stock Is A Buy

Microsoft Corp DCF Valuation: Is The Stock Undervalued?

Disclosure: None.